There aren’t many pieces of technology that can rouse the kinds of emotionally charged debates that Bitcoin can. Lauded as a tool to financially empower individuals by some, and decried as a scam by others, the currency has taken the world by storm.

However, even some of BTC’s most dedicated disciples have wavered in their faith as the bitcoin price has fallen more than 50 percent from nearly $20,000 in December of 2017 to roughly $8000 at press time.

Much confusion and angst have consumed some members of the crypto community and those seeking cryptocurrency trading opportunities at the wake of the drop; others see the market shrinkage as a rational response to the insanity of the Q4 Bitcoin bull run. Others still are smugly enjoying their ‘I-told-you-so’s.

No matter what emotional state people are in, there’s one question that’s on everyone’s mind: what happened?

Of course, the answer is far from simple, but there are some concrete factors that are directly responsible for Bitcoin’s slowdive.

Government Regulation

As cryptocurrency rose at unprecedented rates throughout 2017 and into 2018, governments across the globe began scrambling to appropriately regulate the industry. This was to protect investors as well as collect tax revenues.

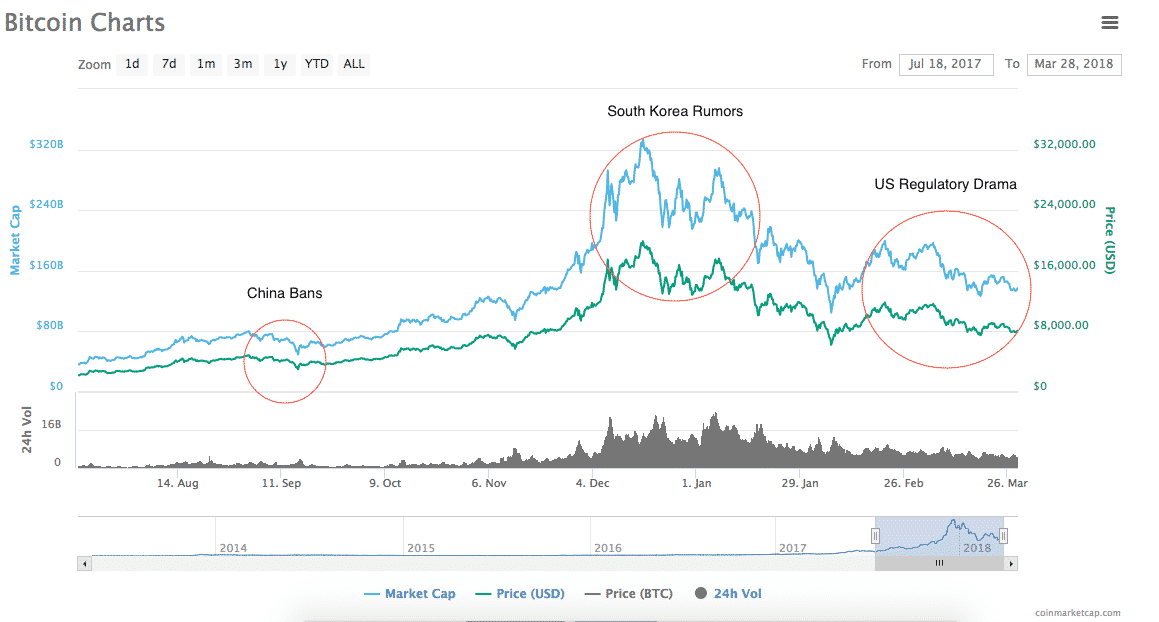

Some countries acted swiftly and harshly. China set a sweeping set of bans into motion that ultimately outlawed domestic crypto exchanges and ICOs. These bans sent the cryptosphere into a tailspin and markets shed billions.

Rumors that South Korea was considering banning domestic cryptocurrency exchanges had a similar (and even more drastic) effect on the price of Bitcoin at the end of 2017. The rumors were later declared as false, and certain South Korean officials were later accused of market manipulation and insider trading.

The United States has acted rather slowly and steadily to regulate crypto. There haven’t been any real new regulations formed to cover crypto specifically, although the SEC, the CFTC, and other governmental branches have made (somewhat contradictory) statements about which existing laws apply to crypto.

The SEC’s announcement on Thursday, March 8, that crypto exchanges must register with the organization seems to have had the most drastic effect on the price of Bitcoin out of any of the US’s actions - the price of a single Bitcoin fell from $11,500 to $9,500 in just four days.

Self-regulations: Internet and social media firms take measures against crypto

In addition to government regulations, companies like Facebook, Google, and Twitter have taken it upon themselves to prevent customers and users from using cryptocurrency services. All three internet giants have made the decision to ban advertisements for cryptocurrency-related services.

Facebook was the first of these firms to make the decision, announcing its discontinuation of crypto ads at the end of January. Google followed in mid-march; Twitter announced its decision on Monday, March 26. Within 24 hours of Twitter’s decision, the price of a single Bitcoin had fallen by more than $600.

Self-regulation has also been something of a trend in the banking industry - banks the world over have issued warnings to customers about investing in cryptocurrency, and some (i.e. Capital One and Metropolitan Bank) have even barred some customers’ crypto-related transactions. However, it does not appear that these measures have caused much movement in the price of BTC.

Not all publicity is good publicity when it comes to bitcoin

Everything moves at lightning speed in the world of cryptocurrency--in less than two years, the cryptosphere itself has exploded from a fringe hobby into a global movement worth hundreds of billions of dollars.

Because everything moves so quickly, words and opinions have significant and immediate effects on the price of Bitcoin. This phenomenon often causes self-fulfilling prophecies; if a major news source reports that the price of Bitcoin is headed upward, investors rush to buy BTC, which then causes the price to move upward.

The same can be true of negative press--the falling price of Bitcoin could be a self-fueling implosion. The more that Bitcoin falls, the more that people say that Bitcoin is going to fall. Then, more people who are worried about losing their funds sell their coins. The price falls, and the cycle continues.

A whole new animal

Bitcoin (and cryptocurrency and general) is such a young concept that many traditional systems of belief about the way that assets behave don’t really apply to it.

While the decision of whether or not to ‘hodl’ your coins is tough, no one can say for certain what the right thing to do is--anyone who does is lying.

The truth is that no one can predict the future. However, we do have the unique opportunity to watch the future of Bitcoin unfold. If nothing else, we know that’s going to be damn interesting.