Digital assets have gradually become a global phenomenon. Over the past years, more and more enthusiasts have dived into the space, steering the crypto industry to post growth rates like never before.

While the trade volume has increased exponentially, market behavior in terms of price volatility has also significantly changed. Previously where centralized exchanges or CEXs used to dominate the market, now the bias is shifting towards DEXs or decentralized exchanges thanks to the meteoric growth in defi.

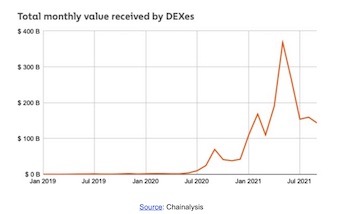

According to a research report from blockchain analytics firm, Chainalysis, the decentralized finance (Defi) industry has registered a massive influx of money in 2021.

The report states, “Total value received by DEXs rose from about $10 billion in July 2020 to a peak of $368 billion in May 2021. While centralized exchange transaction volume has grown, it has not grown at the same rate as that of DEX. During some months DeFi activity has also surged past the activity on centralized services.”

To be noted, the trading activity on large decentralized exchanges (DEXs) has increased by over 686% during this year alone.

Note that a decentralized exchange (DEX) is a cryptocurrency exchange that operates without any central authority, allowing users to transact peer-to-peer from wallet-to-wallet whilst maintaining complete control of their assets. Let’s dive in to understand how some very popular Decentralized Exchanges (DEX) have contributed towards defi growth.

World’s prime DEX built on Ethereum: Uniswap

Uniswap was the first-ever Defi protocol launched in November 2018. It is the largest permissionless decentralized exchange (DEX) operating on the Ethereum blockchain used for swapping ERC 20 tokens.

The network features a native governance token dubbed $UNI. While UNI enables users to vote on key protocol changes, it is the nineteenth largest cryptocurrency by market cap according to data from Coinmarketcap — with a total capitalization of more than $9.4 billion.

Unlike other defi protocols, Uniswap functions for the public good. It enables users to trade tokens without any platform fee or middlemen. However, being built on the Ethereum blockchain, the gas fee is a major issue for Uniswap. Besides this, the platform addresses liquidity issues with the help of its AMM model.

To be noted, Uniswap was the prime player to utilize the Automated Market Maker (AMM) model. (The AMM model enables users to contribute their digital assets to liquidity pools and earn a share of the fees generated by trades that source liquidity from these pools.) This mechanism requires no identity proof from users, therefore anyone can create a liquidity pool for any pair of tokens.

DEX built on Binance Smart Chain: PancakeSwap

Launched in September 2020, PancakeSwap is the leading decentralized exchange built on Binance Smart Chain for swapping BEP 20 tokens. The network features a native governance token dubbed $CAKE. $CAKE is the forty-ninth largest cryptocurrency with over $3 billion total market cap, according to data from Coinmarketcap.

The network uses an automated market maker (AMM) model to fulfill orders, where users trade against a liquidity pool. These pools are filled by users who deposit their funds and receive liquidity provider (LP) tokens in return.

Like Uniswap, the mechanism requires no proof of identity from users; therefore anyone can create a liquidity pool for any pair of tokens.

DEX built on Solana: Serum

Launched in August 2020, Serum is one of the first major open-source projects to be built on Solana. It is the only high-performant DEX designed around a fully on-chain central limit order book and matching engine.

The protocol features its native governance token dubbed $SRM that not only enables users to receive discounts on protocol fees and voting rights but it also puts 100% of exchange fees back to SRM via buy-and-burn, staking rewards, and ecosystem grants. To be noted, currently, $SRM’s market capitalization stands at $453 million, as per Coinmarketcap’s data.

Users can benefit from the exchange’s ‘limit order book’ model as they get the ability to choose the price, size, and direction of their trades. Moreover, because Serum is built on Solana (the blockchain can process 50,000 transactions per second and 400ms block times), its design is meant to ensure that defi can contend against centralized services.

Community governed DEX on Avalanche: Pangolin

Launched in February 2021, Pangolin is a community-driven decentralized exchange built on the Avalanche blockchain. The DEX uses a similar automated market-making (AMM) model as Uniswap.

The network features a native governance token dubbed $PNG, which is completely community governed and is capable of trading all tokens issued on Avalanche as well as Ethereum. At the time of writing, the total market cap of $PNG has surpassed the $64 million mark.

In light of the popularity of DeFi and the over-crowded marketplace with numerous contenders, Pangolin provides users with three critically important benefits. First, faster and economical transactions: similar to transactions within centralized exchanges, users can swap assets in sub-seconds with Pangolin and will need to pay a transaction fee as low as a few cents.

Second, a completely community governed and driven development. Third, a fair and open token distribution: all tokens are distributed directly to the community, without any allocations to team, advisors, investors, or insiders.

AdaSwap, the emerging DEX built on Cardano

In the shadow of the emerging Web3.0, when many blockchain projects are jumping into the crypto arena, AdaSwap has brought another idea to grow and develop the Cardano ecosystem.

Simply put, AdaSwap is a decentralized exchange (DEX) built on the Cardano blockchain that helps the Cardano network to become a unified solution and evolve into an inclusive DeFi protocol. According to the developers of AdaSwap, 'AdaSwap aims to be the backbone of Cardano and build a worldwide community around the network to make $ADA accepted as an international medium of exchange.'

AdaSwap will achieve this by allowing users to create digital artifacts, stake tokens, launch projects, and earn interest within the Cardano ecosystem. The network features $ASW as their native token.

Note that the token is yet to be launched. As $ASW tokens are a Cardano asset, they can easily be swapped with other tokens that are based on the Cardano network.

The network promises to provide large returns for holders while reducing other costs thanks to the utility of the Free Finance Model (FFM). The $ASW holders will be subject to no participation, transaction, or any other kind of fee. Moreover, the community will also be rewarded with airdrops.

Decentralized Exchanges (DEX) eliminate financial bureaucracy from grassroots

Financial bureaucracy (or centralization of power) was a burden in the traditional financial system. It not only imposed opportunities for corruption but also slowed down the conduct of business due to the involvement of multiple intermediaries and innumerable regulations.

Many countries over the past years employed various strategies to diminish bureaucracy and its ill-effects but were unable to stimulate any change.

The inception of blockchain, however, shook the existing traditional systems to their roots. Its ongoing widespread adoption has revolutionized rusty systems and pushed the world toward decentralization while eliminating bureaucracy to a great extent. Interestingly, the advancement has been so rapid that the cryptoverse, which was previously limited to centralized exchanges (CEXs), is now adopting decentralized exchanges (DEXs) rapidly as well.

One of the major reasons why DEXs are gaining critical acclaim from enthusiasts is the meteoric growth of the Defi industry. During last year, the total value locked (TVL) in DeFi was a mere 5% of its current worth, $255 billion.

The change means an explosive growth of 1686%. Another major reason is DEX presents a great income opportunity for retail as well as institutional investors. Like traditional interest-bearing bank accounts, DEXs also provides predefined interest on a user’s digital asset holdings in numerous methods.

There may be hundreds of different DEXs in the ecosystem, but the above-mentioned DEX are ruling the space at present. To be noted, Cardano is believed to outperform Ethereum and other networks, but Cardano was previously facing some issues like the network did not have its own DEX and launchpad, which means tokens built on the Cardano network relied on other centralized exchanges such as Binance for trade and liquidity.

However, AdaSwap, the novel decentralized exchange built on the Cardano blockchain, has solved the network’s major problem. AdaSwap now aims to become the backbone of Cardano and promote $ADA as an international medium of exchange. In addition to this, the DEX boasts no transaction and gas fee for $ASW token holders, which in itself is a unique attribute