Over the past decade, investor behavior and market structure have shown an incredible shift affecting the way in which online brokerages interact with customers.

The dramatic change has had an adverse impact on the conversion, retention as well as the lifetime value of traders which has resulted in brokers continuously searching for new ways to enhance their customer experience touchpoints.

In an ever-changing market, online brokers are looking for new ways to stand out from the competition.

In this interview Kathryn St. John, Senior Director of User Experience at Trading Central will share her insights on the ever changing online brokerage industry whilst touching on the consumer shift and brokerage perspective.

Hello Kathryn and thank you for taking the time to share your valuable insights with our audience.

It's always a pleasure to share what we’ve learned; at Trading Central we’re lucky to have a perspective across many countries while working with firms at different stages of maturity, and with different focus areas or making their own bets on the future, as we are too.

Starting off, I would like to ask… In the past few years, and with the exponential growth of internet penetration globally, consumer behavior has shifted. We are now interacting with a more educated consumer. How do you think brokers should adapt their offering in a competitive market such as the financial industry?

Today’s consumer is data hungry. They want instant access to data because they are becoming increasingly accustomed to applications offering a proactive layer that points out useful insights when their curiosity requests it.

This helps them make decisions faster through deeper learning.

We need to acknowledge that there are different degrees of engagement and providing a customer experience that accommodates these demands is the key to success.

The challenge is to simplify your approach, without removing data and information, but rather allowing people to get to the most pertinent information and make decisions without having to jump through hoops to do it.

That is the promise of modern apps. This is why we’ve launched compact insightful scores across many areas of investment research.

From our flagship technical and fundamental analysis through to our news sentiment product-line. We’ve used this as the connection point.

Bringing people together by looking from a panoramic point-of-view of their account holdings with high level information about what’s changed and what that change means, to digging deeper into research tools providing even more transparency.

This has been done in an effort for customers to view analysis and perhaps draw their own conclusions, at their own leisure.

As we have touched on changing consumer behavior and the competitiveness of the finance industry, brokers continuously strive to either enhance their Lead generation funnels, ROI and LTV but it's proving somewhat of a difficult task. In your opinion, what do traders want and how can brokers build the brand loyalty necessary to achieve their goals? In other words, what do traders want?

They want to know their money is safe, and that they understand the fees and fluctuations in their account.

We don’t operate in that arena, we leave that to the brokers; but rather we do have a link to building trust through access to information.

Traders want true, transparent data that they can use to invest their money. They want to find precisely what they’re looking for when they need it.

It’s actually why core utilities like Search and Feeds and Alerts are so important and why people, as they gain experience, back out of some of the simpler apps they tried at first.

Traders need a firm that’s going to serve them as they grow and as their degree of experience evolves and flows through their lifetime.

It’s why we offer embeddable apps and APIs that allow emerging firms to easily launch the rich Analytics

Analytics

Analytics may be defined as the detection, analysis, and relay of consequential patterns in data. Analytics also seeks to explain or accurately reflect the relationship between data and effective decision-making. In the trading space, analytics are applied in a predictive manner in an attempt to forecast the price more accurately. This predictive model of analytics generally involves the analysis of historical price patterns that are used in an attempt to determine certain price outcomes. Analy

Analytics may be defined as the detection, analysis, and relay of consequential patterns in data. Analytics also seeks to explain or accurately reflect the relationship between data and effective decision-making. In the trading space, analytics are applied in a predictive manner in an attempt to forecast the price more accurately. This predictive model of analytics generally involves the analysis of historical price patterns that are used in an attempt to determine certain price outcomes. Analy

Read this Term that their maturing clients have come to need, with a design that’s re-imagined for what’s expected by consumers today.

How do you see the industry evolving in the next 5 years?

I expect we’ll continue to move further along the decision support spectrum toward prescriptive advice but in a way that offers transparency and keeps the investor in control.

People will do the right things when they are aware and when it’s easy to respond.

Today’s consumers are accustomed to having data and signals on what market moves mean, while taking accountability for their decisions.

I expect that with the proper transparency and user controls, the regulators and compliance departments will become even more supportive of these advancements, as they will see how it enhances the knowledge and habits of consumers.

What comes along with such a change is a fuzzier distinction between “order-Execution

Execution

Execution is the process during which a client submits an order to the brokerage, which consequently executes it resulting in an open position in a given asset. The execution of the order occurs only when it is filled. There is typically a time delay between the placement of the order and the execution which is called latency.In the retail FX space, reliable brokers always strive to deliver best execution to their clients in order to maintain a solid business relationship with them. This is a co

Execution is the process during which a client submits an order to the brokerage, which consequently executes it resulting in an open position in a given asset. The execution of the order occurs only when it is filled. There is typically a time delay between the placement of the order and the execution which is called latency.In the retail FX space, reliable brokers always strive to deliver best execution to their clients in order to maintain a solid business relationship with them. This is a co

Read this Term only” and “digital advice” firms. It will be easier for investors to move between or in parallel with other financial services.

We certainly do see the change coming and we’re preparing for it.

How is the change in consumer behavior going to affect the financial industry?

I’m curious how branding, social media and the online community will evolve.

People like being part of a movement, knowing there is a community around them and having an intellectual past-time that contributes to their identity.

I’m curious how brands will play a role in streamlining people attracted to different levels of engagement, or different tones that match how they see themselves.

In my opinion, the winners will be those that don’t downplay or eliminate what investors need for the sake of simplicity. Instead, they will make it easier for them to make choices, feel smarter and enable them to engage in discussions with others.

Where TC will fit into the equation and play a role in, is providing meaningful insights that can start conversations and educate the investor in a way that will enable them to apply what they've learned while trading in the specific platform offered by their broker.

The link between learning and practice is exactly why at Trading Central we embed education into all the different layers of our products for a more seamless progression that makes good habits easy.

Do you think that Artificial Intelligence (AI) and Natural Language Processing (NLP) will be taking center stage when mapping the customer experience journey over the coming years?

This is a promising technology. A technology that helps us understand what we need to know, without feeling the pressure of let’s say “keeping up with our feeds”. We call that the “infobesity” problem.

People are stressed with following up on their daily lives. We want to help people move away from feeling the pressure of having to monitor all the news and social dialogs that are continuously being published and that could potentially affect their positions.

It’s the feeling of needing to keep up and churn through as much as possible so you don’t miss something.

When there’s repetitive activity that traders are trying to “keep up with” the computer scientist in me sets off and demands to let the computers do it instead. That’s what we’re doing at Trading Central!

Natural Language Processing can do the reading for you. And artificial intelligence can extract the key topics, and evaluate the choice of words to detect the prevailing sentiment whether it’s positive or negative.

It can even evaluate the choice of words to detect emotional vs rational sort of publication. It’s these types of things that our innovation unit, TC Labs works to develop.

With all this meaningful data in our hands, we can boil it down to: here’s the only thing you need to read right now to keep up; and then of course, allow them to follow their curiosity with all the data available to explore as and when they want to.

How can AI and NLP be employed to increase conversion and retention rates?

When you’re this helpful to your clients, proactively telling them what they need to know when they need to know it, you're helping them save time and gather all the valuable information they need when trading.

Inevitably you've then gained their trust, which will in-turn urge investors to keep trading with you.

Even more so when you start leveraging AI on the front-end. This could be applied whilst understanding the investor’s behavior: which topics are of interest to them, patterns to their behavior, etc.

Through understanding their behavior you'll be able to inform them of opportunities that match their interests and aptitudes.

Employing such an approach via the tools available, will take the relationship with your clients to the next level.

I’m therefore very excited to see not only our own AI but how our output is then used and implemented within the logic of consumer behavior AI.

What makes TC Labs unique?

TC Labs is a beautiful example of a successful dichotomy. TC Labs brings together our experience from high street trading desks and leading NLP research, while being a playground for fresh minds to apply AI and visual design.

TC Labs is untethered and innovative, while supported by an experienced software development practice at Trading Central that delivers to the standards expected by even the most demanding financial firms globally.

It’s been great to see TC Labs grow and become an integral part of the innovations happening across our company, as well as the industry.

If you were to suggest ONE tool out of TC's service offerings that you think would be key for any brokerage to have, which one would it be and why?

You’ve got to match this with the goals of the brokerage.

A tried and tested product that has proven to have a very high value rate across our clients (and their traders) is the Technical Insights tool. Within the tool, traders can lookup stocks directly through a mobile app or website.

If you are in the FX space, watch out for the “intraday” streaming edition of this all-star in 2021, as well as our morning news-brief emails! Investors expect our analyst’s insights, and of course our clients love the opportunity to be able to reach out to their traders when they’re not on the platform trading.

We are also re-imagining the news experience, through TC Market Buzz and Crowd Insight products. The second edition of the products is coming in 2021 and you'll have a chance to shape it based on your needs.

If you're already licensed to use our content, don’t miss the opportunity to bring insights to the investor’s account holdings. Take a look at the Panoramic View embeddable app or API.

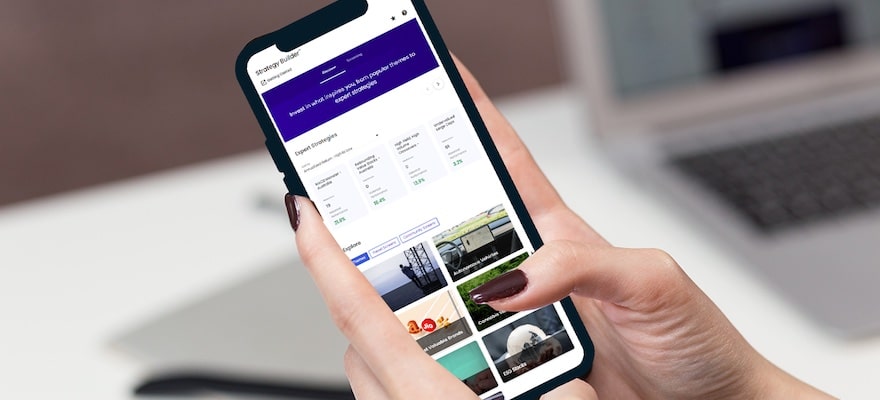

If you are seeking new ways to help your traders discover new stocks, jump ahead by using our brand new Strategy Builder (which by the way has just been redesigned for an enhanced experience).

Nobody believed rich screening for mobile could become easier. We just made it real.

I could keep going but let’s stop there :)

Thank you Kathryn for your time and valuable feedback. It seems like Trading Central and TC Labs have a lot we should be looking out for. So watch this space.

About Trading Central:

As a premium, one stop shop for investment decision support, we firmly believe the best way to support your brokerage business is by facilitating the long-lasting success of your investing customers.

We help them find and validate new opportunities, time their trades, learn about financial markets, and manage their risk.

Our online broker solutions harness an award-winning fusion of automated AI analytics, beautiful user interfaces, APIs and embeddable apps, and senior analyst expertise. Learn more here.

Over the past decade, investor behavior and market structure have shown an incredible shift affecting the way in which online brokerages interact with customers.

The dramatic change has had an adverse impact on the conversion, retention as well as the lifetime value of traders which has resulted in brokers continuously searching for new ways to enhance their customer experience touchpoints.

In an ever-changing market, online brokers are looking for new ways to stand out from the competition.

In this interview Kathryn St. John, Senior Director of User Experience at Trading Central will share her insights on the ever changing online brokerage industry whilst touching on the consumer shift and brokerage perspective.

Hello Kathryn and thank you for taking the time to share your valuable insights with our audience.

It's always a pleasure to share what we’ve learned; at Trading Central we’re lucky to have a perspective across many countries while working with firms at different stages of maturity, and with different focus areas or making their own bets on the future, as we are too.

Starting off, I would like to ask… In the past few years, and with the exponential growth of internet penetration globally, consumer behavior has shifted. We are now interacting with a more educated consumer. How do you think brokers should adapt their offering in a competitive market such as the financial industry?

Today’s consumer is data hungry. They want instant access to data because they are becoming increasingly accustomed to applications offering a proactive layer that points out useful insights when their curiosity requests it.

This helps them make decisions faster through deeper learning.

We need to acknowledge that there are different degrees of engagement and providing a customer experience that accommodates these demands is the key to success.

The challenge is to simplify your approach, without removing data and information, but rather allowing people to get to the most pertinent information and make decisions without having to jump through hoops to do it.

That is the promise of modern apps. This is why we’ve launched compact insightful scores across many areas of investment research.

From our flagship technical and fundamental analysis through to our news sentiment product-line. We’ve used this as the connection point.

Bringing people together by looking from a panoramic point-of-view of their account holdings with high level information about what’s changed and what that change means, to digging deeper into research tools providing even more transparency.

This has been done in an effort for customers to view analysis and perhaps draw their own conclusions, at their own leisure.

As we have touched on changing consumer behavior and the competitiveness of the finance industry, brokers continuously strive to either enhance their Lead generation funnels, ROI and LTV but it's proving somewhat of a difficult task. In your opinion, what do traders want and how can brokers build the brand loyalty necessary to achieve their goals? In other words, what do traders want?

They want to know their money is safe, and that they understand the fees and fluctuations in their account.

We don’t operate in that arena, we leave that to the brokers; but rather we do have a link to building trust through access to information.

Traders want true, transparent data that they can use to invest their money. They want to find precisely what they’re looking for when they need it.

It’s actually why core utilities like Search and Feeds and Alerts are so important and why people, as they gain experience, back out of some of the simpler apps they tried at first.

Traders need a firm that’s going to serve them as they grow and as their degree of experience evolves and flows through their lifetime.

It’s why we offer embeddable apps and APIs that allow emerging firms to easily launch the rich Analytics

Analytics

Analytics may be defined as the detection, analysis, and relay of consequential patterns in data. Analytics also seeks to explain or accurately reflect the relationship between data and effective decision-making. In the trading space, analytics are applied in a predictive manner in an attempt to forecast the price more accurately. This predictive model of analytics generally involves the analysis of historical price patterns that are used in an attempt to determine certain price outcomes. Analy

Analytics may be defined as the detection, analysis, and relay of consequential patterns in data. Analytics also seeks to explain or accurately reflect the relationship between data and effective decision-making. In the trading space, analytics are applied in a predictive manner in an attempt to forecast the price more accurately. This predictive model of analytics generally involves the analysis of historical price patterns that are used in an attempt to determine certain price outcomes. Analy

Read this Term that their maturing clients have come to need, with a design that’s re-imagined for what’s expected by consumers today.

How do you see the industry evolving in the next 5 years?

I expect we’ll continue to move further along the decision support spectrum toward prescriptive advice but in a way that offers transparency and keeps the investor in control.

People will do the right things when they are aware and when it’s easy to respond.

Today’s consumers are accustomed to having data and signals on what market moves mean, while taking accountability for their decisions.

I expect that with the proper transparency and user controls, the regulators and compliance departments will become even more supportive of these advancements, as they will see how it enhances the knowledge and habits of consumers.

What comes along with such a change is a fuzzier distinction between “order-Execution

Execution

Execution is the process during which a client submits an order to the brokerage, which consequently executes it resulting in an open position in a given asset. The execution of the order occurs only when it is filled. There is typically a time delay between the placement of the order and the execution which is called latency.In the retail FX space, reliable brokers always strive to deliver best execution to their clients in order to maintain a solid business relationship with them. This is a co

Execution is the process during which a client submits an order to the brokerage, which consequently executes it resulting in an open position in a given asset. The execution of the order occurs only when it is filled. There is typically a time delay between the placement of the order and the execution which is called latency.In the retail FX space, reliable brokers always strive to deliver best execution to their clients in order to maintain a solid business relationship with them. This is a co

Read this Term only” and “digital advice” firms. It will be easier for investors to move between or in parallel with other financial services.

We certainly do see the change coming and we’re preparing for it.

How is the change in consumer behavior going to affect the financial industry?

I’m curious how branding, social media and the online community will evolve.

People like being part of a movement, knowing there is a community around them and having an intellectual past-time that contributes to their identity.

I’m curious how brands will play a role in streamlining people attracted to different levels of engagement, or different tones that match how they see themselves.

In my opinion, the winners will be those that don’t downplay or eliminate what investors need for the sake of simplicity. Instead, they will make it easier for them to make choices, feel smarter and enable them to engage in discussions with others.

Where TC will fit into the equation and play a role in, is providing meaningful insights that can start conversations and educate the investor in a way that will enable them to apply what they've learned while trading in the specific platform offered by their broker.

The link between learning and practice is exactly why at Trading Central we embed education into all the different layers of our products for a more seamless progression that makes good habits easy.

Do you think that Artificial Intelligence (AI) and Natural Language Processing (NLP) will be taking center stage when mapping the customer experience journey over the coming years?

This is a promising technology. A technology that helps us understand what we need to know, without feeling the pressure of let’s say “keeping up with our feeds”. We call that the “infobesity” problem.

People are stressed with following up on their daily lives. We want to help people move away from feeling the pressure of having to monitor all the news and social dialogs that are continuously being published and that could potentially affect their positions.

It’s the feeling of needing to keep up and churn through as much as possible so you don’t miss something.

When there’s repetitive activity that traders are trying to “keep up with” the computer scientist in me sets off and demands to let the computers do it instead. That’s what we’re doing at Trading Central!

Natural Language Processing can do the reading for you. And artificial intelligence can extract the key topics, and evaluate the choice of words to detect the prevailing sentiment whether it’s positive or negative.

It can even evaluate the choice of words to detect emotional vs rational sort of publication. It’s these types of things that our innovation unit, TC Labs works to develop.

With all this meaningful data in our hands, we can boil it down to: here’s the only thing you need to read right now to keep up; and then of course, allow them to follow their curiosity with all the data available to explore as and when they want to.

How can AI and NLP be employed to increase conversion and retention rates?

When you’re this helpful to your clients, proactively telling them what they need to know when they need to know it, you're helping them save time and gather all the valuable information they need when trading.

Inevitably you've then gained their trust, which will in-turn urge investors to keep trading with you.

Even more so when you start leveraging AI on the front-end. This could be applied whilst understanding the investor’s behavior: which topics are of interest to them, patterns to their behavior, etc.

Through understanding their behavior you'll be able to inform them of opportunities that match their interests and aptitudes.

Employing such an approach via the tools available, will take the relationship with your clients to the next level.

I’m therefore very excited to see not only our own AI but how our output is then used and implemented within the logic of consumer behavior AI.

What makes TC Labs unique?

TC Labs is a beautiful example of a successful dichotomy. TC Labs brings together our experience from high street trading desks and leading NLP research, while being a playground for fresh minds to apply AI and visual design.

TC Labs is untethered and innovative, while supported by an experienced software development practice at Trading Central that delivers to the standards expected by even the most demanding financial firms globally.

It’s been great to see TC Labs grow and become an integral part of the innovations happening across our company, as well as the industry.

If you were to suggest ONE tool out of TC's service offerings that you think would be key for any brokerage to have, which one would it be and why?

You’ve got to match this with the goals of the brokerage.

A tried and tested product that has proven to have a very high value rate across our clients (and their traders) is the Technical Insights tool. Within the tool, traders can lookup stocks directly through a mobile app or website.

If you are in the FX space, watch out for the “intraday” streaming edition of this all-star in 2021, as well as our morning news-brief emails! Investors expect our analyst’s insights, and of course our clients love the opportunity to be able to reach out to their traders when they’re not on the platform trading.

We are also re-imagining the news experience, through TC Market Buzz and Crowd Insight products. The second edition of the products is coming in 2021 and you'll have a chance to shape it based on your needs.

If you're already licensed to use our content, don’t miss the opportunity to bring insights to the investor’s account holdings. Take a look at the Panoramic View embeddable app or API.

If you are seeking new ways to help your traders discover new stocks, jump ahead by using our brand new Strategy Builder (which by the way has just been redesigned for an enhanced experience).

Nobody believed rich screening for mobile could become easier. We just made it real.

I could keep going but let’s stop there :)

Thank you Kathryn for your time and valuable feedback. It seems like Trading Central and TC Labs have a lot we should be looking out for. So watch this space.

About Trading Central:

As a premium, one stop shop for investment decision support, we firmly believe the best way to support your brokerage business is by facilitating the long-lasting success of your investing customers.

We help them find and validate new opportunities, time their trades, learn about financial markets, and manage their risk.

Our online broker solutions harness an award-winning fusion of automated AI analytics, beautiful user interfaces, APIs and embeddable apps, and senior analyst expertise. Learn more here.