Stablecoins or CBDC’s, no matter which one of them gets mainstream adoption first, it is highly essential that the merchants and vendors are prepared when consumers make this transition.

It is really inevitable now, especially with the lessons that the ongoing global pandemic has taught the world about unnecessary touch points in the financial transactions both sides of a product goes through.

During this pandemic, globally all countries have seen a reduction in consumer dependence on cash, there are new technology innovations launching every day that attempt to bridge the gap with merchants and consumers seamlessly with the least number of touch points.

Payments in the future would reduce the dependency that economies have at present. Cash also proliferates evils in society like corruption, terrorist financing and money laundering amongst others.

Understanding this, it is soon becoming a consensus that digital payments would be based on CBDCs and Stablecoins rather than speculative assets like Bitcoin, Ethereum and other Cryptocurrencies .

There are even private companies like JP Morgan, Amazon, Facebook and Wells Fargo building their own stablecoins with the objective of keeping their currency’s value as stable as the dollar is.

in CBDC conversations its not uncommon to see the idea that this new token/network must be traceable to comply with AML.

Cash isn’t traceable https://t.co/UWvcrcL4WR — Neeraj K. Agrawal (@NeerajKA) December 5, 2020

Stablecoins are very often used as a store of value for cryptocurrency investors to enable easier on ramp into buying cryptocurrencies when needed, especially on a short notice.

A stablecoin is a class of cryptocurrencies which are backed by a reserve asset and are pegged to a certain external reference in an attempt to offer price stability in the highly volatile cryptocurrency markets.

They offer a variety of advantages to its users, like the instant transaction processing, having the privacy aspects of cryptocurrencies, and the volatility-free stable valuations of fiat currencies.

Currently, the most prominent stablecoins in the market are pegged to the United States Dollar (USD) as it’s the most used global trade currency at the moment. The most adopted USD stablecoins are Tether (USDT), USD Coin (USDC) and Binance USD (BUSD).

Here Tether dwarfs the other two stablecoins by a margin considering the market capitalization and the circulating supply. The market cap of Tether (USDT) is $34.80 billion in comparison with $8.96 billion of USD Coin (USDC) and $3.16 billion of Binance USD (BUSD).

On Jan. 4, the United States Treasury's Office of the Comptroller of the Currency (OCC) announced that banks would be allowed to run independent nodes for distributed ledger networks and transact in stablecoins.

After this approval, even stablecoin projects like Curve DAO (CRV), MakerDAO (MKR), Terra (Luna) and Reserve Rights (RSR) have seen a surge in incoming volume once investors realise that their regulatory concerns have been eased.

Despite Tether’s high market capitalization and circulating supply, it has been swamped with controversies as well. Tether was taken to court alongside Bitfinex, a cryptocurrency trading platform, by the New York Attorney General's (NYAG's) office for misrepresenting funds and reserves to cover Bitfinex’s losses in that year.

The two parties recently reached a settlement with the NYAG’s office. In a press release from the NYAG’s office, Bitfinex and Tether were asked to pay $18.5 million in penalties to the State of York, and that they would discontinue any trading activity with New Yorkers.

In addition, these companies must submit regular reports to the Office of Attorney General (OAG) to ensure compliance with this prohibition.

CBDC - Digital U.S. Dollar

One of the foolproof ways to avoid these methods of manipulation with balances and reserves are Central Bank Digital Currencies (CBDCs).

At present, the most advanced CBDC project is China’s digital currency project, which is currently at a widespread trial stage with more and more consumers being included in the trial along with in the inclusion of private payment companies like Ant Group and Tencent Group.

To keep up with the times and the increased hype around cryptocurrencies, the United States Federal Reserve’s Chairman, Jerome Powell announced that the U.S. Federal Reserve is approaching the topic of the Central Bank Digital Currency (CBDC) and its native digital U.S. dollar with absolute vigilance.

As mentioned in ByBit’s blog titled “The Role of CBDC in the US”, there are “significant technical and policy questions” remain unanswered, and an extended waiting period lies ahead before the rest of the world will hear about any confirmation on a launch.

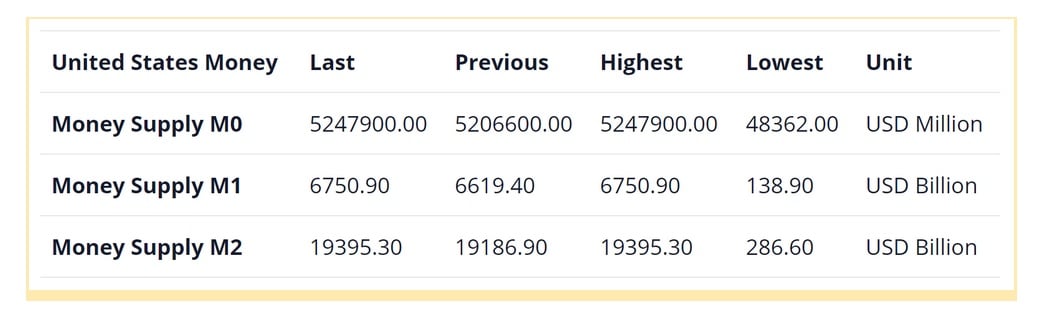

The U.S. Federal Reserve is discussing and exploring ways to replace all the M0 supply in the country which includes all physical currency in circulation in the economy at present.

Below is the data from ByBit’s blog indicates the following numbers for different money supply categories in the U.S. for January 2021:

The blog goes on to talk about how digitizing the U.S. dollar could allow the Fed to exercise end-to-end control over the monetary system aside from the printing and destroying of money, which may lead to greater financial stability for the economy.

This indicates a complete Fed oversight over the digital U.S. dollar that is distributed to the public from commercial banks and other institutions, especially as the Fed is considering utilizing a mix of current and new technologies to facilitate this financial machinery.

Now with the proliferation of USD stablecoins and China’s DC/EP in advanced stages of it’s trial, it is highly essential for the Fed to fast track their contemplating and exploration process to launch a CBDC as soon as possible.

As it currently stands, it already is bound to face major competition in adoption from Tether and upcoming stablecoin projects like Diem.