Equities trading has become ever more popular amongst traders in 2020, with the Naga Group expanding its reach to include new commission-free stocks.

Benjamin Bilski, Founder and CEO of the NAGA Group AG spoke with Finance Magnates for his in-depth perspective on the company and agenda moving forward.

Can you give some insight and rational into NAGA’s launch of real commission-free stocks?

In 2015 our vision was to build a truly holistic trading platform which would allow everyone from everywhere trading across all asset classes.

We started out by creating our social trading app, which was back then called SwipeStox, and then focused on integrating the technically most challenging trading assets; CFDs and Forex.

After that, we recognized the importance of cryptocurrency and the changing face of the financial world.

We quickly took initiative and went “crypto”; we introduced crypto-based trading accounts, our own wallet, and our system now allowed for both physical and CFD-based cryptocurrencies.

Ultimately, after we developed and mastered the features of our platform – which I am proud to say is the most versatile and complete financial system of the digital era.

We wanted to allow our clients to take real ownership of the assets they trade, instead of just focusing on pure bid/ask movements.

Therefore, we integrated on top of our MT4 server the MT5 server and combined our unique social trading engine with both servers and added the real stocks feed into it.

Benjamin Bilski, Founder and Board member of The NAGA Group AG

To make it as community-driven and democratic as possible, we also decided to waive the commissions and let people fully participate in the financial markets as much as possible, without taking the joy out of investing by having to pay high, unreasonable fees to middlemen.

What is the integrated value position on NAGA and how has it grown to be more inclusive given its expanded offering?

NAGA is the most advanced and inclusive financial trading platform on the market.

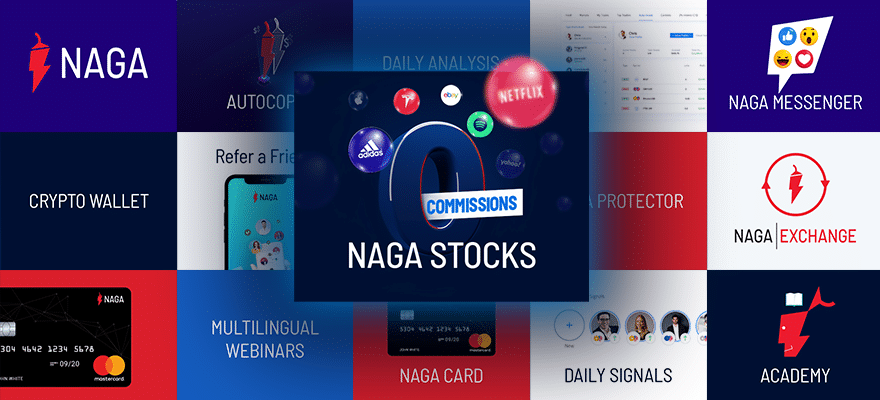

It might not enjoy as much exposure as other brands (yet), however from social trading or direct investing on FX and CFDs to physical crypto trading to real commission-free stock trading, all powered by a social community, and tools such as inhouse Messenger, our Robo-Advisor and our Portfolio-Management tool you can literally do everything based on your own appetite, at your own pace and according to how you like to access and make use of the financial markets.

And ultimately, you can move your funds in real-time to our NAGA Prepaid Mastercard, which connects the digital experience with the real one.

NAGA is truly inclusive in that we have managed to integrate and connect every element across personal finance and investing to provide a single multi-asset and multi-functional solution that literally caters to trader and investor needs across the board.

What makes NAGA’s offering unique relative to competitors and how has the group managed to stay ahead in a cutthroat industry?

I think over the now 3 years that we have been fully operational, we have always had more engineers than sales & marketing personnel.

Our focus has been on creating a product that was not just different, but better; not in specific features, but the synergies that only a truly inclusive proposition can provide.

It definitely gave us an edge in terms of focused platform development and we have developed features such as our Instagram-like “trading stories” which contain trading signals, our unique auto-copy service but also focused on the entire infrastructure offering in order to really connect everything from Payments , to self-trading, to social-trading, personal finance and portfolio investing – everything cross-platform at the highest level of user experience.

Everyone whom we met and meet says that NAGA as a product is way ahead of the game, and the interconnectivity and the socially enhanced environment are an absolute unique combination.

We are also very happy to get feedback from our B2B partners who gladly use NAGA and have double to triple higher conversion rates than when using a classical centralized trading platform.

Have you noticed any trends in client demand, namely in regards to investing, Blockchain utilization, and personal finance?

For sure, we have seen a lot of demand for an “all-in-one” solution when it comes to trading and investing.

The space is so scattered. The industry is saturated with tons of brokers, educators, signal groups or smaller providers.

Clients really get tired sifting through the noise and very easily lose their overview plus have a very bad user experience when having to combine all their needs.

The same way as WeChat in China offers a “messaging-ecosystem” to offer services and products, we believe that the trend is moving toward a more inclusive and more combined offering.

Clients these days are more and more in tune with the digital era and are used to snappy interfaces and everything is approached with a “one tap away” attitude.

Especially when it comes to money, investing in times of crypto and the rise of challenger banks, our industry must accept that. Installing a .exe file for a trading terminal and staring at charts while you are being “coached” by someone on the phone is just not what millennials and the ever-growing digital natives want.

So, in our view it’s all about user experience, access and an open and transparent approach.

There is a good reason why de-centralization in finance has found a lot of followers. That’s generally a mindset which soon will become a requirement.

Are there any other interesting developments in the pipeline at NAGA for 2020?

After 4 years of “engine-room” development, we are ready to focus on our brand exposure and client success.

We will mostly work vertically, which means we will improve certain features and build competitive advantages in generating unique content in the forms that our traders and users need and seek.

We see our userbase and our loyal traders in the context of our open environment as a unique and valuable asset and we want to build on top of that as our foundation.

And of course, we will remain true to our underlying nature; we will go with the trends of investment culture and embrace fundamental movements in personal finance and investing, as NAGA has always done.

If we see an opportunity, we will go for it! We are ready, now more than ever, to penetrate the market and introduce NAGA’s technology-driven and user-friendly approach to everyone around the world.