Everyone has heard the phrase 'if it ain't broke, don't fix it', basically meaning that if something is performing adequately, then there's no real reason to tweak it. Wise words, if we're talking about inventions like the hammer or the wheel, which are both simple enough to have reached some level of perfection in their design.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong. It's when we apply the same mentality across the board, to things that could and should be improved, that we start to run into trouble. I'm thinking specifically of trading platforms here, but the same logic could be used to analyze so much else that we do in the business of Online Trading . In our industry, the phrase could just as easily be changed to 'if it makes money, don't change it'. This has been the position that I've taken in some of my previous articles, regarding how most of us still think of leads. It's also the reason why our industry uses the word 'innovative' more than almost any other in its advertising copy, while most brokers still seem to be offering pretty much the same thing. So, why the cookie-cutter approach? Well, because it's still making money.

Paying Lip Service

In one of my nerdier, obsessive-compulsive moments, I searched the English language versions of several big FX brokers for how many times they used the word 'innovative' in their copy. Ready? The word appeared between 25 and 100+ times. And do you know what all of those brokers had in common? When you cut to the core, the two innovations that all of them were almost completely reliant upon were: 1. The World Wide Web (circa 1989) and 2. MetaTrader 4 (circa 2005) Incidentally, the keyword 'MT4' appeared between 50 and 800 times, which tells you all you need to know about the true landmark moments in the history of online trading. If you're in any doubt about this, visit Google Trends and perform a comparison between MT4 and any other Trading Platform in existence.

A Very Brief History of Innovation

In my line of work, I've had the good fortune to experience the online trading industry from many perspectives. I've been on the client side as a trader. I've been the middleman shuttling clients between brokers. I've also gained intimate knowledge of the inner workings of online brokerages. Finally, I've been able to bring all the things I've learned in these other roles to my current one as a technology and service provider. I believe that innovation is all about not waiting for something to break before improving on it. Don't misunderstand me though, it's not about newness for the sake of newness, either. It's about good timing and creating the conditions that attract a much larger customer base, regardless of what the industry is.

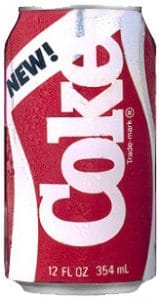

By Can: The Coca-Cola Jetijonez

When Coca-Cola brought New Coke to the market in 1985, it was the mother of all failures. But when Apple brought us the now iconic iPod back in 2001, it dominated even though the market was already flooded with excellent MP3 players. Why? Because old Coke wasn't broke and it wasn't time to fix it and because the iPod did it better from both an aesthetic and user experience point of view. It caught the wave as the music industry was changing and it it made digital music as accessible to children as to their grandmothers. Incidentally, Coca-Cola learned its lesson. Twenty years later Coke Zero came out after we had already re-evaluated our collective sugar intake as a culture, not just from a dieting point of view. Nowadays, how many people do you still see sipping from those old red cans?

Bringing Trading to the Masses

MT4 was such a landmark in online trading that almost everything to be released in its wake has been derivative of it in some way. How many platforms have you seen that look just like it? That function like a cheap copy of it? In my experience, UX is a buzzword that gets thrown around conference tables with no reference to what those two letters are actually supposed to signify. When people in our industry talk about UX, what they really mean is just how it looks rather than connecting it to the user and their experience. UX design is both an art and a science and if you look at some of the interfaces that have changed the world in the last decade or so (FaceBook-2004, YouTube-2005, Twitter-2006, the iPhone-2007), they have all succeeded because they were informed by deep understanding of users and their motivations. This is precisely what's not being done when it comes to the design of trading platforms. Most people who learn to trade on MT4 don't ever want to use anything else. It's a tremendous achievement in software engineering, which has served as one of the pillars of our industry. So why change it? It's not broken right? No, I don't believe it is. But MT4 was created for an entirely different kind of trader, not the kind that most brokerages are trying to target today and definitely not the kind that they're failing to retain. Online trading, like all of the four technologies mentioned above, has gone mainstream, but our trading platforms haven't. What most newbie traders get is a platform that feels as though it was made for someone else, whether its MT4 or one of its derivatives. If anyone took the time to do some research before repeating the existing formula, they'd discover that most beginners feel completely daunted by the software that they're expected to trade on. What's required now more than ever, is a re-imagining of the trading platform, not from the perspective of the Bloomberg Terminal, but from that of the app interface or from the idea of trading as a lifestyle product.

Bloomberg

It should provide the user with the support and confirmations that all of our other modern user interfaces do, whether it's our favorite social media venues or the home screens of our mobile devices. It should provide information, education, handy hints and suggestions, it should help us to connect the dots and it should somehow tie us to the broader trading community, even if social trading is not on the agenda. Think about all the features of the interfaces you use every day. They may not seem earth-shattering to you anymore, but they contribute to why you use them. They serve to make you feel supported, understood and part of something bigger than yourself. Now ask yourself how many such features you offer to your traders. The LiveChat pop-up window on your homepage doesn't count.

In Conclusion

Why do most people use the filters and basic editing functions on their Instagram, rather than exporting their photos into Photoshop? Photoshop is way more powerful right? It's because those filters do the trick and make average snaps look pretty amazing. Why do iPads outsell gaming PCs? Aren't the latter superior machines? Yes, by far, but our parents aren't going to learn to use them to look up their old friends now are they? I believe that our industry is maxing-out on the type of client for whom MT4 can be a gateway into the world of online trading. As with all mass adoption movements, there's a crowd of potential clients out there, who far outnumber our current customer bases, and who are just waiting for someone to make online trading speak to them. I'm sure we'll see many MySpaces as the industry catches up and attempts to reach them, but eventually, someone's going to come up with a FaceBook and then there will be a new thing for everyone to copy. Just some food for thought. This article was written by Ran Cohen, founder and CEO of Traders Education.