10 Actionable Insights for Traders

Understanding the intricacies of securities trading and the impact of earnings releases is crucial for investors and financial professionals alike. As such, grasping the dynamics that drive market activity becomes quintessential to those seeking to optimize their strategies. Based on Q3 2023 data from OTC Markets Group, we explore actionable insights derived from the analysis of the most active European securities, shedding light on some noteworthy trends.

Strategic Timing for Market Impact

As we delve into the distribution of earnings release times across diverse securities, a fascinating narrative unfolds. Companies strategically time their announcements to capture maximum market attention. Early morning releases may target European markets (e.g., Roche at 7:00 AM CET, 1:00 AM ET), while later releases cater to a global audience (e.g., LVMH at 5:46 PM CET, 11:46 AM ET). For traders, this underscores the importance of aligning strategies with these timings to capitalize on potential market movements.

Anticipating and Responding to Market Sentiment

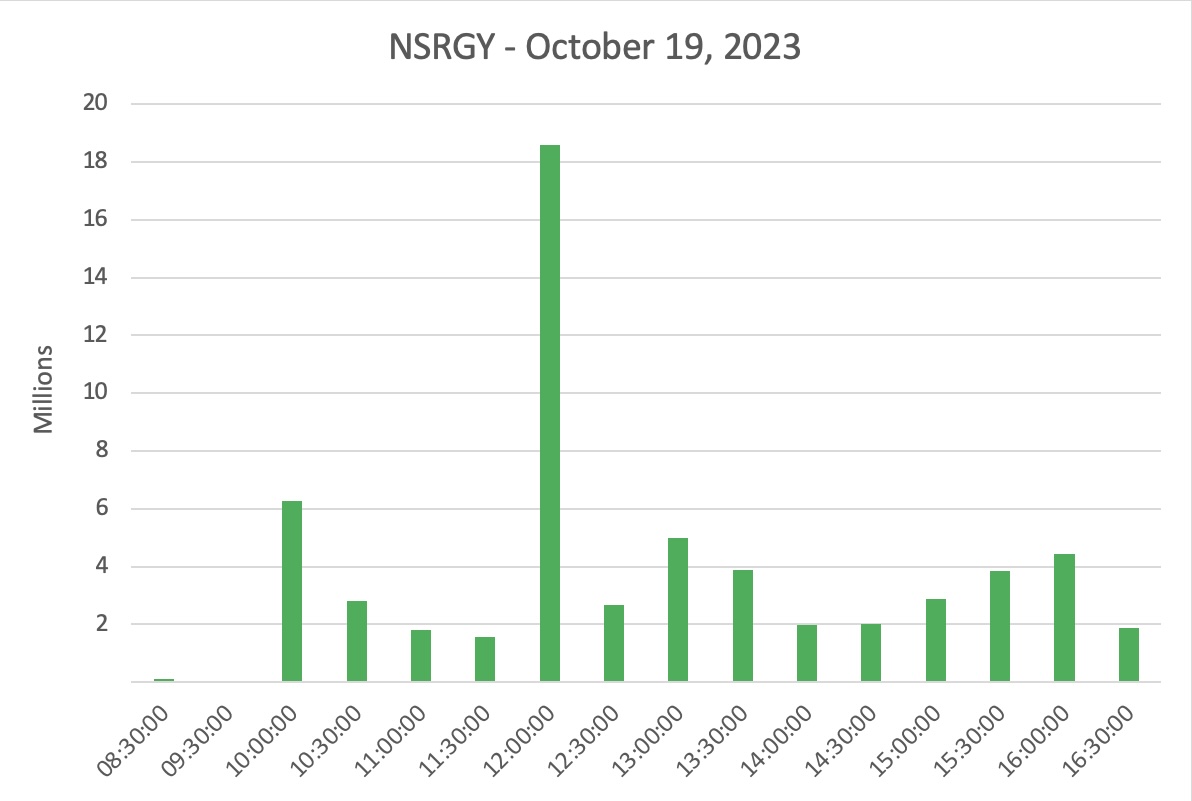

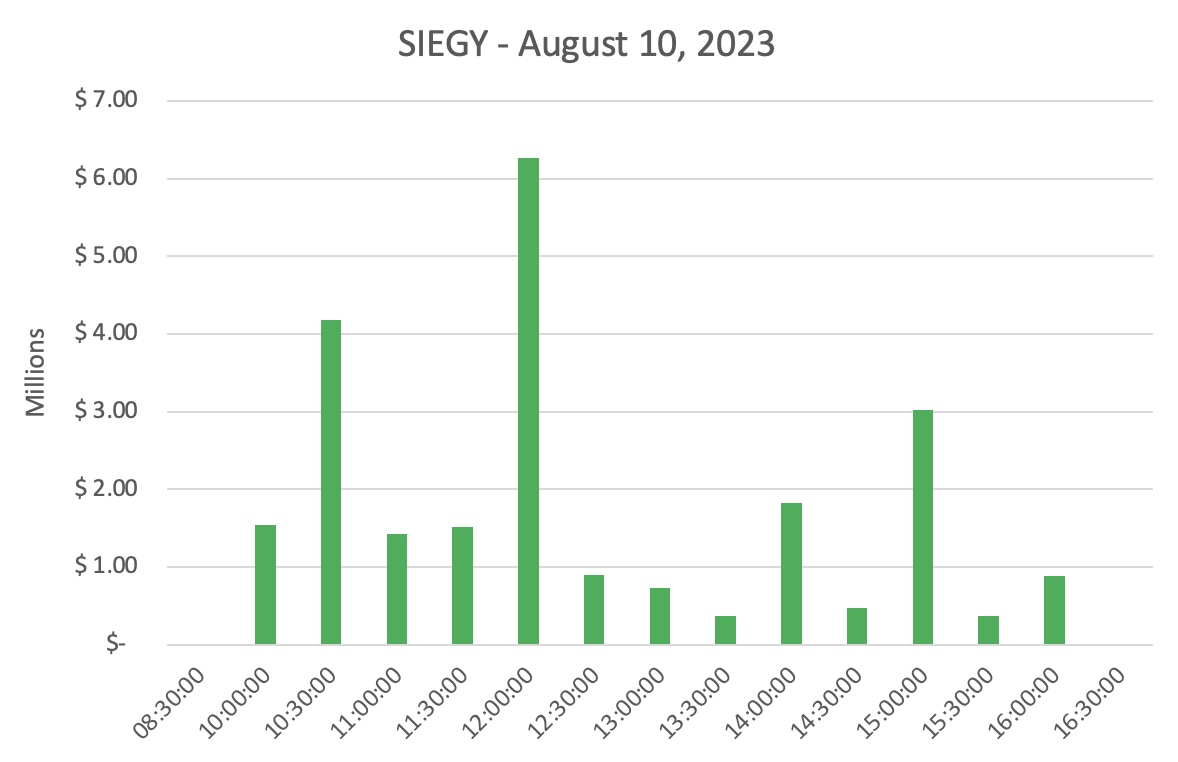

Examining trading volumes corresponding to each earnings release date is also worth of interest. Pre-earnings trading volumes become a predictive measure for investor sentiment, offering a heads-up on potential market movements. Analyzing volumes during and after earnings releases aids in identifying short-term volatility, prompting traders to evaluate entry and exit points strategically. Post-earnings spikes signal sustained market interest, providing traders with opportunities for longer-term positions.

The European market closes at 4:30 PM CET/11:30 AM ET and therefore is a notable increase in trading volumes on the OTCQX, OTCQB and Pink markets from 11:30 AM ET - 12:00 PM ET.

This intriguing pattern warrants further investigation into the factors contributing to increased market participation during these specific time frames, providing insights for traders and investors seeking strategic entry and exit points.

Time Zone Impact: Harnessing Global Market Dynamics

Considering the impact of different time zones on trading activity becomes paramount in our analysis. Differences in trading patterns between European and US market hours highlight the importance of understanding global market dynamics.

The juxtaposition of European and US market hours raises questions about how these distinct time zones contribute to the observed trading patterns. Traders can thus optimize entry and exit points by factoring in time zone differentials, recognizing that increased activity during the US market close suggests cross-market influence. This insight encourages traders to monitor both sessions for comprehensive market coverage.

After Hours Trading of Most Active European Securities

In addition to understanding the intricacies of European securities trading and the impact of earnings releases during regular market hours, it's crucial for traders to explore the realm of after-hours trading. OTC Markets assumes a pivotal role in facilitating trading beyond the conventional market hours.

OTC Markets: The After-Hours Arena

Trading Dynamics and Gaining a Competitive Edge

After the closing bell of traditional European stock exchanges, OTC Markets Group becomes a key facilitator for after-hours trading of the most active European securities. As an established US financial market, it connects buyers and sellers outside of the standard European exchange hours, offering an electronic platform for efficient trading.

Understanding the dynamics of after-hours trading facilitated by OTC Markets Group is thus crucial for traders looking to optimize their strategies in the European securities landscape. Here are additional guidelines to enhance trading effectiveness:

1. Extended Timing Strategies: Incorporate after-European hours trading considerations facilitated by OTC Markets Group into strategic planning, aligning trading activities with both regular market hours and OTC sessions.

2. Post-Market Sentiment Analysis: Extend sentiment analysis to after-hours trading volumes on OTC Markets Group's platform, gaining insights into investor sentiment beyond standard market hours.

3. Flexible Trading Plans: Develop comprehensive trading plans that encompass after-hours trading on OTC Markets Group, acknowledging the potential for heightened volatility in these extended sessions.

4. OTC Time Zone Optimization: Consider the time zone differentials in after-hours trading on OTC Markets Group when setting trade parameters, ensuring optimal alignment with global market dynamics.

5. Dual-Market Engagement: Explore trading opportunities not only during regular market hours but also during after-hours sessions facilitated by OTC Markets Group to maximize market coverage and capitalize on diverse trends.

10 Actionable Insights for Traders

Armed with the knowledge gleaned from our analysis of OTC Market’s data and after-hours trading dynamics, traders can implement actionable insights into their strategies:

1. Strategic Planning: Monitor earnings calendars for Most Active European Securities, focusing on companies with strategic release times.

Traders should adopt a proactive approach by closely monitoring earnings calendars, identifying Most Active European Securities scheduled for release. In fact, focusing on companies with strategic release times allows them to align their strategies with market movements, optimizing their positions to capitalize on potential price fluctuations.

2. Sentiment Analysis: Gauge market sentiment through pre-earnings trading volumes, offering predictive insights.

Analyzing pre-earnings trading volumes provides a window into investor sentiment and expectations leading up to the earnings release. Traders can thus gauge market sentiment by observing volume trends, enabling them to anticipate potential market reactions and adjust their positions accordingly.

3. Comprehensive Trading Plans: Establish trading plans that encompass the entire earnings release period, accounting for heightened volatility.

Comprehensive trading plans should factor in the entire earnings release period, from pre-announcement anticipation to post-release reactions. As such, accounting for heightened volatility during this period ensures that traders are well-prepared for sudden market movements, allowing for more informed decision-making.

4. Time Zone Optimization: Consider time zone differences when setting stop-loss and take-profit levels for optimal market alignment.

Time zone optimization involves strategically setting stop-loss and take-profit levels to align with optimal market activity. Recognizing the impact of time zone differences allows traders to mitigate risks and maximize opportunities, ensuring that trade execution aligns with peak market hours.

5. Global Market Engagement: Explore trading opportunities during both European and US market hours for comprehensive market coverage.

Engaging in trading activities during both European and US market hours provides traders with comprehensive market coverage. Logically, exploring opportunities in different time zones enhances the ability to capture diverse market movements and capitalize on global trends.

6. Post-Earnings Signals: Leverage post-earnings trading spikes as signals for potential trend reversals or continuations.

Traders can use post-earnings trading spikes as signals to identify potential shifts in market trends and recognizing these signals will allows them to adjust their positions, either capitalizing on a trend continuation or preparing for a potential reversal.

7. Outlier Vigilance: Regularly review outliers, conducting fundamental analysis to understand underlying causes.

Vigilance regarding outliers involves consistently reviewing unusual market behaviors and conducting fundamental analysis to uncover the underlying causes. By understanding outliers, traders can distinguish between temporary anomalies and fundamental shifts, making more informed decisions.

8. Discerning Anomalies: Distinguish between temporary anomalies and fundamental shifts when reacting to outliers in trading strategies.

Distinguishing between temporary anomalies and fundamental shifts is essential for effective risk management. Traders should thus exercise caution when reacting to outliers, conducting thorough analysis to ensure that trading decisions are based on a comprehensive understanding of market dynamics.

9. Efficient Execution: Collaborate with global trading platforms to access real-time data and execute trades efficiently.

Efficient execution involves leveraging global trading platforms to access real-time data and execute trades seamlessly. As such, collaboration with advanced trading technology ensures that traders can act swiftly and effectively, maximizing their responsiveness to market developments.

10. Market Awareness: Stay informed about geopolitical events and macroeconomic factors that may influence trading patterns.

Maintaining market awareness extends beyond technical analysis to encompass geopolitical events and macroeconomic factors, meaning, staying informed about external factors allows traders to anticipate broader market trends and adjust their strategies in response to evolving economic landscapes.

Conclusion

Incorporating these actionable insights into their trading arsenal, traders can navigate the complexities of the European securities landscape, making informed decisions and optimizing their trading performance.

The nuanced timing of earnings releases, coupled with distinct trading patterns, provides a rich tapestry for market participants to explore. By staying attuned to strategic timings, market sentiment, and global dynamics, traders can position themselves for success in the dynamic world of European securities trading.