The financial services industry underwent a massive shift nearly four months ago, following the announcement from the European Securities and Markets Authority (ESMA) earlier this year. The move set a wide range of new restrictions on contracts-for-differences (CFDs) and binary options, overnight redefining the playing field for brokers.

By extension, traders both professional and novice have also been forced to adapt to this new world, faced with new parameters. To recap, since the beginning of August, brokers are only allowed to provide clients with Leverage of 30:1 on CFDs in major currency pairs, 20:1 in indices, non-major currency pairs, and gold and 2:1 in Cryptocurrencies .

Having had time to digest these changes, many brokers have decided they won’t be able to remain in business should they continue to operate in Europe. Consequently, many others have opted to move offshore or shut down their shop altogether.

Still, other brokers have instead chosen to adapt to this new world, with FxPro among this segment of retail venues. For its part, FxPro offers a wide range of CFD trading options across MetaTrader 4 and 5 (MT4, MT5) platforms, along with cTrader. As these instruments are no less popular, it’s worth noting the distinction of trading types in the post-ESMA world.

‘Professional’ courtesy

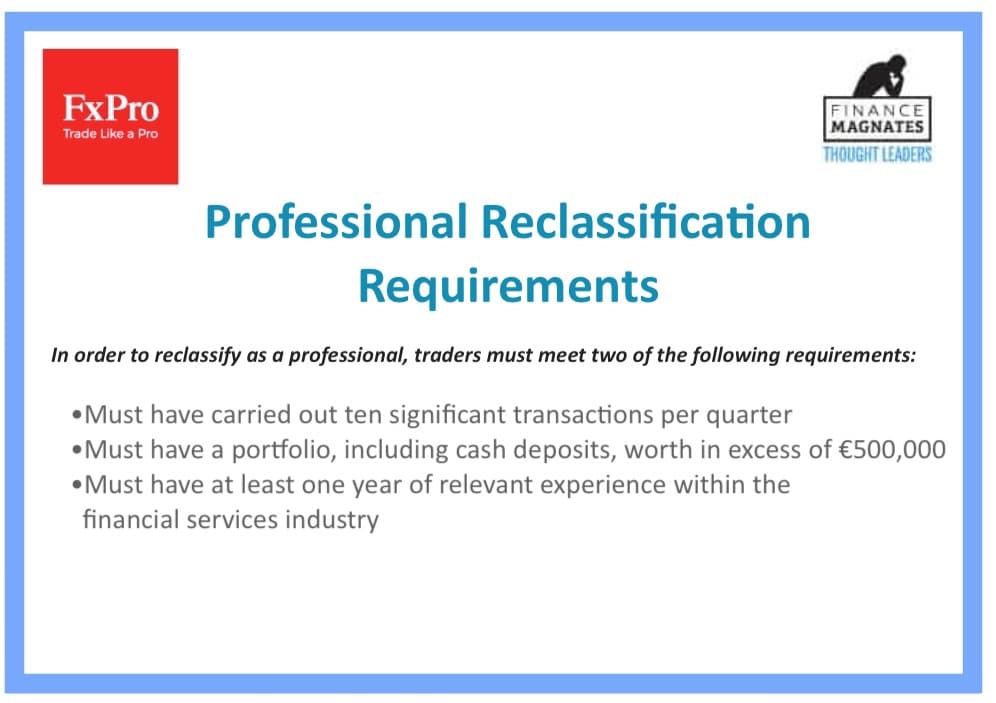

Of note, ESMA’s regulation only applies to retail traders. That means if a broker’s client decides to reclassify as a professional trader, none of the leverage restrictions will apply to him. Consequently, it is important to ascertain what it means to be a professional trader and who is eligible for such a distinction. The classification includes both pros and cons and should not be treated as a one-size-fits-all approach for individuals.

Of course, not everyone can haphazardly classify themselves as a professional trader. Rather, a broker must give the client a test that demonstrates he is capable of making his own investment decisions and has an understanding of the risks involved. How this test is designed will be done at the discretion of the broker.

For many, this new clarity could reflect the new norm and outright panacea for many brokerage operations. After all, the notion of more advanced and diligent traders operating with greater flexibility is a goal many have long wished for. Ensuring less educated individuals also are governed by more strict parameters is also a net positive for the industry as well.

Ultimately, these new changes could spark the beginning of an entirely new stage within the lifecycle of the retail trading industry. In fact, this shift we are seeing may mean it is no longer even appropriate to refer to the industry as ‘retail.’

Many in the industry have predicted that ESMA’s regulation could result in the winnowing of the smaller, less professional brokers but the same could be true for brokers’ clients. If those brokers no longer devote any energy to maintaining or onboarding clients that don’t qualify as professional traders, the number of truly ‘retail’ clients may shrink dramatically.