There are hundreds, if not thousands, of retail Forex and CFDs brokers, and the demand in the industry is only growing. Each one of them is claiming to provide the ‘best’ services, while, in reality, many have sub-par offerings.

So, which of these brokers are actually good? Are they offering enough deposit and withdrawal methods? How long does it take to fund the account?

What are the spreads of each broker? Are there any hidden fees? And most importantly, can traders withdraw their funds without hassle? and how long does it take to withdraw the fund?

To find out, our team at BrokerTested.com opened real accounts with 33 forex brokers and deposited more than US$150,000 with them. We executed 400 trades on each of the popular markets, contacted customer support for the issues we faced, and finally made withdrawals.

Some of the brokers we choose are eToro, FxPro, Pepperstone, CMC Markets and Amana Capital: all of which are licensed by well-reputed regulators. We deliberately avoided offshore brokers for obvious reasons.

How Was Our Account Opening Experience?

Overall, our account opening experience went smoothly with most brokers. We spent almost 14 minutes on average in the registration process, and most of the brokers approved the account in a few hours or a day or two. Only two brokers, eToro and FBS, took up to a week to approve our accounts due to additional verification.

Three of the brokers - Trading 212, Libertex and Dukascopy - also asked us to provide selfies with or without holding our identifications, a process we found very difficult.

How Was the Deposit Process?

All of the brokers we tested supported deposits with bank transfers, credit or debit cards, and some of the popular e-wallets like Neteller, Skrill and PayPal. On average, brokers supported five deposit methods as many did not support e-wallets, and some took deposits in several local payment methods and even in Cryptocurrencies .

Out of the 33 brokers we tested, 27 of them provided instant deposits, 6 of them provided it in a few minutes, while 9 took a few hours. Only one of the brokers took a day to process our deposit. We have observed that brokers usually process funding with credit or debit cards and e-wallets much faster when compared with wire transfers.

Deposits usually were free as 24 of the brokers did not change any kind of funding fees. But, 9 had some type of deposit fees, which were mostly associated with bank deposits or one of the ewallets. Only two brokers charged fees for all of the funding methods.

Furthermore, six brokers - Trading 212, FXTM, Plus500, Markets.com, Fortrade and FXFlat - asked us to provide additional verification documents while making our first deposit with them.

How Were the Withdrawals?

Brokers usually support withdrawals with the same methods as deposits. Only XTB wants all the withdrawals to be made through bank transfers.

Unlike deposits, only four brokers - AvaTrade, FxPro Libertex and Dukascopy - provided instant withdrawals, which were usually associated with e-wallet transfers. While the withdrawal time with 16 of them was only a few hours, 31 took one working day or more to complete withdrawals.

Fees for withdrawals were also common among brokers. Twelve brokers charged fees for one or more of our withdrawal requests, while we did not encounter any fees with the remaining 21 brokers.

Interestingly, five brokers rejected one or more of our withdrawal requests, citing withdrawal limits and technical errors, among others. One even bugged us to provide extra documents with selfies for verification.

Trades and Real Spreads

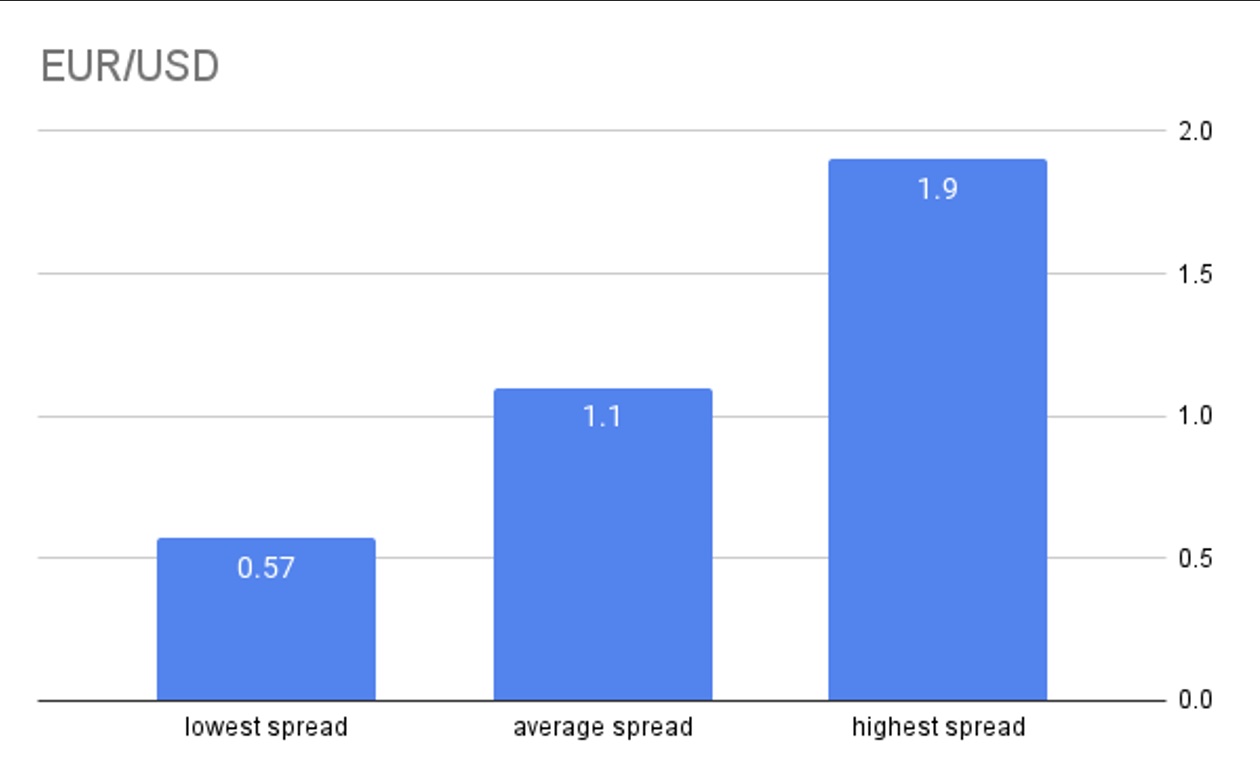

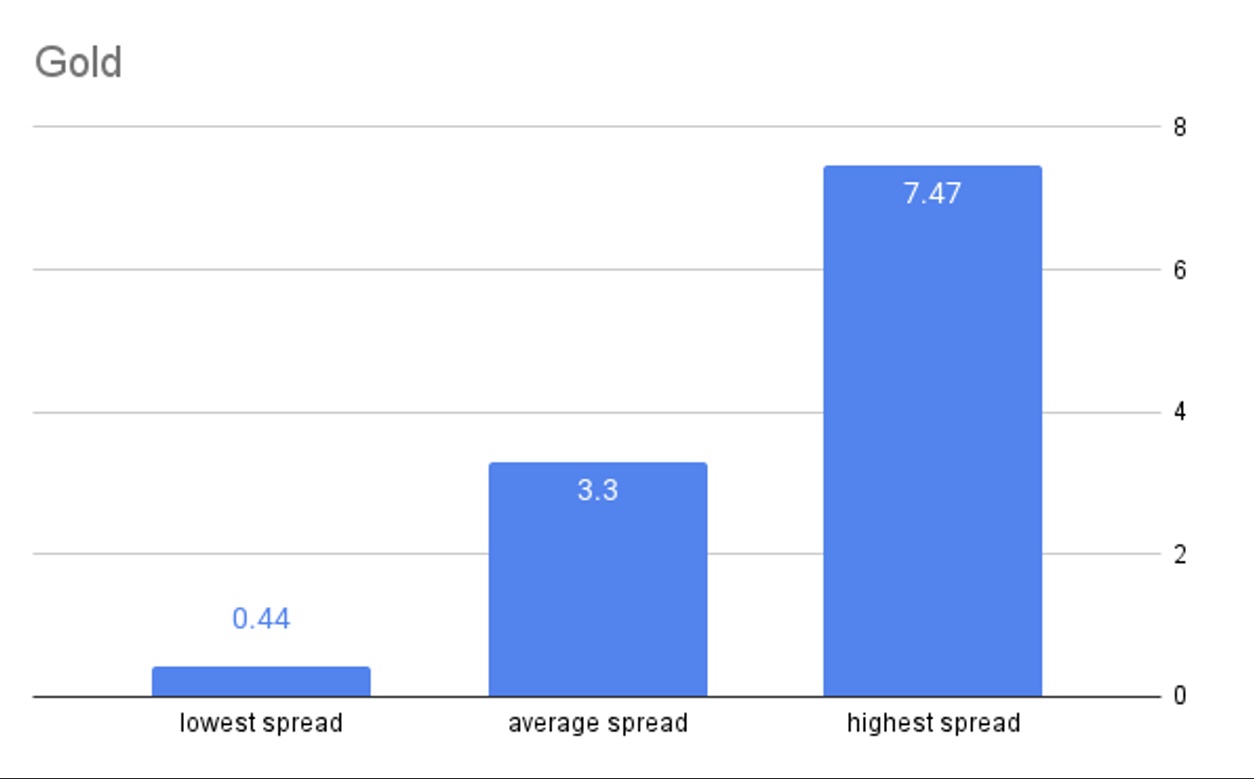

Most of the brokers make money from bid-ask spreads, which vary a lot from the promised levels. To get the actual real spreads charged by the brokers, we executed multiple real trades in each of the popular markets offered by the brokers.

We have executed three trades for EUR/USD, FTSE 100, Apple CFD, Gold and Bitcoin to get the real spreads.

The average spread for the EUR/USD pair for all of our traders came in at 1.11 pips, the highest being 1.9 pips with FXTM and the lowest at 0.57 pips with ActivTrades. For FTSE 100, the average spread stood at 1.57 pips: FXTM again had the maximum spread at 5.1 pips, while Thinkmarkets had the minimum at 0.7 pips.

The maximum spread for Apple CFDs, in our tests, came in at 8.3 pips with Capital.com and the lowest at 0.4 pips with Blackbull Markets, making the average at 1.78 pips.

For Gold, the average spread was at 3.3 pips, Trading 212 charged the maximum at 7.47 pips and XTB levied the minimum at 0.44 pips. XTB charged the maximum spread of 189.55 pips for Bitcoin CFDs, while Axi charged the minimum at 14.4 pips, taking the average spread at around 73 pips.

Customer Service Is Crucial

Customer service is another key for good brokerage services, and almost all of them can be approached on live chat, email and phone.

We identified good customer service considering factors like reachability time and accuracy of the responses. Twenty-three of the tested brokers offer excellent customer services, while others mostly fell short on response quality.

Live chat response time mostly remained below 1 minute, but email response time varied from broker to broker. Email responses of 25 brokers came within a few minutes or hours, while the rest took a day or two to get back to us.

Brokers We Failed to Test

Other than the 33 brokers we successfully tested, we further tried to test two other brokers but failed. We could not open an account with OANDA as the broker asked for too many documents, while FXCM had a few deposit options.

About BrokerTested.com

Brokertested.com is a forex & CFD broker review and comparison platform. We aim to provide a transparent and trusted review to traders so they can pick the broker that fits their needs. We believe a review can be truly trusted by traders if we write the review based on a real experience in which we open a live account, deposit real money and place real trades just like a trader. We will continue to expand the number of reviews and content on our site.