oneZero Financial Systems, a leading provider of OMS, Risk Management and Trade Routing software for Retail brokerages, has announced its second major release of 2017.

The new set of features in oneZero’s flagship product, the Liquidity Hub, focuses on expanding Multi-Asset trading capabilities for brokerages who currently use oneZero for FX/CFD and OTC instrument routing. Along with new order management functionality and reporting tools, oneZero has released a number of new connectivity endpoints in their EcoSystem specific to Exchange-based pricing and Execution .

Retail regulatory field dictating market offerings

Multi-Asset offerings have been a major trend for Retail market participants over the past 18 months. From the perspective of Finance Magnates, this trend is driven by two major factors: (1) the clamping of global regulations on the FX/OTC space and onset of new trade reporting, capitalization and best-execution requirements that have driven Retail market participants to implement compliance standards that closely resemble traditional Exchange traded markets, and:

(2) the recent push by MetaQuotes toward transitioning brokers to adopt the MetaTrader5 Platform. The combination of these two industry pressures have led many brokers to explore both the regulatory and technology requirements to offer Exchange products alongside FX or CFDs.

When asked why oneZero has focused on Exchange-based connectivity and routing for this release, CEO Andrew Ralich explains: “Our broker client base has really started pushing for Exchange connectivity as a reaction to demand from their own clients. It’s clear from the success of leading global Retail brokers that there is proven demand from the Retail trader to use the same platform to trade FX alongside more traditional financial products such as Equities, ETFs or Futures.""

There’s proven demand from the Retail trader to use the same platform to trade FX alongside more traditional Exchange products

“There are more and more front-ends emerging that support multi-asset, including of course MetaTrader5. oneZero has always been an innovator in providing back-end brokerage technology that caters to a variety of regulatory markets and execution behaviors. For us, integrating Exchange connectivity was a natural transition and one in which we are proud to be the first to market in what we expect to be a broader trend over the coming years,” he added.

Andrew Ralich, Co-Founder and CEO of oneZero

Adding true Exchange pricing and execution (also known as “Direct Market Access”, or DMA) is something numerous providers have looked to achieve in the past. Traditionally, only larger firms (Saxo, IG, etc.) have been able to wrangle the complexity of such an offering alongside FX and CFDs.

A DMA product offering comes with a number of hurdles and caveats for brokers and technology companies alike. In a complete contradiction to FX markets, Exchange Data feeds are considered IP of the Exchanges and need to be managed separate to execution.

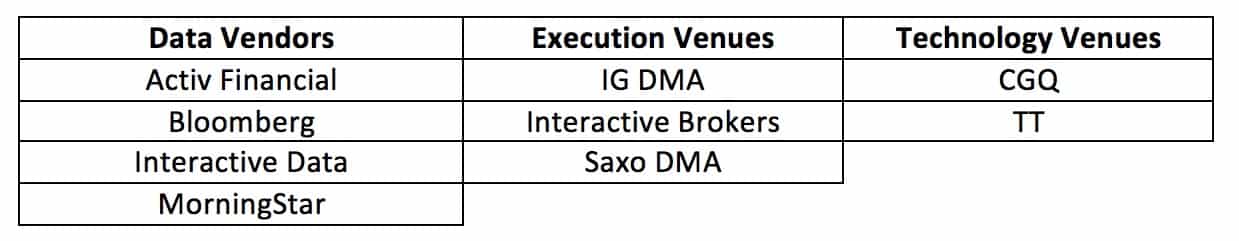

This can provide challenges in terms of the cost of offering multi-asset, and the complexity of the environment (as a broker can no longer find a single source for quoting and trading). oneZero seems to have taken the challenge head on, with a list of Data Vendors and execution / trade clearing providers which includes some of the biggest names in fintech globally.

For the Retail trader, having DMA products alongside FX and CFDs creates more avenues to execute trades, and also a greater level of comfort with their selection of a broker. Though the barrier to entry for a brokerage to offer DMA is slightly higher than FX, when a Retail client sees the same exact Exchange pricing for an Equity with their broker that they would directly on an exchange, it provides a level of comfort, legitimacy and validation that will likely become a “must have” checkbox for Retail traders in years to come.

Though DMA execution, or at the very least valid sourced Market Data, may not directly drive a tremendous amount of volume for brokers, it will inevitably become an essential marketing tool in years to come.

First step

When asked whether the future of oneZero is specifically focused on Exchange and DMA execution, Mr. Ralich noted: "This release was an important first step in delivering true multi-asset capabilities to our client base, but this does not mean we have lost focus on features and functionality for more traditional FX or CFD products."

"oneZero benefits from having an extremely robust development and operational scale within our organization, which allows us to iterate on our products and add new features at a pace that has proven to keep up with market demand and been quite difficult for our competitors to match," he reiterated.

As an overview of how to integrate true Multi-asset capabilities and Exchange pricing into an existing brokerage, oneZero is co-sponsoring a webinar with MetaQuotes on Sept. 21st. In addition to this Finance Magnates will be expanding its coverage of the mutli-asset space in a series of articles in October leading up to the November Expo in London.