In a landmark shift, the US government might be poised to loosen its grip on marijuana. The US Department of Justice (DOJ) recently proposed reclassifying cannabis from a Schedule I drug to a Schedule III drug. This historic move could have a profound impact on the cannabis industry if approved, igniting a potential Green Rush 2.0 for investors. With federal restrictions easing, the doors are opening for wider research, banking access, and interstate commerce for cannabis businesses. Let’s have a closer look at what it means for cannabis stocks.

Schedule I vs. Schedule III: Understanding the Shift in US Marijuana Classification

The Drug Enforcement Administration (DEA) under the Department of Justice announced a significant development on May 16th: it issued a notice of proposed rulemaking, which initiates the formal process to reclassify cannabis. This move could have major implications for the legal status and future of the cannabis industry in the United States.

The Controlled Substances Act (CSA) balances purposes by placing each drug warranting control into one of five “schedules,” with drugs in Schedule I subject to the strictest regulatory and criminal provisions, Schedule V being the least strict. Currently, cannabis sits on Schedule I of the CSA, enacted by Congress in 1970.

This classification signifies that it has no currently accepted medical use and a high potential for abuse and addiction, placing it alongside drugs like heroin, LSD, and ecstasy. However, the DEA's proposal seeks to move cannabis to Schedule III. This schedule encompasses medications with a lower potential for dependence and accepted medical uses, such as drugs including codeine, ketamine, and anabolic steroids.

The proposed reclassification aligns with the Department of Health and Human Services (HHS) recommendation from August 2023 that came after Biden asked to initiate an

“administrative process to review expeditiously how marijuana is scheduled under federal law” on October 6th 2022. The HHS believes cannabis has established medical benefits and a lower abuse potential compared to its current classification.

This development could open the door for a potential transformation within the cannabis industry.

What Could Be the Potential Impacts on the Majijuana Industry?

Research Opportunities

Understanding the potential benefits and harms of any substance, from common medications to newly discovered compounds, is crucial for public health. But this process relies heavily on scientific research, which often involves conducting clinical trials. However, scientists face significant hurdles when it comes to studying drugs classified as Schedule I.

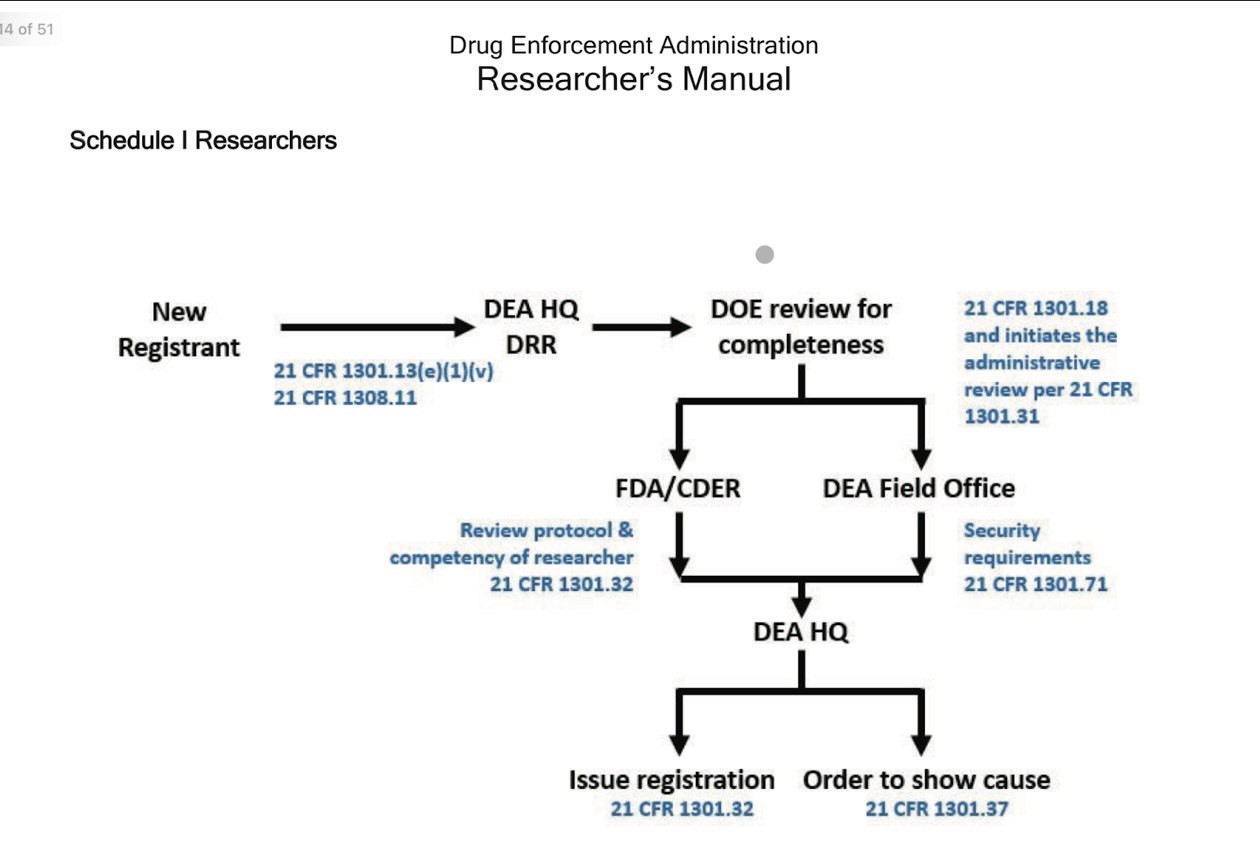

Source: Drug Enforcement Administration Researcher’s Manual

According to Dr. Nora Volkow, Director of the National Institute on Drug Abuse (NIDA), the complex and bureaucratic process for obtaining approval to research Schedule I drugs discourages many researchers. She highlights the cumbersome nature of this system compared to studying other substances. This multi-layered approach, involving elements like new researcher registration, certificate acquisition, and application fees, creates a significant barrier to scientific exploration.

Reclassifying cannabis from Schedule I to Schedule III could be a significant step in making research easier and somewhat faster. A Schedule III classification typically involves less stringent research restrictions, potentially opening the door for more comprehensive studies on the effects of cannabis. This could provide valuable scientific data to inform future policy decisions and potentially improve public health outcomes.

Improved Banking Relationships

The legal cannabis industry faces another significant hurdle: restricted access to traditional banking.

Due to its Schedule I classification, federal regulations currently prohibit most financial institutions from working with cannabis businesses. And even if the Financial Crimes Enforcement Network (FinCEN) previously issued guidance for banks to serve cannabis businesses compliantly, they are hesitant to engage due to perceived risks and uncertainties linked to Schedule I type of drugs. This forces cannabis companies to rely heavily on cash transactions, creating a cash-intensive system.

According to a 2022 report by the Congressional Research Service (CRS), the legal cannabis industry and its relationship with cash sales highlights the substantial amount of money flowing outside the traditional banking system. Security risks, transparency concerns, and difficulties collecting taxes all become major issues with such a cash-dependent environment.

Reclassifying cannabis from Schedule I to Schedule III could be a game-changer for banking access and incentivize more banks to enter the cannabis space. While Schedule III wouldn't automatically guarantee it, it would remove a significant federal barrier. This could pave the way for banks to offer basic services like deposit accounts, loans, and payment processing to cannabis businesses.

Additionally, this would likely improve financial stability, transparency, and tax collection within the cannabis industry, benefiting both businesses and the government.

Should Traders Turn to Cannabis Stocks Now?

With a less restrictive classification, research opportunities about cannabis could expand, banking access could become easier, and potential interstate commerce of cannabis products might become a possibility, which could support the growth of cannabis companies if the DEA’s reclassification is approved. The coming months will be crucial as the department gathers public comments and finalises the rulemaking process.

Daily Charts of Canopy Growth and Tilray - Source: ActivTrader

The recent news regarding cannabis reclassification has triggered a surge in stock prices for many companies within the industry. For instance, Canopy Growth, Cronos Group, Green Thumb Industries, and Trulieve Cannabis gained 80.61 %, 40.49%, 34.63 %, and 123.66% respectively over the past 6 months.

Investors, however, are probably wondering whether or not this a sustainable growth trend, or a short-lived echo of the 2019 phenomenon in Canada when recreational marijuana legalisation sparked a similar, yet ultimately fleeting, rise in pot stock valuations.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.