One of Uber’s most incredible accomplishments is how it standardized the ride sharing industry in the United States. Need a ride from New Jersey to New York City? Use the Uber app to find a ride. Need to take a trip from San Jose to San Francisco? Find an Uber driver. By standardizing the ride sharing economy, Uber has created a profitable enterprise where user experience is paramount.

The same can’t be said for the apartment and home rental industry. Unfortunately, each state has its own rules and regulations, which can make it difficult to find a place to live, especially when moving in from another state. What’s more, landlords sometimes require ludicrous security deposits, on top of paying first and last month’s rent.

When combined, initial expenses are easily several thousand dollars. The best way to address these issues is to standardize the rental application process.

RentBerry

Rentberry is a San Francisco startup with a working platform in already in place. With over 224,000 properties, 4,000 plus applications already processed, and $4 million in seed funding, the team is looking to standardize the rental process by implementing Blockchain technology.

Rentberry is currently working on a decentralized blockchain platform that will dramatically alter the long-term rental landscape. Their goal is to create a tokenized rental marketplace whereby landlords and tenants can interact directly and transparently. This will foster trust between the parties and standardize the rental process. Additionally, Rentberry’s platform will introduce a way to minimize the security deposit liability.

How to Standardize the Renting Process

In a traditional apartment rental setting, a landlord and a tenant are connected through a third party. This is usually a listing agent, ad agency, or online rental website like Zillow or Rent.com. Once the third party agent makes the connection, the tenants are required to fill out paper applications, mail in or scan the appropriate I.D. documents, and then wait while the landlord or apartment complex owner makes the decision.

What’s more, there isn’t a lot of consistency between states, let alone apartment complexes. To some, credit scores matter more than personal recommendations. Other apartments value personality and likeability over fiscal responsibility. The lack of uniformity hurts both tenants and landlords, as the process disincentivizes applicants from finding the right match.

RentBerry

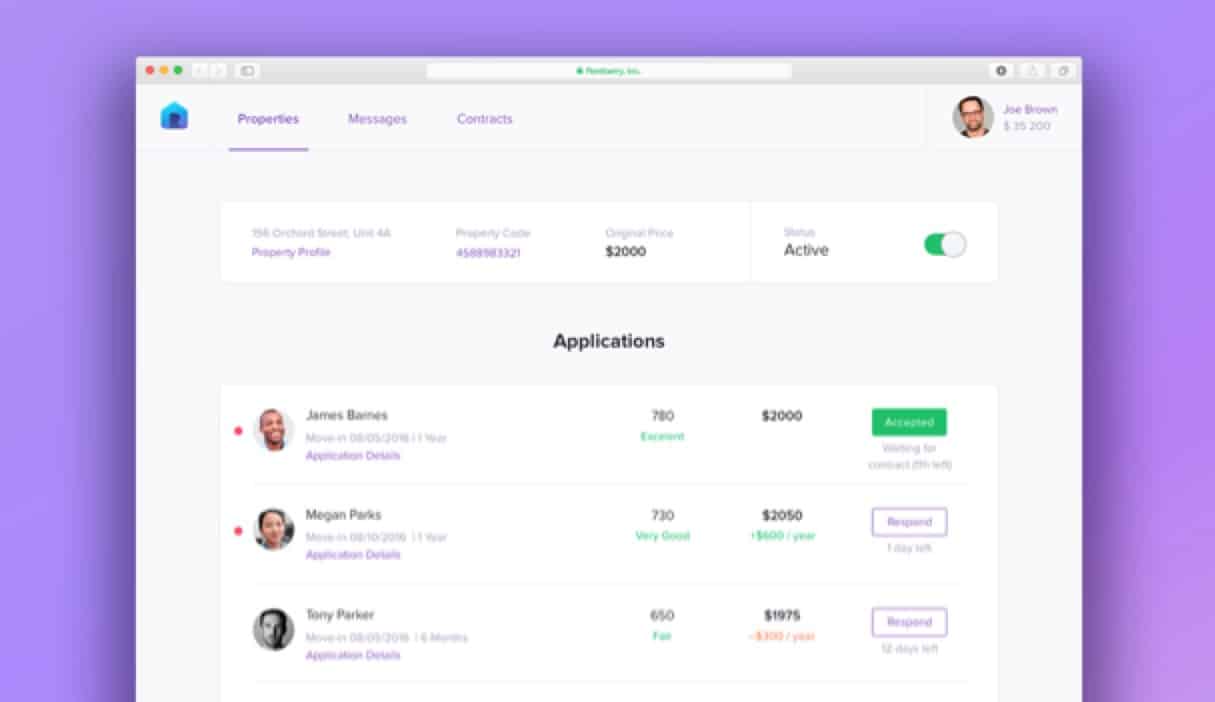

To standardize the process, the Rentberry platform will host the entire application process through the decentralized platform. This includes e-documents, e-contracts, and a proprietary scoring system based upon publicly available information (credit reports, background checks, etc.) and applicant profiles, including past rental history.

The score allows landlords and tenants to evaluate each other beyond user reviews and single-focused credit scores. The standardization of the rental process will encourage landlords to compete for tenants and vice versa, encouraging competitive pricing and transparent interactions.

How Blockchain Technology Can Mitigate Security Deposit Sticker Shock

Let’s use an individual who wants to move to San Francisco as an example. This young woman wants to get a one bedroom apartment, which in San Francisco costs an average of $3377 a month. The landlord is also charging a security deposit equal to two times rent, which isn’t unheard of. The upfront move-in cost, excluding moving expenses and rental applications, is an astounding $10,000. This represents a 10% down payment on a house in most states.

How can blockchain technology help minimize the completely understandable sticker shock? Blockchain platforms like Rentberry allow the community (tenants, landlords, friends, family, etc.) to cover a portion of the security deposit with the platform's tokens. The helping community is therefore rewarded with the platform’s token as a result of fronting the security deposit. In essence, the Rentberry community has formed a decentralized loan for the tenant in question.

Tick Tock...only 1 day left for our long awaited #ICO and with over $27 mil subscribed, we are excited to get everyone on-board! Register today! https://t.co/pRS0vEDquu #homerenting #tokensale #rentberry #cryptoinvesting

— Rentberry (@Rentberry_) December 3, 2017

Taking the example above, the woman will only have to pay 10% of the down payment--the equivalent of $1,000 in platform tokens. The other $9,000 is fronted by security deposit backers, who are then paid monthly by the tenant with a combination of principal and interest over the course of the lease. The interest rate will be lower through the platform than through a traditional loan with a bank, mostly because there isn’t a loan broker or bank that receives commissions.

The crowdsourcing feature will allow landlords to rent more apartments to otherwise qualified applicants. It will also allow tenants to get the housing they deserve, but may not have the immediate funding for.

Those that want to participate in the development of Rentberry’s decentralized platform can do so by signing up for the token pre-sale that begins on December 5, 2017 and runs until January 26, 2018. The main sale will start on January 26, 2018 and end on February 28, 2018. The proceeds will be used to tokenize the platform and establish the security deposit Crowdfunding feature, as well as other platform developments.