COVID-19 has created an environment of great challenges and great opportunities for the financial industry.

Users, traders, and clients of every stripe are demanding more than ever from their financial service providers. As a result, platforms across the industry are finding themselves in a position of constant change and innovation. Existing users require new products and services, as well as enhanced customer service; at the same time, platforms are scaling for waves of new users.

Recently, Finance Magnates spoke with Carla Nemr, global head of business at dynamic forex and CFD broker Tickmill, about how her company has turned the challenges presented by COVID-19 into opportunities for growth and innovation.

During her career, Carla has worked at a number of Cyprus-based companies. After she ventured into the industry in 2009 with FxPulp, she spent brief stints at Alpari FS and FXTM. She was also a Sales Manager at Falcon Brokers, where she spent nearly two years.

Finance Magnates · FMTV -- Turning Challenges into Opportunities: A Conversation with Tickmill’s Carla Nemr

This is an excerpt that has been edited for clarity and length. To hear Finance Magnates’ full interview with Tickmill’s Carla Nemr, visit us on Soundcloud or Youtube.

Tickmill’s Strong Performance in 2019: Key Factors

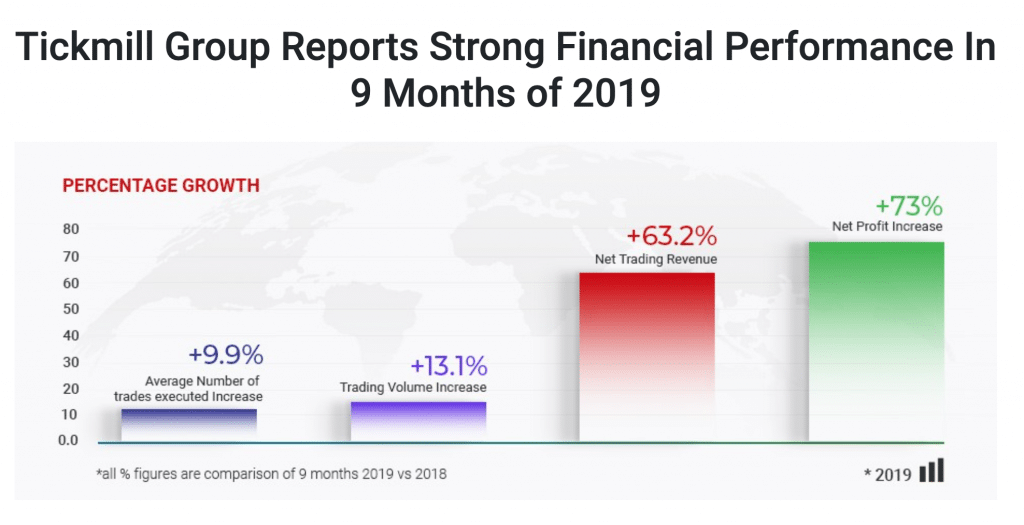

We asked Carla about Tickmill’s strong performance in 2019: the factors that contributed to the success of the year, and whether or not these factors have contributed to further growth in 2020.

The company published a report saying that the “unaudited consolidated net profit for the first 9 months of 2019 came in at $29.46 million and the Company is projecting to reach $35 million net profit for the calendar year, in comparison to 2018’s consolidated net profit, at $19.67 million.

“Tickmill Group attributes its strong profitability figures to organic growth in key markets, cost optimization and investment into new technology, achieving increased efficiency through automation,” the report said.

Carla explained that “when it comes to the key factors that contributed to this very strong year (2019), I would emphasize the further expansion we had always looked into in new markets, as well as the solidification of presence that we have in existing markets.

“In addition to that, we have tailored relationships with certain Liquidity providers, and we are trying to look into the best price and execution in order to offer the clients the best trading experience with Tickmill,” Carla stated.

The company has also been working to “enhance our services around the globe,” Carla said, in terms of providing the best tools and services tailored for each individual market” in terms of “their respective languages, educational webinars, and being close to the market culture and seeing exactly what each market needs.”

In 2020 and 2021, ”We Expect to Capture a Bigger Market Share”

Carla said that she expects Tickmill’s growth throughout 2019 to continue through 2020 and into 2021.

“If we look back at our performance through the years, I think that we can only observe that Tickmill has been recording stable growth every year,” and despite the COVID-19 pandemic, Carla said that “2020 is not an exception to this.”

Of course, “this year did not allow us to organize a lot of the activities that we had planned at the beginning of the year, or to attend physical events like seminars and expos like we did in previous years,” Carla said.

The change in circumstances caused Tickmill to have to think outside of the box: “we took advantage of our own resources to develop new products and streamline our existing services,” Carla said. “We launched a new version of the website, we developed a new blog that focuses exclusively on educational material, and we’ve added additional tools that clients were keen to have in their client area.”

Therefore, “we expect to capture a bigger market share,” Carla said, adding that Tickmill has also expanded its “regulatory footprint”: Tickmill has “acquired two additional licenses,” including one license from the Labuan Financial Services Authority and another from the Financial Sector Conduct Authority in South Africa.

“The Lack of Physical Interaction with Our Client Base Made Us Shift to a More Human Approach in the Way That We Communicate with Clients.”

Therefore, COVID-19, while it has brought a serious dose of chaos to nearly every corner of modern life, has presented companies like Tickmill with a number of unique opportunities.

“If we are talking about our sector of the financial market, [the COVID crisis] caused some advantages and disadvantages,” Carla said.

“It caused us to rely on our digital resources: perhaps to host events that would have otherwise been physical,” she continued.

“The lack of physical interaction with our client base made us shift to a more human approach in the way that we communicate with clients: for example, we were trying to focus more on communicating with clients more often.”

This includes “different types of communication, following up, providing support when they need virtual existence,” Carla explained.

Indeed, in a way, 2020 has presented “the ideal opportunity to invest in digital technologies” that support this kind of communication.

Beyond that, Carla believes that the events of the year have greatly increased the pace at which innovation happens: “I believe the rate of innovation within the fintech sphere has, inevitably, changed,” she said. “Necessity is the mother of invention.”

“Clients Were Looking for More Clarity, Control, and Communication Than Ever Before.”

Still, there were COVID-induced challenges that Tickmill met along the way throughout the year.

For example, in addition to increasing the pace of innovation, Carla also observed that trading activities increased throughout the pandemic as people “had to stay at home.”

“This caused increased trading volumes for us,” she said, ”in a good way.”

However, at the same time, these increased trading volumes brought a new wave of increased client demand.

“Clients were looking for more clarity, control, and communication than ever before,” she said.

But Tickmill rose to the challenge: “in response to this need, we went the extra mile to provide them with up-to-date forecasts and market trends delivered by our internal market analysts,” Carla said.

This is also because traders were “more concerned with the volatility of the market” at certain points throughout the year. Specifically, “if you remember March, we had a lot of volatility in financial markets, so clients were always in communication with us to understand what was going on.”

“COVID-19 Has Had and Will Continue to Have a Lasting Effect on How Businesses Operate.”

While the pandemic will eventually pass, Carla does not necessarily see any of the changes that Tickmill made in response to the pandemic as temporary.

“COVID-19 has had, and will continue to have, a lasting effect on how businesses operate,” she said.

She specifically pointed to the massive increase of work-from-home employment in businesses everywhere. In the financial industry, “we can see that the work-from-home and flexible practices have become the norm in working conditions, and I think that this will prevail in the year ahead.”

Tickmill has “fully embraced also from our side this remote work culture, and we are also open to adopting appropriate technologies that will enable our team to work and collaborate in a very efficient and productive manner.”

Carla said that she believes that allowing for this kind of flexibility will be crucial in the future: “I think the winners in the brokerage domain will be those companies that can successfully adapt to meet the evolving needs of their customers.”

Additionally, we asked Carla about what she sees in the future of the financial trading space after COVID has passed.

From Tickmill’s perspective, “after COVID-19, we’re hoping that things will become easier in terms of moving around,” she said. “We already have plans to go to physical events and to meet our clients face-to-face.”

This could result in “a slowdown in trading activities,” she said, “as clients will be flying and much more ‘on the move’ compared to now.”

Into the Future: “We Are Also Looking to Expand into New Markets and Increase Our Market Share”

However, the end of COVID could still be a long way away. Therefore, for now, Carla said that Tickmill’s focus is to “continue to diversify our product portfolio.

“We would like to enhance the number of instruments and products that we are going to offer our clients,” she said, “because the demand is growing, the expansion of markets is growing. So, traders in every market would like specific instruments or products tailor-made for them.”

Additionally, “we are also looking to expand into new markets and increase our market share,” Carla said.

Furthermore, Tickmill is “launching more trading platforms to add more trading experiences for our traders, and more trading tools that traders will benefit from, which will add value to the experience of trading at Tickmill and maintain our competitive advantage as one of the industry’s low-cost brokers.”