The past month has been an eventful period for ETHLend, having recently launched several key project developments. This includes the deployment of its decentralized application, Alpha 0.3 (Kogia) to the Ethereum Testnet, as well as new FIAT lending capabilities. During this period, ETHLend has also recorded a new record breaking figure of 12,000 ETH in lending volume.

The lending figure is noteworthy given ETHLend’s volumes have doubled since its last update on March 22, 2018, which saw 6,000 ETH in loans. The record 12,000 ETH in lending volume was calculated on ETHLend’s dApp (Alpha 0.2.0 and Alpha 0.2.1 codenamed Omura).

All part of the plan

Such an increase bodes well for ETHLend, which highlights an increase in both transactions and size of loans. The increasing traction of the project has also sped up in 2018, with ETHLend targeting specific upgrades in Q1.

ETHLend is currently building a statistics module for the decentralized application. During Alpha 0.2.0, the group’s lending volume reached 3,500 ETH, with its current Omura version having already reached 8,500 ETH. ETHLend estimates this figure to reach 10,000 ETH before the Kogia main net release, bringing the total to 13,500 ETH in volume.

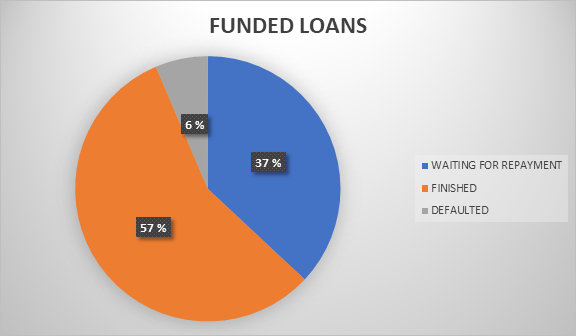

Total amount of 1,148. loans have been funded on Omura version. Out of these 619 are already finished, 451 are waiting for repayment and 78 have defaulted.

Coming Next: KOGIA Alpha 0.3

Looking ahead, the release of ETHLend’s Alpha 0.3 Kogia is right down the corner. In this new version users will be able to utilize a number of improvements. With the upcoming version, paying an installment on the loan will result in LTV ratio decreasing. LTV will also naturally decrease in case of borrower refilling the collateral, which is a new feature introduced on this version. Both of these introductions will help protect borrowers position and avoid collateral calling.

Alpha 0.3 will also introduce much anticipated new and improved user interface and also improved usability by mobile devices. The new version is more user friendly, with users able to access the new test version to get acquainted with the new features.

ETHLend will also be looking to introduce LEND as Method of Exchange, and by doing it will enable the users to use our decentralized application with zero fees. Prospective users or individuals interested in learning more about the project can also speak directly to company representatives during Blockchain Week in New York.

Beginning of May 2018, CoinDesk, together with the New York City Economic Development Corporation (NYCEDC) will be working to host the Blockchain Week. Looking to see over 5,000 attendees, ETHLend will be organizing a ‘MeetUp’, giving crypto enthusiasts and its growing community a chance to learn more about the project.