Since its creation in 2009, Bitcoin has fundamentally changed the financial landscape by introducing the world to decentralized digital currencies. As the original cryptocurrency, Bitcoin is more than just a payment method; it represents a new model of trust, security, and financial autonomy. A key feature of Bitcoin's design is the "Bitcoin halving," a deliberate mechanism that reduces the mining reward by half approximately every four years. This process, integral to Satoshi's vision, controls Bitcoin’s supply, curbs inflation, and simulates scarcity, thereby influencing its long-term value and maintaining its deflationary nature.

The next halving, due to occur on April 20th 2024, represents a historically significant event and could have large ramifications for Bitcoin and the wider market as a whole.

What is The Bitcoin Halving?

To grasp the impact of the halving, it's essential to understand the mining process. Miners are pivotal to the Bitcoin network, securing the blockchain by validating transactions to prevent issues like double-spending. They ensure the blockchain's integrity by linking new blocks with previous ones via cryptographic hashes and achieving network consensus through Bitcoin's Proof of Work (PoW) model. Miners solve complex mathematical problems to add blocks, receiving a reward composed of new Bitcoins and transaction fees for their efforts. Initially, miners received 50 Bitcoins per block, but this reward halves every four years—a process known as "Bitcoin halving," which directly influences miners' rewards.

Definition and Mechanics of the Halving Process

The first Bitcoin halving occurred in November 2012, when the initial mining reward of 50 Bitcoins was halved to 25 Bitcoins per block. The second and third halvings followed in July 2016 and May 2020, with the rewards dropping to 12.5 and then 6.25 Bitcoins, respectively. These events not only highlight the predictable and transparent monetary policy of Bitcoin but also contrast sharply with the often unpredictable fiscal policies of traditional fiat currencies.

Historical Impact of Previous Halvings

Bitcoin halvings have historically been significant catalysts for price fluctuations and long-term valuation trends. Each has tended to lead to increased interest and speculative trading as traders and investors anticipate the reduced supply's effect on Bitcoin’s price.

- First Halving (2012): The first Bitcoin halving occurred on November 28, 2012, when the mining reward dropped from 50 to 25 Bitcoins per block. In the months leading up to this halving, Bitcoin's price began a slow ascent, rising from around $5 in June 2012 to approximately $13 by the first halving event. However, the most substantial price movements occurred post-halving, with Bitcoin's price experiencing an unprecedented surge and peaking at around $123 in April 2013.

- Second Halving (2016): The second halving took place on July 9, 2016, reducing the reward from 25 to 12.5 Bitcoins. Prices had stabilized somewhat since the turbulence following the first halving, with Bitcoin trading around $660 at the time. Over the next year and a half, Bitcoin's price experienced a dramatic bull run, culminating in a peak of nearly $20,000 in December 2017. This was fuelled by growing public awareness, speculative demand, and the inception of various Bitcoin-based financial products.

- Third Halving (2020): The most recent halving occurred on May 11, 2020, with the reward falling to 6.25 Bitcoins. At the time, Bitcoin was trading around $8,000. Despite the global economic uncertainty due to the COVID-19 pandemic, Bitcoin's price soared over the following months, reaching all-time-highs over $69,000 in April 2021. This rally was attributed to institutional adoption, increased investment from both retail and institutional investors, and a broad rally in cryptocurrencies.

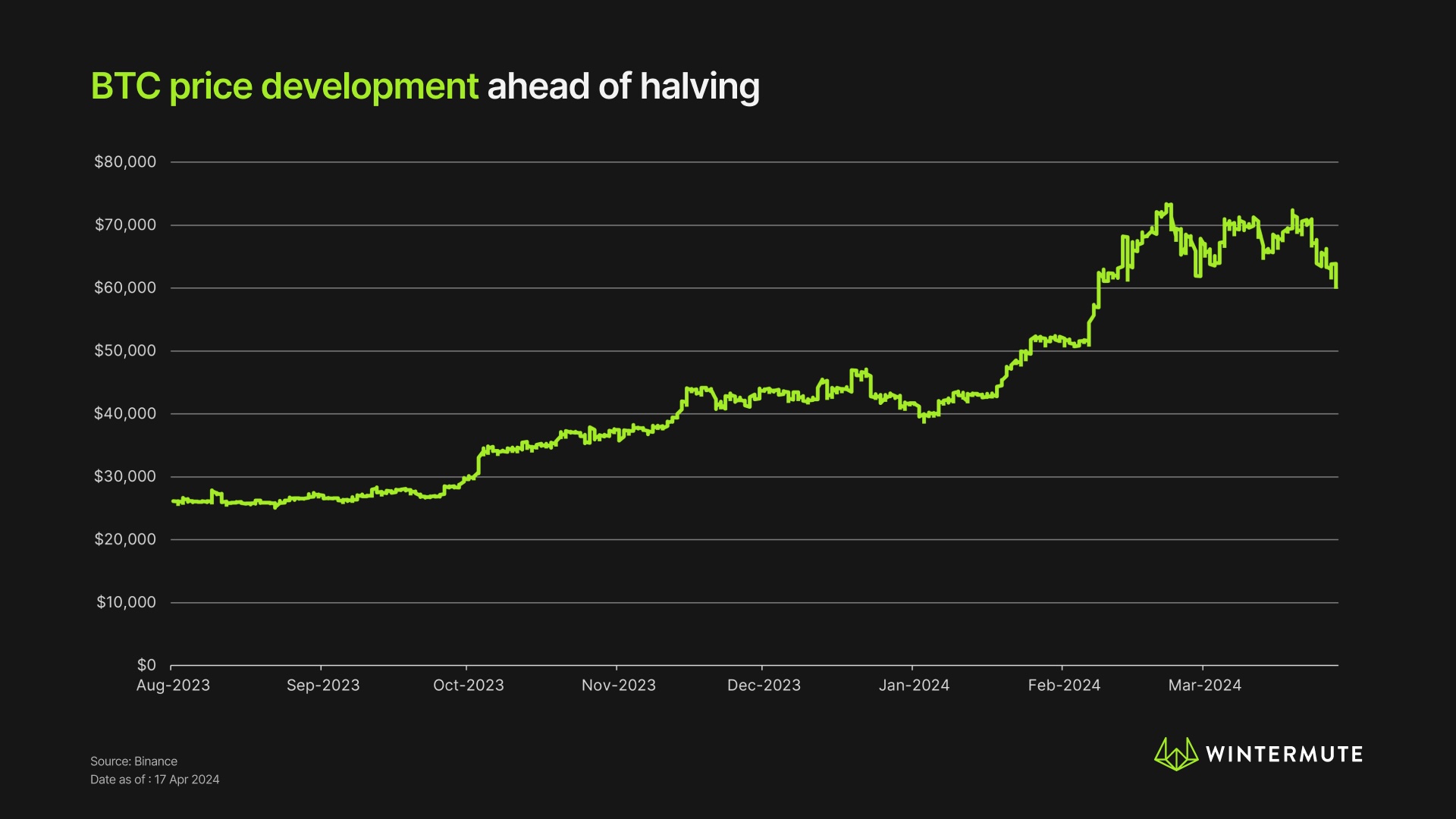

Given the small sample size of prior events, drawing conclusions on potential price impact has to be approached with caution. In the last 6-months, Bitcoin has rallied over 136%, however this has been driven by speculation then actualisation of Spot ETFs, rather than the halving.

Despite this, analysts seem to be coalescing around the view that the halving likely triggers increased short-term volatility due to speculative interest and trading activity in anticipation of the supply squeeze. In the longer-run, consensus is that halvings have a bullish impact on price, a view with attribution to supply and demand: halvings reduce the rate at which new Bitcoins are created, thereby slowing supply and potentially driving up prices if demand remains strong. Additionally, as the market matures and attracts more institutional investors, the impact of halvings could become more pronounced, potentially bringing greater stability and growth to Bitcoin's price post-halving.

Impact on Miners

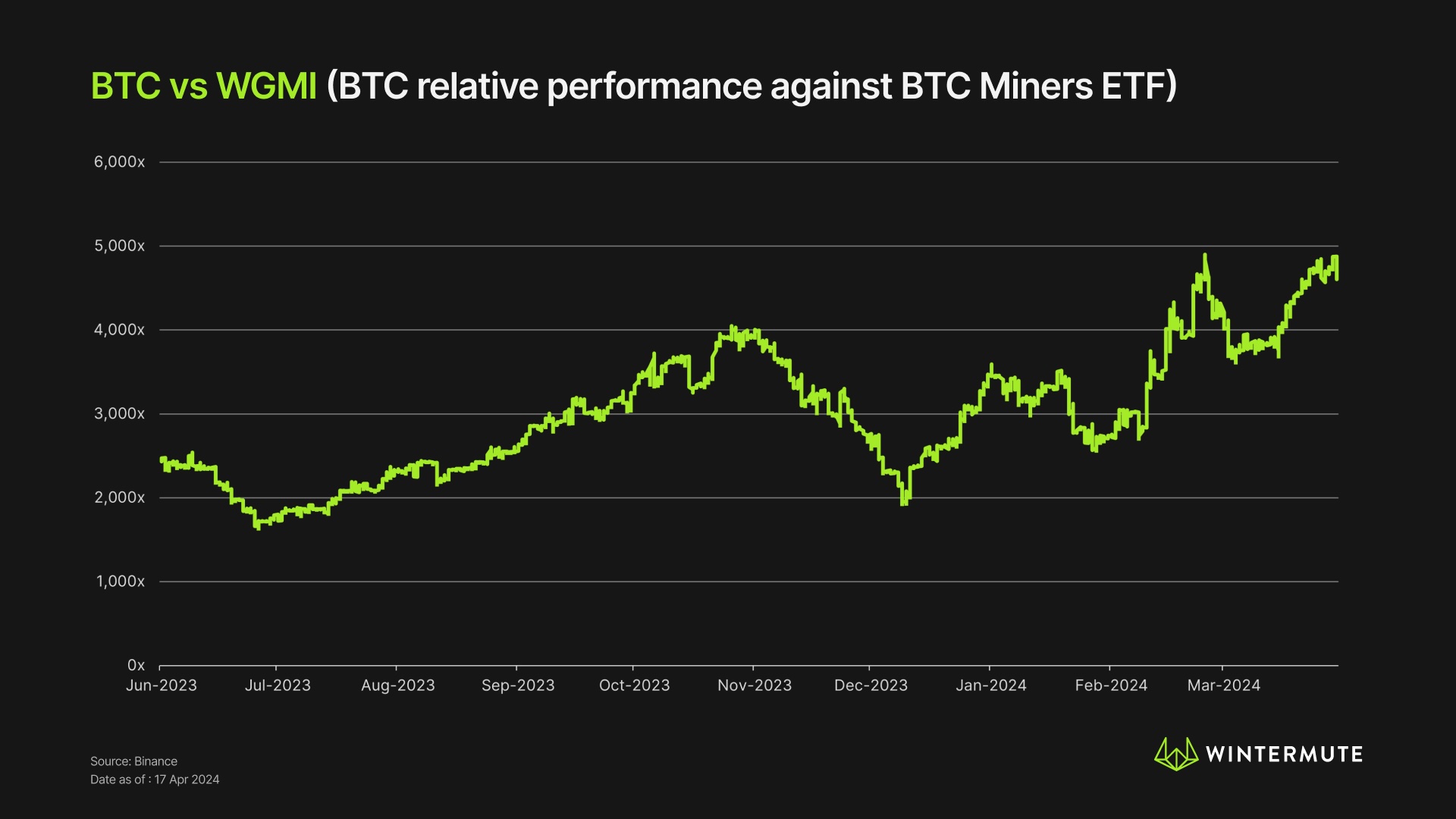

While the direct price impact of Bitcoin halving on its value remains somewhat ambiguous, more concrete reasoning can be applied to assess how miners are likely to be affected by the event. A recent analysis by Bernstein highlighted the underperformance of mining shares against the broader market, driven by concerns about the halving's impact on revenues.

This argument is well-founded, as the halving reduces the block reward, directly slashing miners' earnings unless there's a compensatory increase in Bitcoin's price. At current prices, the estimated economic loss to these entities could be as much as $10bn. Historically, the anticipation and actualization of halving events have led to a tumultuous period for miners, who must recalibrate their operations to maintain profitability.

Furthermore, the diminished rewards not only stress current operations but also discourage new entrants, potentially stifling innovation and investment in mining technology. The next few months post-halving will be critical for miners to adjust to these changes, exploring efficiencies or scaling operations to leverage economies of scale, or leaning on new revenue streams - such as those offered by Layer-2 solutions in order to survive. As miners will need to continually spend more money in a never-ending, technological arms race for smaller rewards, many analysts speculate we may see “meaningful” mining-related mergers and acquisitions (M&A) in the second half of 2024, and into next year.

Wrapping Up

In conclusion, the upcoming Bitcoin halving is set to be a significant event, affecting both the market dynamics and the economic framework of cryptocurrency. This event will reduce miners' rewards, a core feature designed to enhance Bitcoin's value by simulating scarcity. Historically, halvings have led to increased market volatility and speculative trading in the short term, with potential long-term stability and growth fueled by heightened institutional interest. For miners, the reduced rewards necessitate operational efficiencies and could drive industry consolidation. Overall, while the halving presents challenges, it also reinforces the deflationary aspect of Bitcoin, supporting its long-term appeal as a decentralized financial asset.

While recent geopolitical developments have tested short-term sentiment in the market, the longer-term positioning remains firmly supportive of further Bitcoin upside. This optimistic outlook is clearly reflected in the 3-6 month options skew, which shows a continued preference for call options. Furthermore, there has been significant interest in calls at the $100,000 strike for December 2024 and even at the $200,000 strike for March 2025. This robust interest in Bitcoin options, notably absent in Ethereum, likely represents positive market positioning in anticipation of the upcoming Bitcoin halving event.

About Wintermute

Wintermute is a leading algorithmic trading firm in digital assets that provides liquidity to a wide range of market participants via our OTC desk. With coverage of hundreds of cryptocurrencies across dozens of trading venues, Wintermute offers reliable 24/7 access to the digital asset market via spot and derivative (options, CFDs, NDFs, etc.) products.

If you would like to learn more about how Wintermute’s OTC offering can benefit your trading experience, you can reach out to our Business Development team at trade@wintermute.com, fill in the contact form here, or check the in-depth review for detailed information here.