The total value of assets locked up in Ethereum protocols surged from just $1.25 billion to well over $40 billion, as the utility and appeal of DeFi platforms over regular traditional finance products became apparent.

Moreover, the absolute number of DeFi users over time has exploded from just 110,000 in February 2020 to almost 1.4 million a year later.

But in recent months, the ballooning transaction fees on the Ethereum network have made the world of DeFi a rather expensive endeavor, which threatens to undermine the benefits of these platforms — since they’re becoming less and less accessible to casual users.

Here, we take a look at the current fee situation and examine some of the projects that offer a suitable workaround.

Loans Are Getting Expensive

Open lending protocols are currently one of the most common uses for DeFi. They’re essentially platforms that allow users to deposit collateral, and easily take out a (typically) low APR loan — which needs to be paid back before they can retrieve their collateral.

They’re also used as a source of interest, since users can deposit their assets which are then securely loaned to others, earning a large chunk, or all of the interest paid by the borrower as a result.

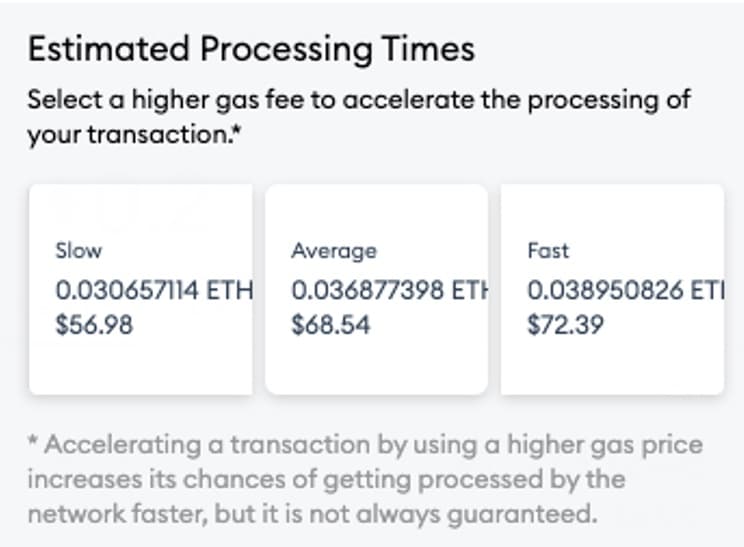

But like most DeFi applications, they’re suffering due to rising gas costs, which recently passed an average of $25 each due to the congestion of the Ethereum network.

Unfortunately, this has made low-value loans all but unreasonable on many open lending platforms — since users would need to not only pay a fee to deposit their collateral and take out a loan, and another fee for repaying the loan and retrieving their assets.

For amounts under $1,000, odds are these transaction fees would sum to more than the interest due, making for an expensive experience.

Fortunately, a number of platforms have been incorporating innovative solutions to get around this issue, allowing users to easily leverage their assets to ramp up their investments without needing to sell out.

One such platform is EasyFi, a borrowing and lending platform that leverages the Matic Network to practically eliminate gas costs, while opening the doors to undercollateralized loans thanks to its integration with Koinfox TrustScore.

Trading Favors Whales

In this bull market, practically every prominent cryptocurrency has demonstrated impressive gains over both short and medium timescales.

However, success in trading has always favored those moving significant sums, and the recent gas fee issues have taken this to a whole other level, by making it extremely difficult for less well-heeled traders to turn a profit on decentralized exchanges.

Right now, Uniswap is incredibly popular among traders due to its permissionless nature, deep Liquidity , open liquidity provider capabilities, and massive range of supported assets — but the fees associated with trading on it are simply nightmarish.

Uniswap

Though Uniswap has a respectably low 0.3% fee for trades, actually executing a trade can cost north of $100 during peak times — when congestion is high and traders need to ensure their orders get through without failing due to Slippage issues.

As you might imagine, with such high gas fees, it can be very difficult to turn a profit when trading with a low amount, since the transaction fees on both sides of the trade (buy then sell) will cut into the profit margin.

But Ethereum isn’t the only platform with an automated market maker (AMM) like Uniswap. A variety of other blockchains with far lower transaction fees have recently launched their own AMMs — including TRON’s JustSwap platform and Qtums QiSwap.

Though these don’t offer quite the variety or the liquidity found on Uniswap, their fees are negligible, making them more suitable for those trading with low volume.

The Problem with Yield Farms

Yield farms have become incredibly popular in recent months. As more people look to earn a return on their idle assets, yield farms have grown to become one of the go-to options for many cryptocurrency investors — due to their simple concept, ease of use, and generally high yields.

But like cryptocurrency trading, yield farms have largely become a whale’s club, since the costs associated with withdrawing yields regularly could exceed the gains.

To put this into perspective, imagine a trader deposits $1,000 to a yield farm that pays out an average of 12% APR — which means they could expect around $120 per year in interest.

However, given that the average transaction fee on Ethereum is now $25, and potentially more when invoking a smart contract, this investor would need to wait several months just to recoup their transaction fee.

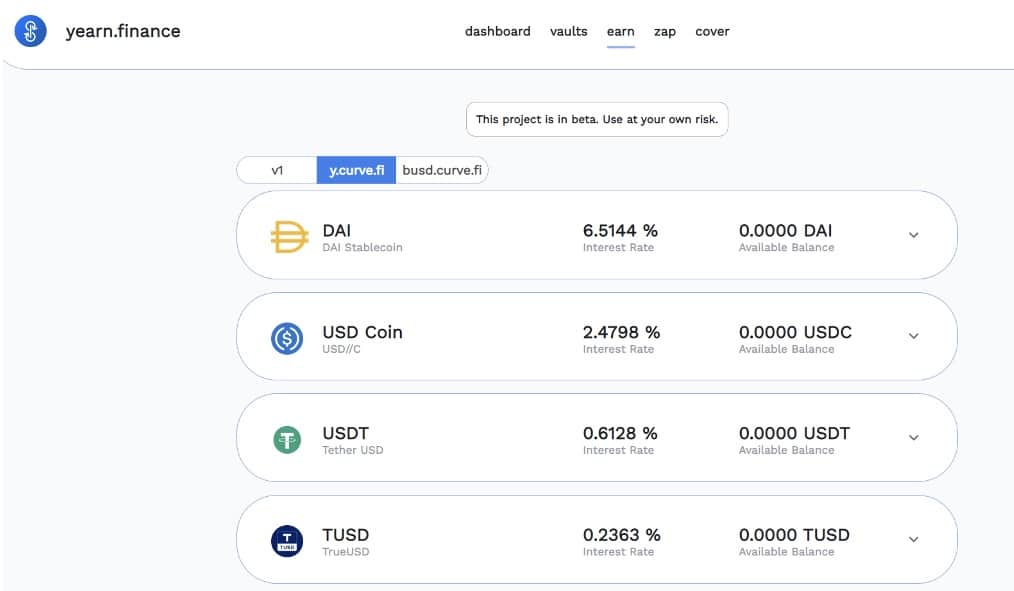

Yearn Finance

Now, this isn’t a major problem for those earning several hundred or thousands of dollars in yields per year — but for those earning more modest sums, the transaction fees can be significant, making it difficult to withdraw any accrued gains.

Platforms like Yearn Finance (YFI) can help to mitigate these fees by using a pooled funds system shared across all of its users — which is arguably the only way to avoid the issue right now. That is, until platforms like YieldShield go online.