We close out the last quarter of 2023 experiencing the longest crypto winter, witnessing an unprecedented period of stagnation in the market. Many investors who rode the high on soaring values in 2021 are nowhere to be seen as crypto prices continue to dwindle day after day. Notwithstanding, capital inflows have shifted from neutral to negative in the past few months, aligning with Bitcoin and Ethereum capital outflows, which reflects growing uncertainty in the market.

Despite Bitcoin outperforming many assets during the year, witnessing a 66% growth since January 1, the overall global crypto adoption is in a massive slowdown. Volatility has spiked over the last two quarters but realized volatility has remained consistently low, with liquidity across the crypto ecosystem reaching historical lows.

A graph showing the 30-day Bitcoin’s realized volatility (Image: CoinGlass)

This begs the question – What has caused this prolonged bear market and why are adoption rates so low despite technological developments being built every other day? Many factors are at play, both internal and external, despite crypto acting as an independent market.

Crypto works towards being fully decentralized and disconnected from the traditional financial system. However, for crypto to witness global adoption, platforms should work towards integrating with TradFi instead of completely distancing itself. Luckily, the presence of centralized exchanges such as Binance and Coinbase makes it simpler for users to buy and sell their assets, and brokers such as MultiBank Group with their crypto-focused exchange MultiBank.io enables users to connect and integrate traditional finance instruments and digital assets.

But before we understand how TradFi platforms can expand the global adoption of crypto, let’s take a look at why global crypto adoption has been declining over the past few years.

Why Crypto Adoption is Slowing Down Globally

To really understand why crypto adoption is falling, we need to understand that many factors impact the market. One of the biggest factors for the current slowdown in the market is the regulatory uncertainties pertaining to crypto globally.

Since the bankruptcies that involved top crypto firms, including FTX, Celsius and Voyager, regulators worldwide have become more wary of digital assets trading and exchanges. Following the FTX scandal, European Union states unveiled the world’s first comprehensive set of laws to regulate cryptocurrencies and digital assets in May 2023 and are set to come into effect in 2024. While staking remains a grey area, many believe the laws are a step in the right direction for the industry.

However, as the rest of the world plays catch up investors are left with uncertainty causing a massive exodus from space. Financial regulators worldwide having negative sentiments on digital assets also causes fear within investors’ minds and undermines the adoption of crypto. It is becoming increasingly clear that regulators need to create clear frameworks on rules and laws if crypto adoption is to soar once again.

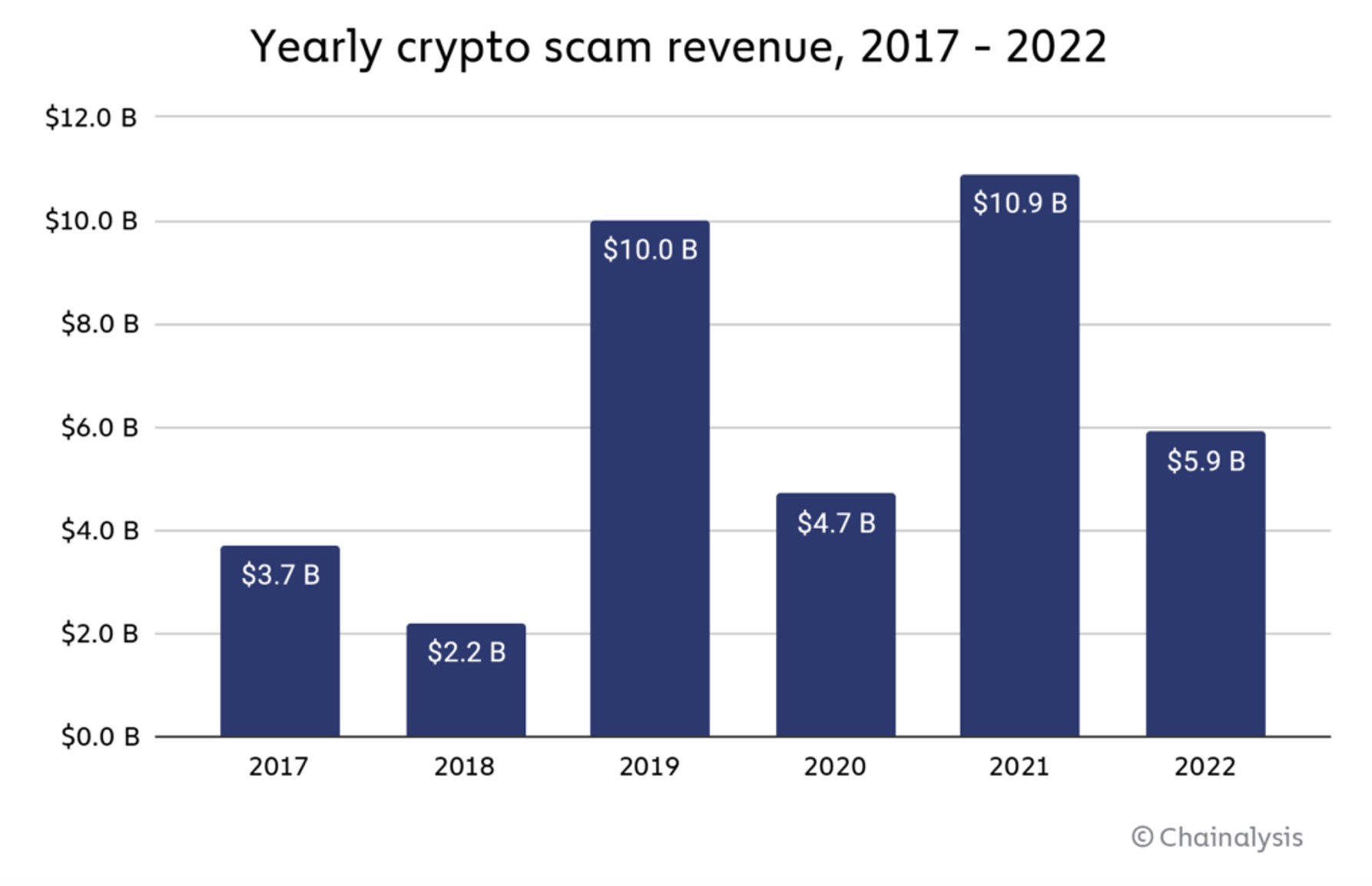

Notwithstanding, the prevalence of scams within the space has discouraged investors from ‘gambling’ their capital on the space. According to Chainalysis, the yearly revenue from scams dipped by 46% to $5.9 billion in 2022 from $10.9 billion the year prior. The sharp decline in scams can be attributed to the significant fall in crypto prices over the year, but scam artists are getting better and they remain a tough headache to overall global adoption.

While regulation and scams may play a big role in adoption, the technology faces a challenge as most people have yet to embrace this new technology. Complex terms, complex platforms, and poor ease of use across the field have made customers think twice before investing their capital in the crypto market. For instance, most people can’t open a personal wallet by themselves, let alone transact on decentralized finance (DeFi) platforms.

Finally, crypto faces a challenge in the customer service department, as you may have experienced before. It is understandable as the crypto industry’s exponential growth means that many companies have scaled at an unprecedented rate: this means hiring and training hundreds if not thousands of new employees in a short space of time.

How TradFi could help reshape Crypto

To get a clear understanding of how the banking system is slowly reshaping crypto adoption, we take MultiBank Group as an example. The brokerage was launched in 2005 aiming to bring regulation and safety to the financial industry and create a trusted trading environment. Since its launch, the platform has grown into one of the largest financial derivatives institutions, with 12 financial licenses worldwide and over 1 million active customers.

With staunch experience in derivatives trading and a licensed trading platform, MultiBank Group launched its crypto wing, MultiBank.io, with the objective of creating an ecosystem that solves the issue of lack of regulations within the industry. MultiBank.io revolutionized the crypto industry by leveraging its established reputation for security and regulations in the derivatives sector to create a one-stop trading shop for all assets.

Additionally, the platform partners every user with a relationship manager to ease their trading and give a more personal touch to them. Finally, the ease of trading removes the complexities associated with crypto trading, enabling experts and newbies alike to enter the space without being bombarded with big words or complex trading platforms that may require an external wallet.

Final words

In a landscape marred by regulatory uncertainty, scams, technological complexities, and a lack of user-friendly interfaces, the path to widespread crypto adoption appears fraught with challenges. However, as the crypto market grapples with its longest winter, a glimmer of hope may emerge from the world of traditional finance.

Institutions like MultiBank Group are pioneering a shift towards integrating crypto with traditional financial systems, offering regulatory oversight, user-friendly platforms, and personalized support. This convergence of crypto and TradFi holds the promise of reshaping the future of digital assets, potentially breathing new life into the world of cryptocurrency adoption.