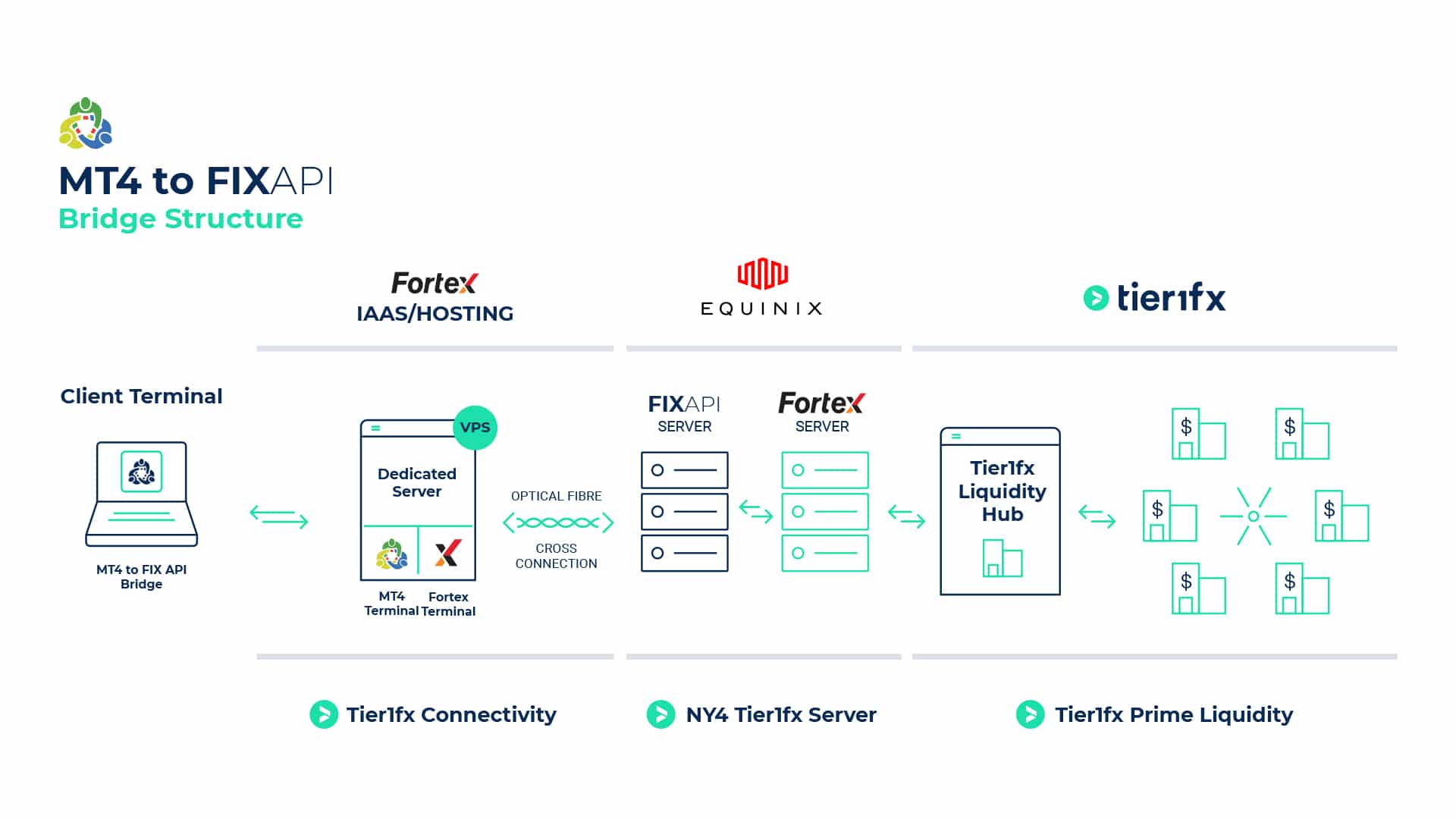

The new jointly launched FIX API Bridge from Tier1fx and Fortex looks to be a game changer for market participants, given its connectivity capabilities. More specifically, the bridge helps connect the widely-used MT4 platform to the FIX API Server such that clients of all caliber can reap its advantages.

Albert Galera, Chief Operating Officer, Tier1fx noted: "At Tier1fx, we wanted to address the main needs of our clients as they are our primary concern. As such, we have been working side by side with Fortex to develop a new way to consolidate the potential of FIX API and offer it to all traders.”

Harnessing FIX API protocol

Financial Information Exchange (FIX) API constitutes a trading protocol with multiple advantages for professional traders. This is crucial to trading operations as it reflects an electronic communications standard for the international exchange of information on securities transactions and markets.

By utilizing a FIX API, FX traders can reduce trade latency as well as gain access to pre-trade information, while accessing levels of Liquidity , depth of market, and order flow. Moreover, by harnessing FIX API, traders also can accelerate their trades via multiple order types, also enabling key transparency measures.

FIX API helps drive not only the execution, but frequency of trade transactions. Of note, FIX API is also built on an anonymous environment, ideal for algorithmic trading capabilities and robot traders. For these reasons, this protocol is instrumental for professional traders.

Despite these benefits, FIX protocol does necessitate a high level of programming skills, mostly due to trading algorithms that were developed in advanced programming languages like C++, C# and Java.

As such, FIX API has to date yielded a relatively low level of implementation across the FX trading ecosystem. Rather, hedge funds, high-frequency traders (HFT) and algorithmic traders are typically developing their systems using the Metaquotes MQL4 language due to its flexibility and easy programming.

What the new MT4 Bridge can do for you

The product’s newest connection seeks to bring some much-needed change to the current MT4 landscape. By translating the MT4 trade to a FIX message that is sent to the liquidity providers, Tier1fx and Fortex have engineered the only MT4 to FIX API bridge available in the market for all types clients using MQL4.

“Thanks to the new MT4 FIX API Bridge, we are seeing the evolution of trading, bestowing the capabilities and strengths from FIX API to all traders, no matter the size. This is a great achievement from Tier1fx and Fortex, and ultimately, is of great value to all our clients,” commented Mr. Galera.

The bridge’s compatibility with MT4 is an important move for Tier1fx, given the Fortex platform’s stance as the most popular FX Trading Platform available on the market. The innovative bridge also affords a large swatch of advantages for traders, including the following:

-A FIX account with DMA access to Tier1FX’s professional liquidity

-Lower trade latency

-MT4 to FIX account real-time synchronization

-Platform redundancy (Fortex 5/6, MT4)

-Professional post-trade reports

-Position netting: FIX account will net up the positions by instrument without affecting MT4 hedging capabilities

-Swap netting: clients will pay swaps based on the NET exposure of the FIX account

As such, traders are able to discern valuable post-trade information and participants on the transaction, while still preserving anonymity in the market. The advanced bridge also stands to benefit from Tier1fx’s server architecture in Equinix NY4.

Ultra-low latency connection pushing new boundaries

Its strategic location in Equinix NY4 ensures the lowest latency possible between the MT4 server and the client FIX account. Moreover, all the trading servers are located physically in the same rack, reducing the latency between MT4 and FIX servers to sub-millisecond and guaranteeing ultra-fast access to the market.

"With regards to connectivity, we believe that this is one of the most paramount attributes in trading. That’s why we wanted to go further with our new MT4 FIX API Bridge. To our clients, milliseconds are crucial in their performance and our goal is always to make possible that any performance is optimal. Therefore, our goal was to reduce latency as much as we can, so we decided to set all the servers on the same rack in Equinix NY4,” explained Mr. Galera.

Nowhere are these latency constraints more critical than for high-frequency-trading clients, or traders engaging in news and arbitrage strategies. Tier1fx also offers full fiber-optic cross-connected VPS and dedicated servers in collaboration with top service providers such as Fortex IAAS/HOSTING. According to Mr. Galera: “We can say with no doubt that this execution setup is one of the fastest available on the market.”

In doing so, this streamlined connectivity setup will allow clients to reduce latency between the MT4 terminal and the Tier1fx’s execution servers down to 0.1 – 0.2 milliseconds.

About Tier1fx

Tier1fx is a boutique provider of prime liquidity and trading capabilities, whose offering is built on a foundation of trust, reliability and a new way of looking at transparency. The group ultra-tight spreads and prime liquidity from Top Tier1 Banks and an Agency Model with pure DMA-STP execution and no dealer intervention.

About Fortex

Fortex is a leading FX trading platform, headquartered in Silicon Valley. Fortex consistently has added new capabilities to help its clients succeed, ranging from middleware, APIs, and a rich array of trading consultation, analysis, and customization services to elegant end-user applications for desktop, web, or mobile trading.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates.