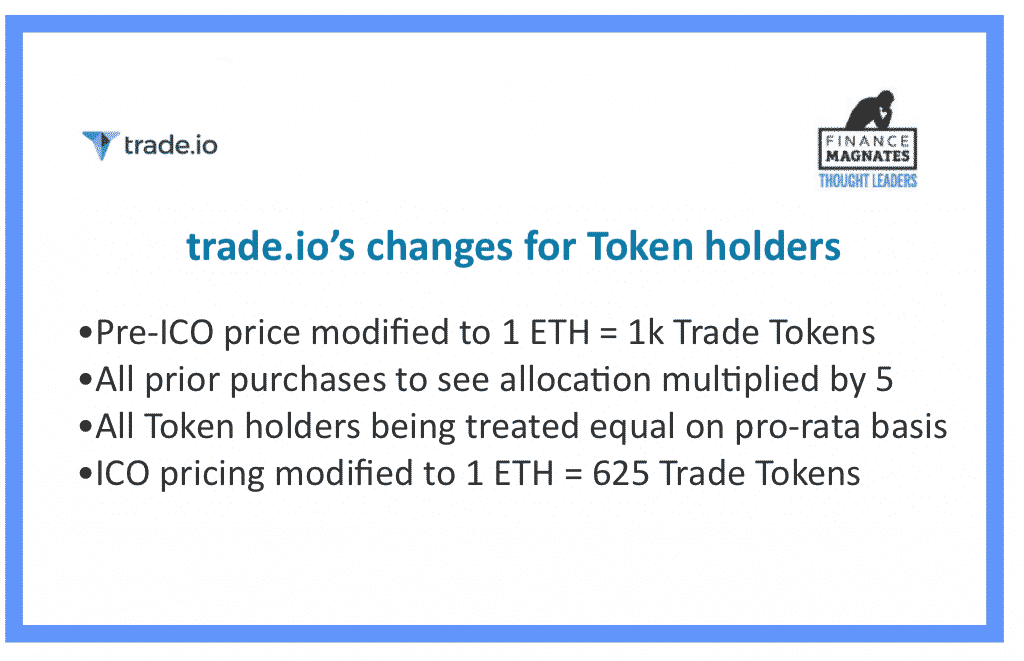

The launch of trade.io’s pre-ICO sale earlier this month has been more successful than previously imagined, prompting the group to take new steps to enable greater participation. After embarking on a pre-ICO sale on November 7, trade.io will be adjusting the entry price per Trade Token to a lower price. This will help allow for more participation from investors, reflecting the rise in Ethereum , which is used for purchasing.

trade.io’s soft launch has already exceeded expectations during its pre-ICO – its latest decision to implement a price reduction will help in lowering the upper level of the fund raise to approximately $135 million.

Rise of Ethereum impacting token sale

More importantly, the result of this reduction will be net positive for existing and future Trade Token participants. As such, the reduction will provide existing token holders with a greater amount of additional tokens, whereby allowing new participants the ability to obtain a larger amount of Trade Tokens. Additionally, the start of the ICO has been revised to December 5, still concluding on the originally planned date of December 15, 2017.

Commenting on the changes, trade.io’s CEO Jim Preissler noted: “One of the primary factors that prompted the price reduction was the ongoing rise in the price of Ethereum. We’ve been selling Trade Token based on the price of Ethereum, and the impact of the increase in its value has priced out many of the participants with a desire to get involved in trade.io.”

“The trade.io community now numbers in the thousands, and we felt it was only fair to lower the entry point to allow greater participation, and still allocate a large amount of Trade Tokens to our loyal followers,” he explained.

“As previously announced, we have surpassed our soft cap of $5M in the first few days of pre-ICO. The modified market cap, as noted, leaves us with plenty of room to execute upon all original initiatives and milestones. We’re anticipating some major announcements over the next 1-2 weeks and as a result, in order to communicate the updates, we felt it was in the best interest of the community to push back the ICO start date to December 5."

"This will allow a more uniform ICO sale of which we are gauging tremendous interest, and will be fair to everyone who wants to get involved,” reiterated Mr. Preissler.

What does the lowered hard cap mean for Token holders?

As a result of the lowered hard cap, current Trade Token holders will have their current allocation multiplied by a factor of five, while this change will appear in their Members Area no later than close of business today. In addition, Liquidity Pool participation will increase by a factor of five, which has been outlined in the white paper.