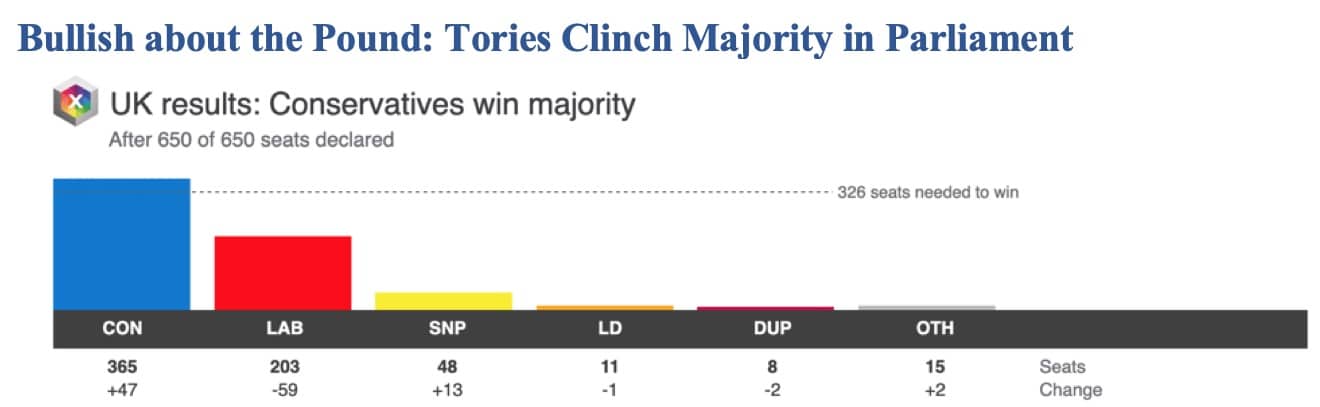

Prime Minister Boris Johnson hedged his bets when he called for snap elections on December 12, 2019. The election gods were certainly with the Conservatives on a night that Labour will rue for years to come.

In a stunning development, the Conservatives gained 47 seats, largely at the expense of Labour who lost 59 seats. The Tories now control 365 seats of the 650 seats declared in the House of Commons.

With just 326 seats needed to win, the Conservatives now have a clear mandate to rule the country and set the tone vis-a-vis Brexit proceedings.

BBC News

Labour, for its part, is in disarray. Opposition leader and avowed socialist Jeremy Corbyn has agreed to step down before the next general election.

It was not only Corbyn’s radical leftist agenda that failed miserably at the polls; he also lost many seats that were considered Labour strongholds.

The election was all about how Britain will proceed with the Brexit process. Corbyn and his socialist allies were intent on stamping their brand of left-leaning politics on the electorate; but Britons were having none of it.

The implications of Corbyn’s firebrand politics have transformed Labour into an ultra-leftist political machine that embraces unpopular policies.

Similar trends are currently occurring with the Democrats in the United States, and elections in November, 2020 will determine their fate too.

Nonetheless, the ramifications of political shenanigans are having an outsized impact on the GBP – the Queen’s currency.

As it stands, the GBP/USD pair – the cable – has had a spectacular run of form in December 2019.

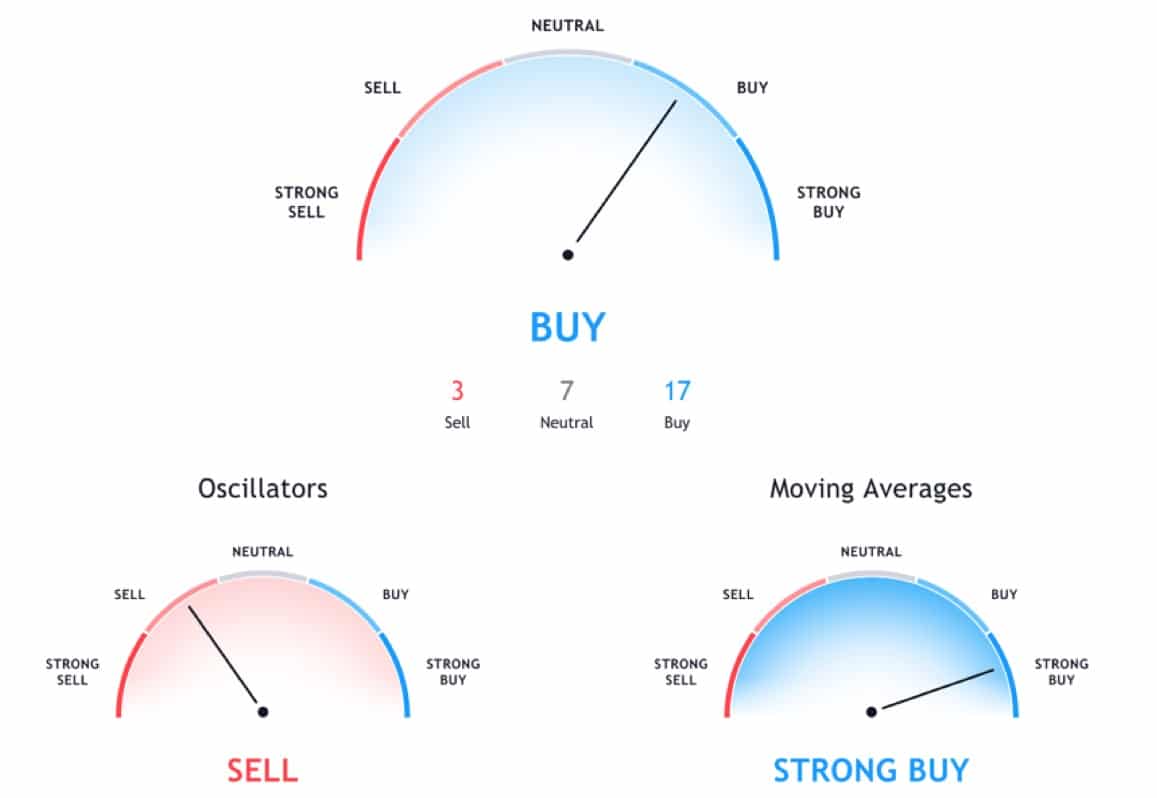

Technical Indicators for the GBP USD Currency Pair

From beleaguered currency to spotlight currency, the GBP/USD pair is now trading around 1.33482, a strongly bullish currency for short-term traders.

The technical indicators clearly illustrate that GBP/USD is a strong buy, given the momentum generated through the Tory victory recently.

To truly appreciate the performance of GBP/USD, one has to assess the recent values of the pound prior to the election.

Trading View GBP USD Pair (Mid-December 2019)

At around 1.28 to the dollar, the GBP/USD is up $0.05 in a matter of days, highlighting the power of speculative trading activity on the currency.

While the technical analysis clearly indicates a buy rating overall, the oscillators are less flattering.

Overall, the technical oscillators indicate a neutral-sell rating for the pound, while the moving averages are strongly bullish.

As we drill down into the technical oscillators, the relative strength index (RSI) indicates a sell, the commodity channel index indicates a sell, and the momentum oscillator indicates a sell.

From the other side, the moving averages are all bullish, with the exponential moving average (EMA), and simple moving average (SMA) indicators, across 5, 10, 20, 30, 50, 100 and 200-day moving averages all indicating buy signals.

Other Events Impacting Forex Trading

Geopolitical considerations need to be carefully considered when trading currencies. Many examples abound, notably the Brexit saga which kicked off with the unexpected June 23, 2016 referendum when Britons voted in favour of divorcing the EU.

The GBP recoiled from 1.48 to the dollar to 1.21, and the recovery took years to remedy. Political theatre has a strong impact on the performance of a national currency, given the confidence or lack thereof that it inspires in the country's economy.

A sharply divided UK electorate fomented uncertainty in the financial markets, given the lack of a clear vision for Brexit. Prime Minister Johnson tried unsuccessfully to get a Brexit resolution passed, given staunch resistance from Labour and other groups.

After a strong election mandate post December 12, 2019, the Tories can now move forward with their Brexit plans.

The consumer price index (CPI) is one of many events that impact Forex trading, as it determines the rising costs in the economy.

Since central banks are tasked with the dual objectives of price stability, and full employment, increases to the CPI are notable. When inflation levels move off target, currencies react immediately.

Speculators will often look at the inflation figures to determine if there is value in the currency or not. Steadily rising inflation tends to erode the value of currency and generates bearish momentum.

Beyond Brexit, they are a host of factors impacting Forex trading, notably the unemployment rate. The lower the unemployment rate, the greater the confidence in the national economy.

This tends to have a bullish effect on Forex trading. A dip in the unemployment rate tends to result in large-scale selling of currency, having a bearish effect on the markets.

Beyond unemployment rates are the decisions made by central banks such as the Bank of England, the Fed, the Bank of Japan, the European Central Bank, et al.

When central banks decide to raise interest rates, this tends to drive up demand for the currency by dint of the fact that more interest will be paid on deposits held in interest-bearing accounts.

When more money is removed from the system – as what happens when interest rates rise, this leads to increased scarcity and a higher exchange rate value.

When interest rates rise, people tend to spend more per unit of their currency on interest-related repayments on credit cards, mortgages, long-term loans, et cetera.

This reduces the personal disposable income of consumers, but also tends to bode well for savers who earn more money on their funds.

Many factors, events, and activities impact Forex trading activity. It is incumbent upon traders to carefully analyze the financial markets at macroeconomic level to determine which way currencies are likely to move.

Disclaimer: This is a contributed article and should not be taken as investment advice.