With the industry showing no sign of slowing down, ICOs have remained one of the most popular and fastest growing vehicles for investment to kick off 2018. To help meet this demand, BlockEx Markets has positioned itself as an open marketplace for buying a variety of asset classes including Initial Coin Offerings (ICOs).

BlockEx has tailored a unique product to help foster an ICO Market – there has long been a need for a dedicated space for ICOs, as enterprises are looking to issue ICOs and publish information while individuals want to view ICO information and purchase ICO tokens. In light of this trend, BlockEx’s product rollout will aim to standardize the marketing of ICOs to a larger buyer base.

This will be accomplished via a number of different initiatives, including the proactive management of information being published by the issuers. One of the most important elements of any ICO is reliability and transparency, with BlockEx looking to publish all relevant information on multiple ICOs on one centralized platform.

Adam Leonard, the CEO of BlockEx, said “We wanted to create an exchange that feels familiar to traditional traders, while offering them exciting new products and Blockchain technology. We see BlockEx as a bridge between the old world of traditional finance, and the new world of blockchain and Cryptocurrencies .”

Meet the OTC Desk

One way BlockEx is looking to accomplish this is its OTC desk, which grants companies who have already had their ICOs the ability to manage their liquidation in a compliant manner, while maximizing their cash conversion. BlockEx OTC desk is also suited to onboard clients who are non-crypto users interested in participating in an ICO. This is important given a large number of potential investors that exist for ICOs are not active cryptocurrency traders.

BlockEx can even provide secondary trading in select instances. As such, BlockEx will list ICOs that have been issued on other platforms, evaluating each application on a case-by-case basis before listing an external ICO.

Full offering on display next week at iFX Expo

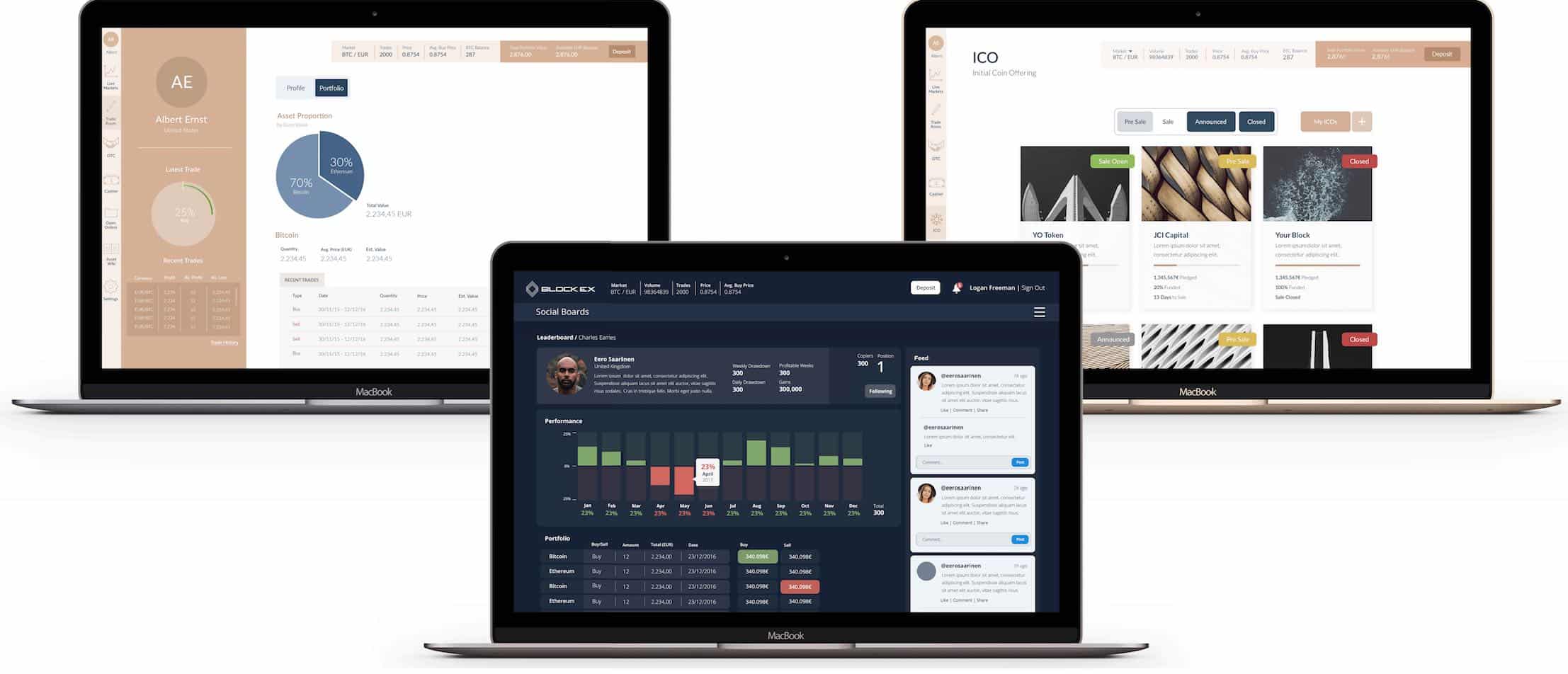

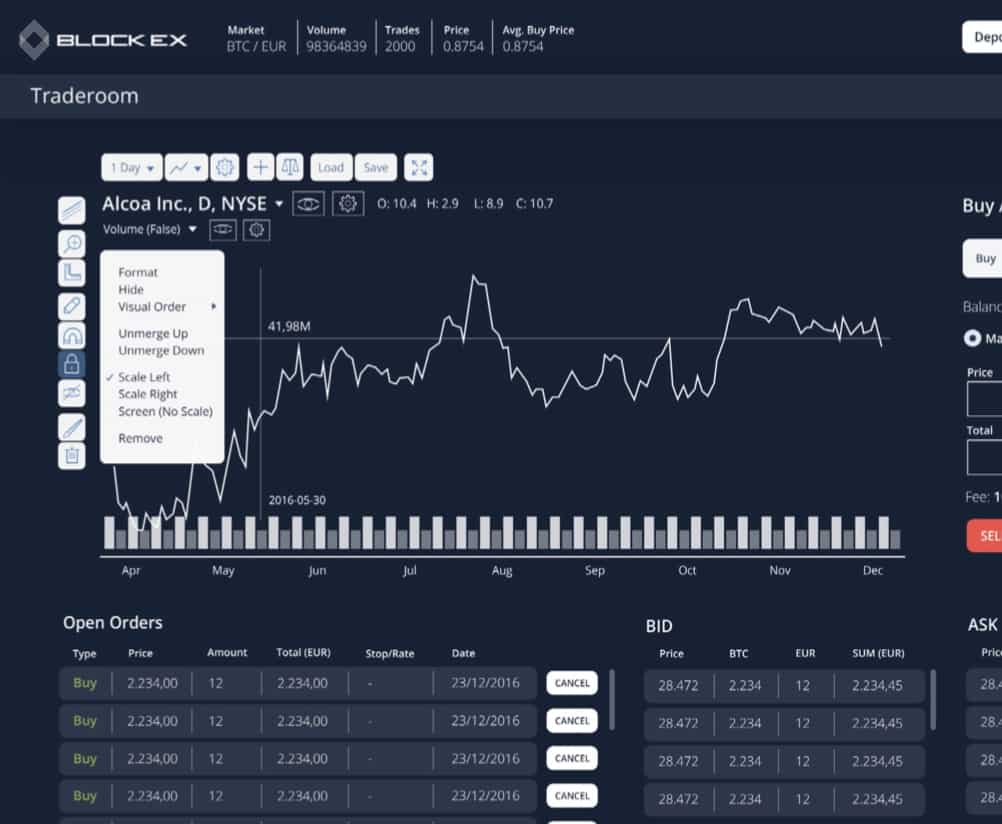

BlockEx will be attendance next week at the iFX Expo in Hong Kong to demonstrate its product suite. This includes its white label brokerage software offering, which caters to retail brokers. With a diverse range of functionality, BlockEx’s offering entails competitive leverage, several trading options, and copy and social trading capabilities.

In particular, the group’s Brokerage Desk service covers the full trading lifecycle, including asset management, issuance, and clearing & settlement, among other functions. By using blockchain technology, the software offering is one of the most advanced on the market, with its customizable interface beneficial for brokers.

This includes the support of several asset classes, a customizable interface, a regulatory-friendly product, and lost cost to entry, among other attributes.

BlockEx DAxP and ICO

BlockEx recently launched its Digital Asset Exchange Platform (DAxP). The initiative is part of BlockEx’s offering of a global marketplace for all asset classes and instruments harnessing blockchain technology. It is an institutional grade exchange with blockchain asset origination, issuance, dematerialisation and lifecycle management tools.

In light of the launch, the group has also begun offering the Digital Token Product Offering and the Digital Asset Exchange Token (DAXT) as part of its efforts to add Initial Coin Offerings (ICOs) to the asset classes being serviced.

BlockEx’s state-of-the-art infrastructural framework also allows for custom blockchain integrations. The platform’s primary goal is to service multiple traditional and non-traditional asset classes under one comprehensive exchange, as well as overhauling the capital markets by making trading, clearing, and settlement in real time.

BlockEx ICO Market

BlockEx’s DAxP caters to a wide range of conventional and non-conventional asset classes, including the ICO asset class. Its Digital Token Product Offering is comprised of BlockEx Markets, i.e. advisory and structuring services, and the BlockEx ICO Market, which gives access to compliant, high quality ICO tokens. This product offering looks to reconcile problems related to distribution and allocation, as well as a lack of regulatory compliance and standards in the current ICO market.

Aleks Nowak, BlockEx’s CIO said “BlockEx’s range of ICO initiatives, from the ICO Market to the Digital Token Product Offering are exciting. They’re offering a new vision for the ICO landscape. We want to bring the good governance and regulatory framework of traditional finance to ICOs.”

Part of the BlockEx ICO Market is the Pot Allocation System. It is an embedded program within the ICO Market. It calculates the allocation of ICOs during a pre-sale according to the share of total funds subscribed. The Pot Allocation System aims to ensure that every participating buyer is allocated a fair share, proportional to the amount of funds committed to the pot. All participant in the BlockEx platform, from participants to ICO issuers, have passed KYC and AML checks, creating a safer environment for all.

Individuals interested in the DAxP and ICO can familiarize themselves with BlockEx’s whitepaper.

Disclaimer: The content of this article was provided by the company, and does not represent the opinions of Finance Magnates. Finance Magnates does not endorse and is not liable for any content presented on this page.