In our previous article, we established that many companies and individuals may find it challenging to buy or sell large amounts of Cryptocurrencies . Some examples of businesses looking to buy or cash out cryptos are miners, ICOs, or institutional investors.

We explained that, in many cases, businesses will turn to crypto Liquidity providers (LPs) or FX brokers in order to make large ticket crypto to fiat trades. These type of liquidity providers could facilitate transactions from $100,000 to $10 million fairly easily, and Nekstream can help connect you with these firms.

How to make a trade

When making large transactions, there are two ways to go – over-the-counter (OTC) and on the markets. Transactions made OTC will not make it to the exchanges. This will mitigate the impact of the trade on the market.

If trading on the exchange, the trader/broker will need to work the order professionally. You will rarely see huge bids or offers hit the exchanges that are not worked by professional traders to minimize market impact.

An example of how a trader would make a trade without moving the market would be an ‘iceberg order.’ Traders place an order on the book for a smaller amount, replenishing the order when it gets executed. When trading with a crypto LP or broker you can direct your trade to be OTC or to hit the market.

How to get started

If you are a company looking to buy or sell a large amount of cryptos you need to find a crypto liquidity provider or FX broker that can help facilitate your trade. At Nekstream we can connect you with large crypto LP’s or FX brokers that can help properly facilitate your trade.

Once you find the right counterparty the process typically works as follows:

Step 1 - Opening an account

In setting up an account with a broker or liquidity provider, users will complete the Anti-Money Laundering (AML) and Know Your Customer requirements (KYC). In the simplest terms, these are background checks to ensure that the funds are not being used for illicit purposes.

Step 2 - Funding your account

After completing this necessary paperwork, most venues will require you to fund your new account. Make sure the broker is properly registered and/or has a history of doing large transactions, so you can feel comfortable sending large amounts of money.

You will want to ask for examples of previous clients in order to ensure that your funds are safe. You can fund your account with cryptocurrencies or fiat.

For crypto you will send your coin from your wallet to the brokers/LP’s wallet. For fiat you will simply send them a wire. Once funded you will see your funds on that broker or LP’s client portal.

Step 3 - Begin trading

When you have successfully funded your account, you can begin trading. Making the trade is fairly straightforward. There are two ways you can get started. Large trades are typically done over a Request for Quote (RFQ), though some trades can be done on the exchange platform.

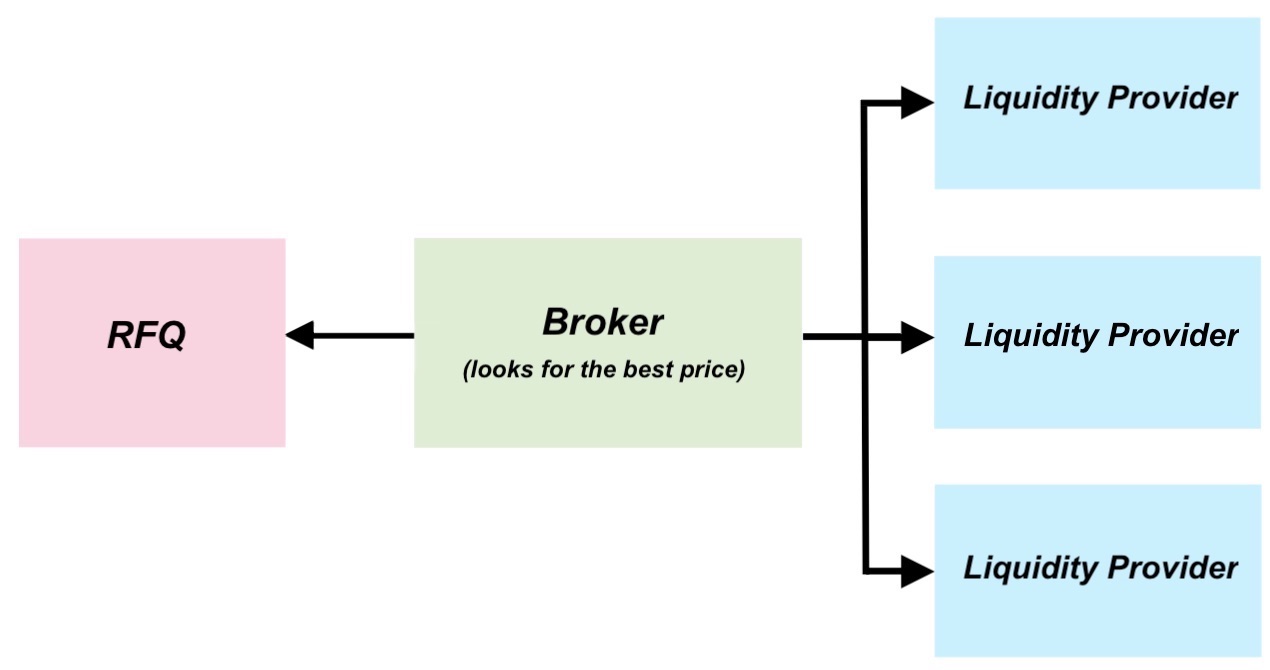

A RFQ is as simple as it sounds. A business or individual will request a quotation for a specific amount of cryptocurrency to buy or sell, and then the broker will give the buyer a price to fulfill the order. These are typically done over chat channels or on the telephone. Brokers will work with a number of liquidity providers to find the best price for your order.

Smaller trades can be done on the broker’s platform. These trades use streaming two-way pricing. When you find a suitable price for your order, you simply execute the trade.

Receiving your funds

After you have successfully executed your trade, you have different options, depending on whether you are buying or selling cryptos. If you have just sold cryptocurrencies, your fiat will be transferred back into your brokerage account. From there, you can send it via wire, or store it for further trading.

If you bought cryptocurrency with fiat, your coins will be transferred to the broker’s wallet which will be in your name. To ensure the safety of your investment, however, most people choose to transfer their cryptocurrency to their own wallet.

There are several different types of wallets; hardware wallets, paper wallets, software wallets, and hot wallets.

Hot wallets

Some examples of these wallets are, among others: CoinBase, Kraken, and other exchanges. These wallets are web-based, and typically do not provide users control of their own private key.

Cold wallets

A couple of examples are Trezor or Nano Ledger. These wallets are essentially USB drives where you can store your cryptocurrencies offline, with complete control over your own private key.

Paper wallets

Alternatively, you have paper wallets such as MyEtherWallet. These wallets allow for the highest level of security but have a steep learning curve.

Software wallets

Notable examples include Jaxx, Exodus, and BRD. These wallets are more secure than hot wallets, and are created for desktop or mobile use.

What do these services cost?

Pricing for the services of a broker are split into two categories: commission or markup/discount. With a markup/discount model you will be buying for slightly more than the regular market price, and when selling, you will be selling for slightly less than the market price.

Most of the time, this will be around 0.75 percent, but it can be up to 3.0 percent. For example, if the Bitcoin price is $10,000 you would be buying for $10,100 in order to pay the trade facilitator. Conversely, if you are selling Bitcoin you would be selling for $9,900.

Commission

The typical commission is 0.5 percent but can be up to 1.0 percent this will be charged on top of the market price of the instrument you are trading.

Why use a broker to make large trades?

As cryptocurrencies gain in popularity, more businesses will be looking to make large ticket trades to and from fiat currencies. These businesses will require trusted, highly knowledgeable assistance, security of their funds, and the ability to make large trades without moving markets.

FX brokers offer all of these services, and more. Though most brokers fly under the radar, Nekstream can keep you connected, and keep your money flowing with your privacy and your security as a top priority. Send an email to info@nekstream.com to find out more.

Alex Nekritin is the Managing Director of Nekstream Global, a liquidity and technology consulting company helping brokers, HFT traders and money managers to find proper liquidity and tools for their ventures. Alex has over 10 years of experience in the financial space.