WiresWise is an innovated wire transfers solution provider intended to make money management simple and secure. We are honored of our individual approach to customer service.

With WiresWise, you are guaranteed an own account manager and a member of our support team always available should you have any requests or problems.

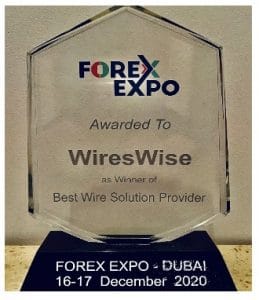

We've been on the market for just over 2 years but we are proud to be honored with “The Best Wire Solution Provider” award for 2020 in the FX Dubai Expo back in December 2020.

With the claim for fast, secure wire transfers continuing to increase, financial institutions are looking to streamline their wire transfer systems to support future growth and global obligations.

WiresWise provides you with different options for increasing the efficiency and safety of your wire processing procedures so you can experience cost savings and enlarged efficiency, find new income sources and gain competitive advantages.

WiresWise modernizes every step in the wire transfer procedures, allowing straight through processing and a paperless transaction environment, which means you can handle a higher volume of wires more professionally.

WiresWise was established to assist corporate entities with strengthening the foundation of their business. If payment services are essential to the operation of your business, our company has found a solution to all present issues of the market.

We offer a variety of services for industries such as FX Traders, Crypto Companies, Marketing Agencies,Gaming, Payment Service Providers, E-Commerce, Affiliates.

What makes us different?

In a nutshell, it is our ability to combine scale and global reach with flexibility and agility to leverage this for both businesses and consumers. This is the 'WiresWise difference' and it flows directly from the DNA of our culture: to put the customer first, to make a difference, to always find a way

- Strong and reliable partnership with most of the biggest banks

- Direct access to the banks

- Dedicated bank accounts with multiple currency acceptance

- Low risk and High-Risk businesses acceptance

- Fast and secure C2B and B2B Payments via SEPA and SWIFT

- Daily payouts

- BTC and other Cryptocurrencies payments

- Professional KYC assistance

- 24/7 support via email, skype or phone

We can consider complaints about banks making mistakes when they process payments. This includes wrongly delaying or failing to make a payment, repeating payments, or giving the wrong information about payments.

We don’t have the power to set rules about how banks process payments. Electronic payments to accounts at the same bank happen straightaway.

Those to accounts at other banks take longer and depend on when the payment was set up, the payment type, and when the bank processes the payment. Payments between banks consist of the following steps:

A customer instructs his or her bank (the sending bank) to make a payment. The sending bank checks the customer has enough money in the account for the payment.

The sending bank prepares an electronic file, along with other transactions, for the bank whose customer is receiving the payment. This collection of individual transactions is called a "batch".

The sending bank forwards the batch to the Reserve Bank, which transfers the value of the batch between the sending and receiving banks’ accounts at the Reserve Bank. This is called "settlement".

Once settlement is complete, the Reserve Bank forwards the batch to the receiving bank. This is called "interchange. The receiving bank credits the payment to its customer’s account.

Banks used to batch and process payments overnight, but nowadays they do this frequently each business day. This gives customers faster access to deposits made into their accounts.

More frequent processing also means banks are likely to take the money for scheduled or future electronic payments earlier in the day. If such payments aren’t successful the first time because there isn't enough money in an account, a bank may try again later in the day.

This could incur a fee, so be sure to check you have enough money available.

Also check that your bank does try a second time. Some banks generally won’t process payments to accounts at other banks over weekends or on public holidays. Payments made on a non-business day will be processed the next business day.

Also, if you set up a payment late in the day, the bank will generally send your payment the next business day. Banks stop sending payments at a certain time each night so they can update your account and transaction information.

Cut-off times depend on the payment type and can vary bank to bank. Check with your bank. Once you set up and confirm a payment, your bank will take the money from your account and put it into a batch to await processing.

This immediately reduces the available balance in your account. If your account pays interest, you will usually continue to earn interest until the batch is sent to the receiving bank for processing to the recipient’s account.

The amount of interest may depend on the timing of processing. This is just an example of international payment processing and there can be many more parties involved that cause delays to the transaction.

Directly straight-through-processing procedures and among banks communication abilities, including SWIFT connectivity help you expand customer service, increase into new areas of business, increase revenues, and reduce fees and risk throughout the entire payment lifecycle.

Clients and businesses are redefining how they want to interact with their wire transfer providers and the types of services they want to receive – making an institution's geographic footprint less important and its ability to connect with consumers and businesses on their own terms mission critical.

WiresWise employs a unique approach to integration and is quickly advancing our open banking strategy.

Offering suitable, real-time access to capitals and payments in a developing payments market is crucial to meeting consumer and business needs today and in the future.

Consumer preferences and activities are regularly changing with technology innovations driving expectations for speed and convenience.

At WiresWise, we will always push the boundaries of what can be achieved with our payment solutions, offering more value and functionality to businesses that partner with us, as well as helping you to offer more to your own clients too.

Incorporate innovation into company’s culture. Encourage your clients to come forward with feedback, ideas and suggestions on how you can do things better.

Every great idea starts with taking a risk. Not everything will work, but at the end of the day, people remember the achievements, not failures. Create dialogue that feeds enthusiasm and drives innovation.

Don’t be quick to dismiss ‘crazy’ ideas. It’s these ones that very often lead to great innovations. About finding ways to add value beyond the core transactional capability, about providing a different value suggestion for each and every customer that goes beyond the typical offering.

We are devoted to sustaining a safe financial environment for our clients, inevery part of the world. When it comes to payments, WiresWise are facing a number of challenges – from pressure to increase revenue by using fee-for-service business models to increasing competition and a demanding customer base.

Desirable and increasingly restrictive regulatory situation is forcing WiresWise to find better ways to deliver payments solutions in a way that grows their business.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates.