FX technology service providers who were catering to retail brokers quickly realized that the gross margins on licensing thier technologies were either capped or diminishing.

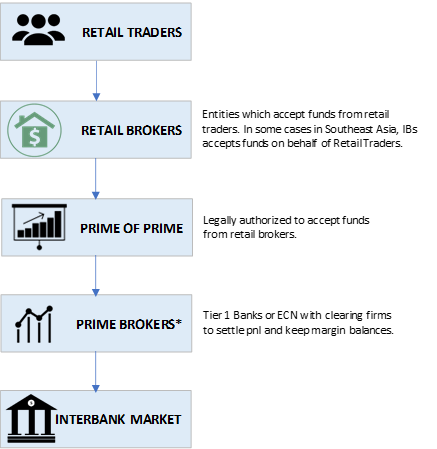

With a healthy existing client base, some of these FX technology firms transitioned their technology clients to Liquidity clients by providing indirect access to the interbank market. In PoP, a large broker or FX service provider typically opens an account or arranges a clearing relationship directly with a Prime Broker or a tier 1 bank or an established ECN and then redistributes the tier 1 liquidity at a marked-up rate and takes on risk correlated to the size of the firm's balance sheet.

FDC

As a pure technology provider, FX technology firms earn a fixed fee or a per mm cost of $1 to $10 per mm USD. By bundling technology and liquidity, FX technology firms are able to transform its business into PoP, where now they would begin to earn revenues of $25 to $500 per mm.

This means that instead of $1000 to $10,000 per each yard (billion USD notional volume) in trading volume firms can earn $25,000 to $500,000 per a yard when bundling technology with liquidity in a prime of prime business model.

With the cash flows becoming attractive, many more firms and entrepreneurs entered the PoP space

In doing this transition, these firms increased their operational and counterparty risks while at the same time rapidly increasing their cash flows. With the cash flows becoming attractive, many more firms and entrepreneurs entered the PoP space.

The firms who succeeded were the ones who successfully addressed three (3) main areas of PoP business. The successful PoPs in the traditional sense had an experienced team of FX experts with specific skill sets in key areas of marketing, technology, risk management, compliance and financial discipline.

These PoPs had certain economies of scale with a minimum burn rate of $150,000 per month to effectively employ and retain the right personnel to make PoP a going concern.

Fund Custody

The greatest risk in OTC FX is the Counterparty risk. While Black Swan events can collapse just about any firm, successful PoPs are able to actively market their safety of funds and present a reasonable case as to why FX brokers can trust their services as an alternative to their competition.

For PoPs, they could earn additional income from holding customer funds, which in turn would enable them to realize minimum monthly fees, interest on deposits, increased credit lines from rehypothecation of deposits to its prime brokers.

Trading Conditions

Successful PoPs have reasonable spreads and competitive fees for the types of trades the clients send. A good PoP will be able to customize a large band of traders who place larger than average trade sizes or who actively trade in obscure pairs.

Spreads are easily referenced on interbank platforms so the spreads PoP provide must remain correlated to the interbank market. PoPs that provide good trading services must employ significant operational staff or utilize PoP Back Office (such as Condor Risk Management for MT4) to efficiently operate the business.

Due to the complexity of hedging algorithms used by successful PoPs, the main risk is out-trades and successful PoPs have very good risk management practices specific to its market. By providing market access to the traders, PoPs earn revenue from spread markup, brokerage fee, swaps and market making. Having a professional risk management strategy is paramount to the success of any PoP.

FX firms are able to increase the lifetime value of a trading client thus enhancing the value of the business itself

Complete Technology

Successful PoPs either directly or through trusted partners provide a complete solution where they control some or all the technologies used by their clients. This increases PoPs’ client retention period as the switching cost and integration risk to another provider becomes high.

The traditional white label model, where a firm like FXCM, GFT or Saxo Bank would white label their proprietary platform to another financial institution has an extremely high barrier to entry for these firms as it requires firms to have a proprietary trading platform. However, FX traders tend to prefer the platform they learned to trade on.

Consequently, it is a huge advantage for FX firms to be able to offer the most popular platform of choice along with the proprietary trading platform. By providing multiple platform choices, FX firms are able to increase the lifetime value of a trading client thus enhancing the value of the business itself.

Typically, these firms use the technology themselves for their own brokerage activities, thus proving the viability of the technology and then begin to earn additional revenues by white labeling their technology to other financial firms. These financial firms only offer the technology to other brokers to subsidize the cost of their technology department.

This popular white label solution was replaced with technology solution offered by firms like Leverate and Advanced Markets/Fortex where firms provide a complete technology and liquidity solution and have the flexibility to approach the market either as a technology company or a financial firm depending on the needs of the client.

Firms like PrimeXM and OneZero have made it more difficult for PoPs to control the technology component of their brokerage services by providing a highly scalable low-cost technology (as low as $1 per mm). By some estimates these low-cost technology providers service over a trillion a month in retail FX volume.

The ones who are successful will be the ones who serve all the needs of the clients

This means to be a successful PoP firm, either one must provide a complete MT4 solution (such as NSFX Prime), which truly meet the needs of its clients or have a proven proprietary platform that has served traders for the past 20 years (such as iFOREX Prime).

Going forward, more firms will enter the PoP space and the ones who are successful will be the ones who serve all the needs of the clients. For those firms interested in becoming a PoP, FDC offers a unique value proposition to develop and implement a successful business strategy whereby a firm can employ a team of FX industry experts at a fraction of the cost of hiring an in-house team. Click here to request an extensive 18 slides case study on PoP.