eFXplus is a derived-data service (DDS) for advanced FX traders to capture an edge on markets’ major analytical views and sentimental targets. eFXplus is a product by eFXdata, a Boston-based Fintech company.

The key edge of the data within eFXplus is not only in the high-end institutional data sources (most recently its partnership with Thomson Reuters, but mainly in how eFXdata picks, derives, records, and streams its systemized data.

eFXplus is built on the top of a proprietary price-based recording system, which is partially a machine reader and partially an AI-supported optimization tool, which in turn, screens, filters, and/or modifies the received data before recording the output into their related derived desks or what eFXplus coined as ‘d-desks’.

What can eFXplus do for you?

At-Mkt OrdersData

For example, trade recommendations’ data that are derived by eFX from Thomson Reuters IFR Markets will be found in Orders under d-desk R'(IFR). In short, eFXplus provides a smart, comprehensive, and at-market (@mkt) time-stamped data stream derived from the research notes, market commentaries and originated feeds of it multiple data sources.

Source: eFXplus Orders on March 05, 2018

Untampered Data Record

Of note, eFXplus boasts a robust data record, including up to five years of untampered data. This is instrumental for analysts, leveraging this feature as a strong resource. The utility also allows for tracking the record of trades of different d-desks.

Actionable Trade Units

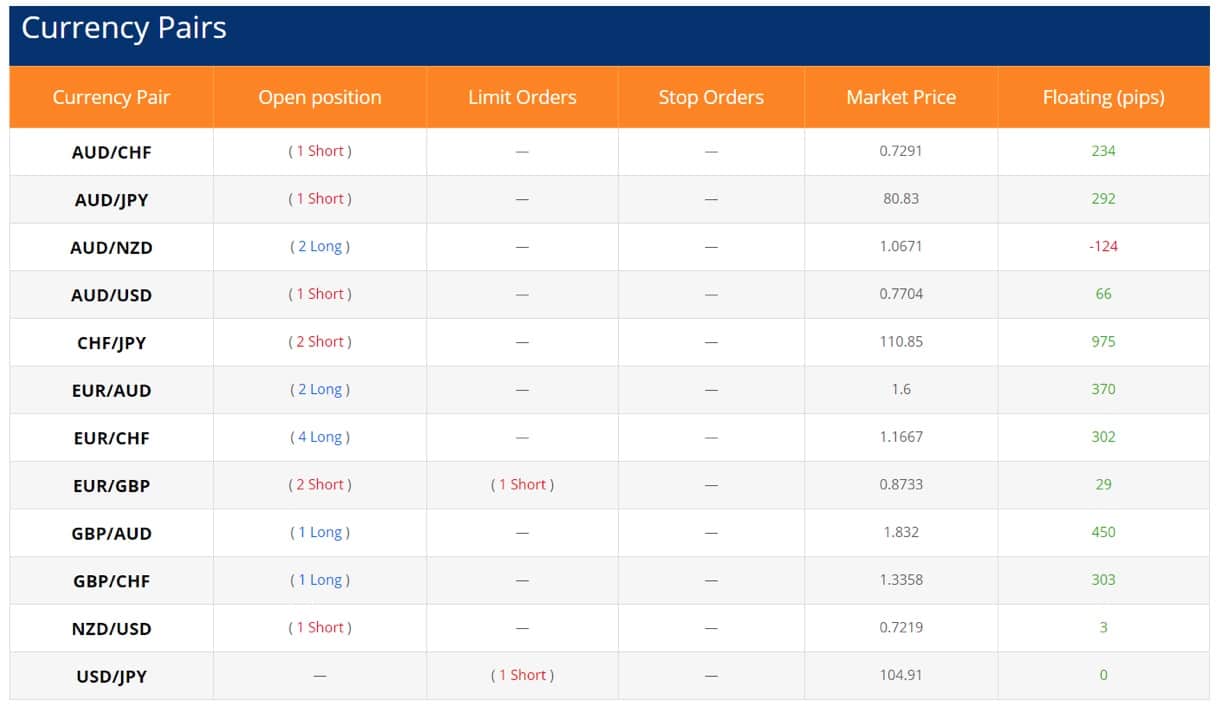

Flipping d-desks into currency pair mode gives a collective smart sentiment on multiple FX majors, which is dynamically adjusted and measured against real-time live prices (@mkt time-stamped). With full customization options on selecting specific pairs and crosses, eFXplus subscribers receive the data stream on the selected pair in real-time in the form of fully actionable trade units with unique trade IDs.

Each trade ID is aunique digital identifier for the given trade across its full cycle on eFXplus in Notifications, Orders and later in Trade Stats. The entire Orders page is particularly engaging as it allows you to see at a glance who is short and who is long, which currency pairs and what floating pips they have on their current positions.

Utilizing LSI, ISI

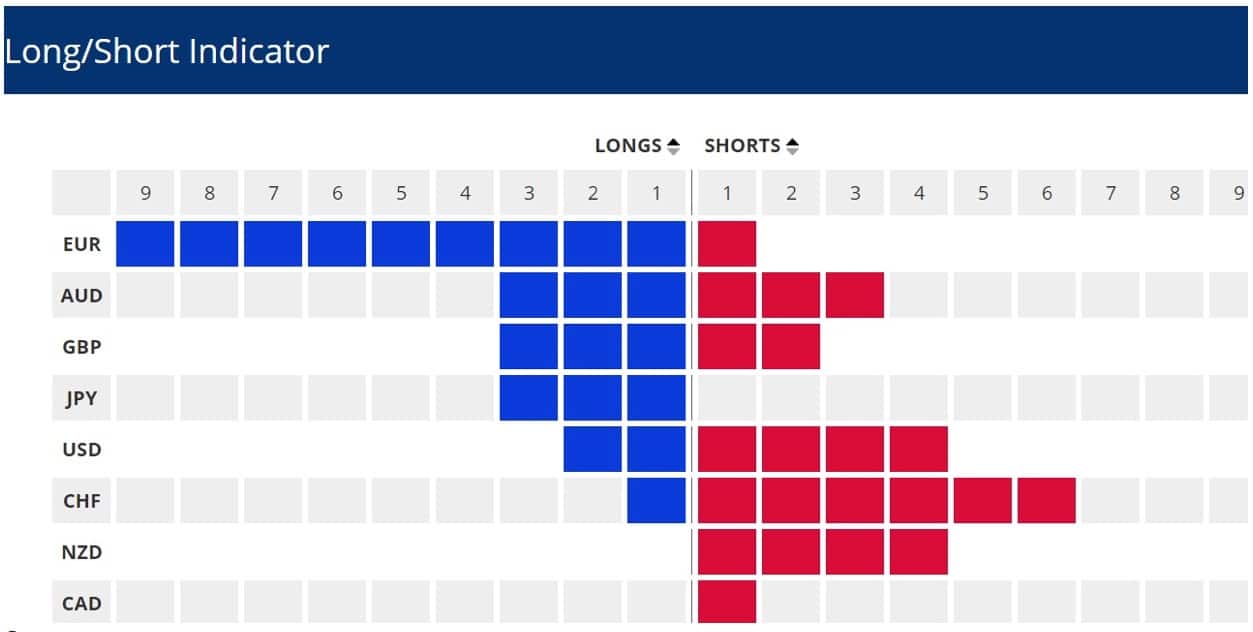

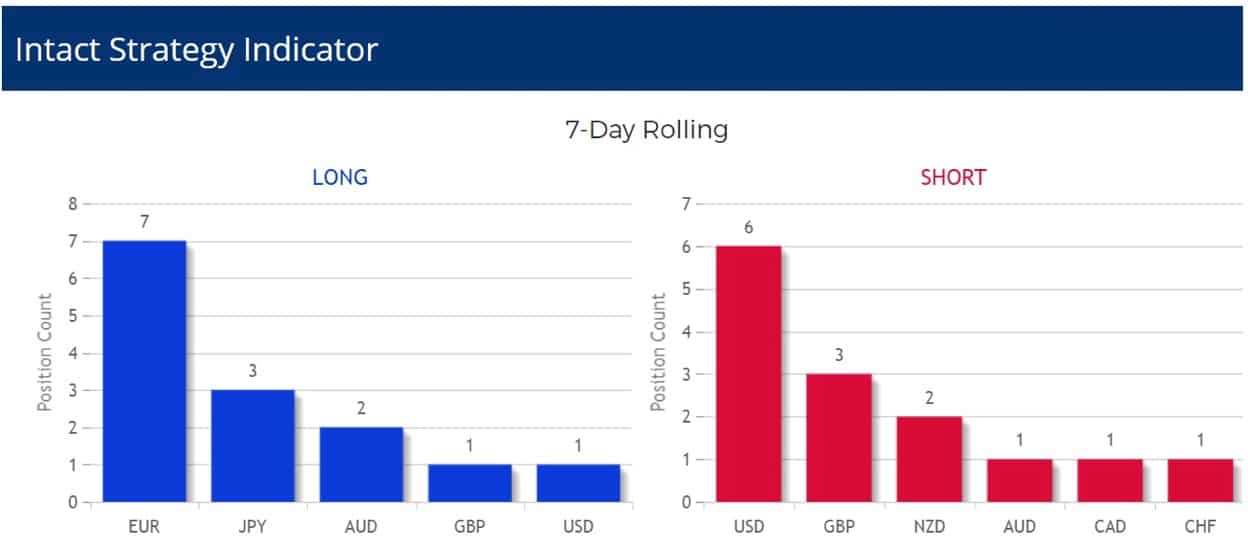

Switching Orders mode on eFXplus from datato visual indicators, provides dynamic strategy building tools for spotting tactical and structural trading opportunities via a mashup of orders data.

eFXplus runs two fascinating indicators that can be understood as smart interpretation of the order data: this includes the Long-Short Indicator (LSI) and the Intact Strategy Indicator (ISI).

Source: eFXplus Orders - Visual Indicators on March 07, 2018

Both LSI and ISI provide a range of benefits for users. In particular, LSI can help to discover thematic trading opportunities (medium- to long-term). By extension, ISI can also help in the analysis of tactical trading opportunities (short-term), which may arise when considering a buy strategy in currencies with most intact longs and pairing them with a sell strategy in currencies with the most intact.

Source: eFXplus Orders - Visual Indicators on March 07, 2018

Forecasts

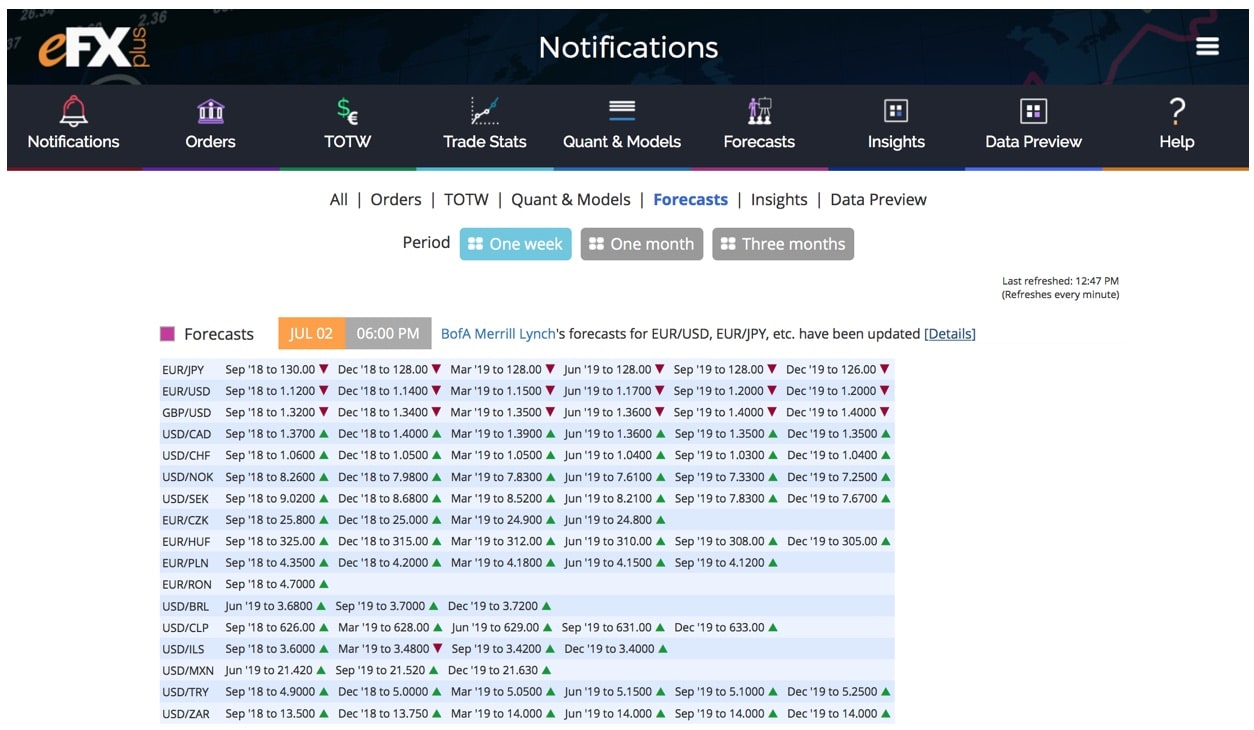

Another useful tool is a detailed forecasts section. Importantly, in addition to viewing them fully in the forecasts section, these are updated in notifications for easily spotting up and down revisions (see image below). Forecasts gives a rundown of expectations for the future rate of the selected currency pair. It also provides an excellent snapshot of major institutions’ expectations for a range of currency pairs.

Insights

By simply opening the ‘insights’ tab you can see the key sentimental shifts of each session. Holding multiple factors together can be a challenge for even the most competent analysts and the collection that eFX have brought together ensured that missing any key sentiment shifts would be greatly reduced.

Another useful feature of the ‘insights’ tab is the ability to search the latest institutional ‘insights’ via the currency pair. This proves to be a great way to filter the latest views on currency pairs in a very specific way and allows you to be specific and focused.

Stay ahead of central banks

One very versatile feature that could still be included in eFXplus is a central bank tab. Having all the commentary of central bank analysis under a single tab would be quite useful for users. By aggregating this information in advanced filters, users could see all the comments on the Bank of England or the Fed etc.

An example of this is following USD/JPY insights, reinforced by providing a framework for the recent USD/JPY price action. It helped frame the latest expected moves from the Federal Open Market Committee within current price context around the risk off sentiment going into the G7 summit in Canada in early June 2018.

Ease of Use

Beyond the functionality of the platform, the layout of eFXplus is very simple and intuitive to use. There is a notifications tab, which lists all the most recent data updates to the site. This functions as an overarching navigating guide to what has been recently-added.

Moreover, this is a very useful feature, as you have the assurance that you are not missing any data updates as long as you check the notifications tab, which has an optional sound-alert. It really anchors the site and ensures that none of the many updates are missed. It keeps it practical and usable in a busy environment.

For those users, often away from their desk, the use of the options e-mail notifications in the Premium package is a good use, however, for those at their desks having the notifications tab on one of your screens would provide a great constant resource for a very reasonable cost without the need of the e-mail notifications package.

Pricing

eFXplus offers a basic tier at US$ 99 per month and a premium tier at US$ 129 per month. Premium users receive additional email options that can customize them based on data type and currency pairs. For first time users, a 7-day free trial is available for US$ 19 or 29 respectively.

Conclusion: eFXplus Is Worth It!

Yes, eFXplus will help your trading decisions. Competitively Priced, eFXplus aims to bring a breadth and depth of market analysis, comment and orders and make them accessible to nearly all levels of traders.

The searchable features are practical, and this resource is ideally suited as a support package for decision makers executing trading decisions. It is a bit like having a constant peer review in that the voice of many analysts ensure that you don’t miss key, critical information.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates.