The crazy crypto bull market of 2017 had such a disorienting effect. To most crypto-enthusiasts, trading cryptocurrencies was just a get-rich-quick scheme. Not many really cared to learn anything about the principles and values of Blockchain technology or the benefits of a decentralized economy.

The spectacular rise of bitcoin started a world-wide “Madness of Crowds”. Everyone wanted to make huge profits quickly. But then the market crashed, the result was a lot of grief, and 2018 became the year of reality checks.

After the market sputtered, speculators migrated away and actual “users” who were truly invested in the success of a project, remained. The most powerful thing we have learned from the success of cryptocurrencies is this unique ability to align users and investors alike through ICOs.

An ICO (Initial Coin Offering) acts as a fundraiser of sorts; a start-up looking to create a new app or product launches an ICO bypassing the regulated and rigorous capital-raising process required by VCs or banks.

Interested investors buy into the offering and receive a new cryptocurrency token hoping that this token will provide them with a return on investment.

Will Cryptocurrency trading stage a comeback?

Something in this industry needs to bring back the enthusiasm. And so far we have only seen a limited number of breakout successes. We think 2019 will be the year of that breakout killer success.

We will see the first proof point of a project that will bring investors back into the crypto world; it might be a whole new class of a payment application or one killer gaming app. Will it be an existing cryptocurrency or an upcoming altcoin? No one can predict that for sure. But every new technology inevitably evolves.

Just like the internet evolved and changed drastically from its early adoption in the 1990’s. Do you remember the very first Netscape Navigator web browser? It made the internet accessible to everyone. And then it died a quiet death, replaced by better, more robust technology.

In fact, we are witnessing today a kind of hybridization in the industry where projects are finding success in the middle ground. Things like “Hashgraph” which is a publicly distributed ledger that has a set of validators but does not need miners to validate transactions.

It is more decentralized than a centralized system, but not as decentralized as blockchain. Several experts describe Hashgraph as a continuation of where the idea of blockchain begins.

Ripple's XRP is looking rather bullish

Ripple (XRP) is another example of a hybrid system, more centralized than bitcoin, but decentralized enough to provide a faster, cheaper, transparent, and a more secure payment alternative solution. Ripple has built a decentralized network of financial institutions called RippleNet that can send and settle international Payments on-demand.

Reuters

RippleNet is now active in over 40 countries worldwide, and its members have the ability of transacting with payment providers or digital wallets that they don’t have a direct relationship to, all within a regulated framework.

It is clear today that the future of finance and the future of blockchain lie in the convergence of regulation and decentralization, not in a network of pure decentralized systems. It is very difficult to build a decentralized system that is outside the purview and control of governments. They will fight it until it yields!

WALLSTREET will take it from here!

In late 2018, big institutional firms like Goldman Sachs and Nomura Holdings started working on crypto-custody services. Other institutions are also reportedly exploring possibilities of providing custody for crypto-funds.

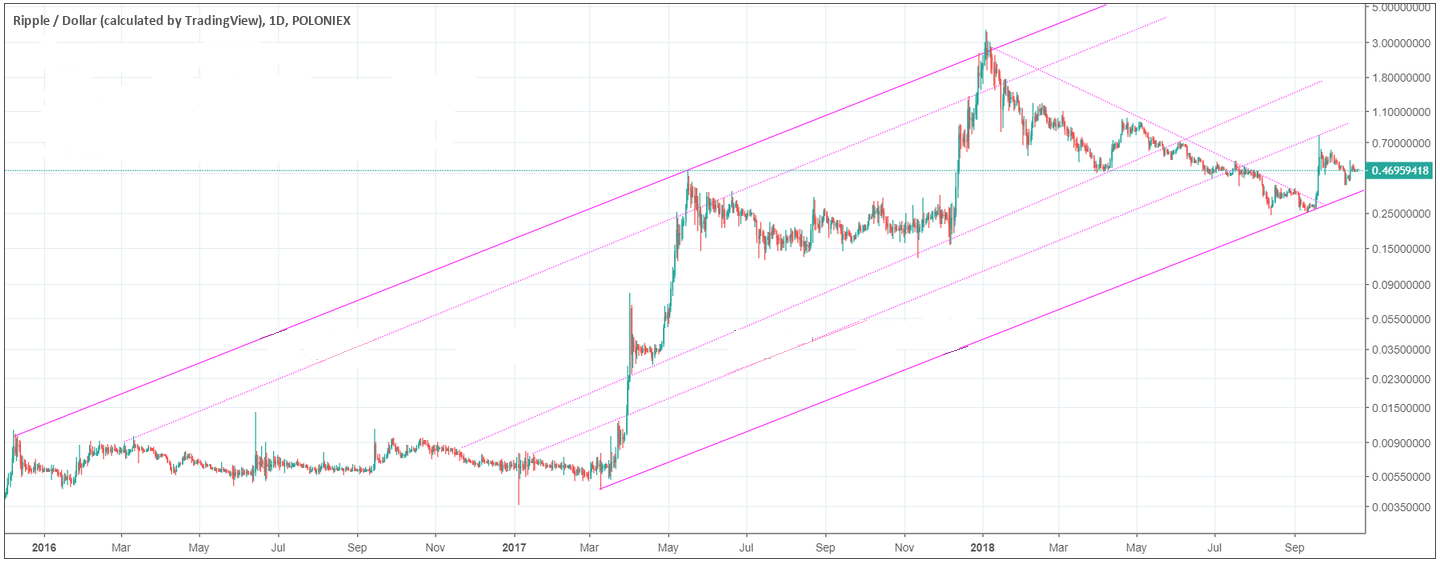

If Wall Street’s institutional investing titans keep backing crypto trading in 2019, Ripple’s XRP will benefit the most. And XRP might even hit the higher side of the below channel as it did before both in 2017 and 2018 (see chart below).

Moreover, we are seeing true supporting infrastructure being developed for cryptos, like Bakkt, the venture launched in September 2018 by a consortium led by the Intercontinental Exchange (ICE), parent of the NYSE. Bakkt is pitching itself as a cryptocurrency investment platform that will bring bitcoin and other crypto ETFs to Americans' 401(k).

In addition, there are testimonials from some well positioned sources at NASDAQ that the second biggest stock exchange in the U.S. is reportedly gearing up to list and support the trading of cryptocurrencies through a coin exchange platform.

If NASDAQ goes through with the listing, the move will put the exchange at the forefront of institutional money flowing into crypto, as well as set a precedent for U.S. regulator, the SEC.

In sum, institutional money will obviously be the catalyst for a resumption of the crypto bull market or at least the stimulant behind a comeback in cryptotrading in 2019. And even though bitcoin will most likely remain the leading indicator for cryptocurrencies in 2019, it is unlikely that it will deliver 10-fold returns similar to the previous 7 years.

Instead, real investors will separate the hype from the real, and concentrate on the existing or upcoming projects that have real value…. Real technological breakthroughs, the ones which can truly change the world.

This was written by the ADSS Research team.