This piece was written by FXTM Senior Staff Writer, Kirsty MacSween

The Forex market can be intimidating for any trader – let alone one who can only devote a couple of hours a day to navigating its twists and turns. Even trading on a mobile app doesn’t mean you’ll necessarily be able to jump on breaking market news at a moment’s notice to find opportunities, considering there are meetings to attend and deadlines to hit.

Yet the most liquid market in the world can still offer plenty of opportunities to time-poor traders. You just need to know the common pitfalls to dodge. FXTM has put together a list of the top five mistakes to avoid as you embark on your side gig as a part-time trader.

Choosing an inconvenient instrument

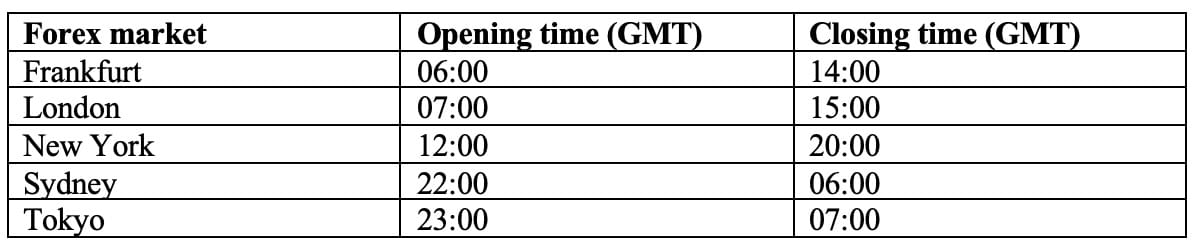

Selecting the right currency pair may just be the difference between finding comfortable trends to trade with and playing a frantic game of catch-up as you fall behind key movements. The forex market may technically be open 24 hours a day, 5 days a week, but market activity for individual currency pairs typically hots up in the hours after and before major markets open and close.

These flurries of volatility are useful if you can commit to focusing your trading early in the morning before your workday starts and/or late in the evening when the office is closed.

Traders are naturally tempted to trade a pair that includes a currency they are familiar with and understand the fundamentals of. However, if your own workday is starting when your domestic market opens, you most likely won’t be available to take advantage of increased activity. Consider looking further afield for a currency pair that suits your timetable.

Major trading sessions:

The AUDUSD or USDJPY could be more attractive to part-time traders in Europe who are trading early in the morning or late at night. A trader who can be active at lunchtime GMT might find the EURUSD a convenient instrument. Whichever one you choose, make sure you familiarise yourself with the wider context and do your due diligence with the help of a relevant currency outlook.

Trying to trade the news

It’s easy to get swept up in market-moving news. However, as a part-time trader you’re more likely to be consistently successful if you swap on-the-spot reactivity for prior research. Since you won’t be able to stay glued to your trading account and respond immediately to every development in a news cycle, it’s often better to play the long game.

Consider focusing on finding longer-term trends you want to follow and plotting positions you might want to hold over a wider timeframe.

Part-time traders will likely find that position trading is more suited to their lifestyle than fast-paced day trading. Position traders typically use weekly or monthly charts to identify a prevailing trend they wish to capitalise on, keeping positions open for weeks or months at a time.

With this strategy, because you’re focused only on long-term movements, you don’t have to concern yourself with short-term fluctuations. Instead of agonising over every small dip or waver, you can spend your time researching prevailing trends and honing your selection process.

Attempting to go it alone

When you’re scheduling trading into an already busy day, it can be tempting to hope you’ll pick it up as you go along. However, it rarely pays in the long run to neglect education; investing your time in learning how and why things work is more likely to result in steady gains. Understanding the theory behind what moves the markets is particularly important if you’re committing to a long-term position.

There are plenty of free educational resources online. Reputable brokers like FXTM provide training materials that you can digest at your own pace, from Ebooks on technical analysis tools to comprehensive forex glossaries and in-depth videos. Making the time to participate in a physical seminar, or setting aside an hour for a live webinar, means you can ask experienced traders your questions directly.

Being too rigid

While in general we’d advise that part-time traders should mostly avoid chasing sudden opportunities in favour of long-term positions, live trading apps can still be hugely beneficial. As well as being able to open, close or modify positions on the go, the right forex app can also help you finesse your strategy whenever you have a spare moment.

Strictly separating your work and trading time by not staying on top of market news may mean that you’re needlessly missing out on important context that could inform your next decision. Regular analysis on your instrument of choice, user-friendly economic calendars and real-time rate updates can all feed into your trading even when your attention is mostly directed elsewhere.

Letting emotions take over

This is by no means a mistake that only part-time traders make; even experienced, professional traders can quickly lose their cool and make rash decisions if the circumstances encourage it. However, the time pressures involved in extra-curricular trading make you particularly susceptible to hair-trigger responses based more on panicked emotions than thought-out strategy.

That’s why it’s so important to practise disciplined trading. One way to ensure emotion isn’t running the show is to implement automatic tools into your strategy – that way you can be confident that your positions are under control when you’re away from your computer.

Stop-loss orders help protect you from sudden losses, for example, closing positions immediately when the price reaches a certain level. These kinds of orders can be real sanity-savers when you have to step away.

Invest your time wisely with an award-winning, global broker. Join FXTM today.

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider.You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The FXTM brand provides international brokerage services and gives access to the global currency markets, offering trading in forex, precious metals, Share CFDs, and CFDs on Commodity Futures. Trading is available via the MT4 and MT5 platforms with spreads starting from just 1.3 on Standard trading accounts and from 0.1 on ECN trading accounts. Trading on the MT5 platform is not available for Forextime UK Limited. Bespoke trading support and services are provided based on each client’s needs and ambitions – from novices, to experienced traders and institutional investors. ForexTime Limited is regulated by the Cyprus Securities and Exchange Commission (CySEC ), with licence number 185/12 and licensed by the Financial Services Conduct Authority (FSCA) of South Africa, with FSP number 46614. Forextime UK Limited is authorised and regulated by the Financial Conduct Authority, firm reference number 777911. FT Global Limited is regulated by the International Financial Services Commission (IFSC) with license numbers IFSC/60/345/TS and IFSC/60/345/APM.