2019 has seen as much brokerage turnover as any year in recent memory. In what has devolved into a cutthroat industry, its more important than ever to stay on top and ahead of headwinds and volatility.

Finance Magnates spoke with Michael Nichols, Director of Institutional Sales at TopFX for his perspective on the company's trajectory heading into 2020. Additionally, he delves into the industry at large, and what it takes to succeed and prepare for any unknowns.

What challenges do startup brokers face? Is it possible to succeed as a small startup in such a competitive field?

One of the main challenges startup brokerages face is putting the puzzle together. There are a lot of different parts that you are required to combine such as choosing a regulation, your technology partner, finding a Liquidity provider, CRM systems, and Payments , which we all know can be one of the most significant issues.

Michael Nichols, Director of Institutional Sales at TopFX

If you try to launch your brokerage as a startup, it will quickly become evident how challenging this can be and often the right selection of solutions is a make or break for a broker’s success and future scalability.

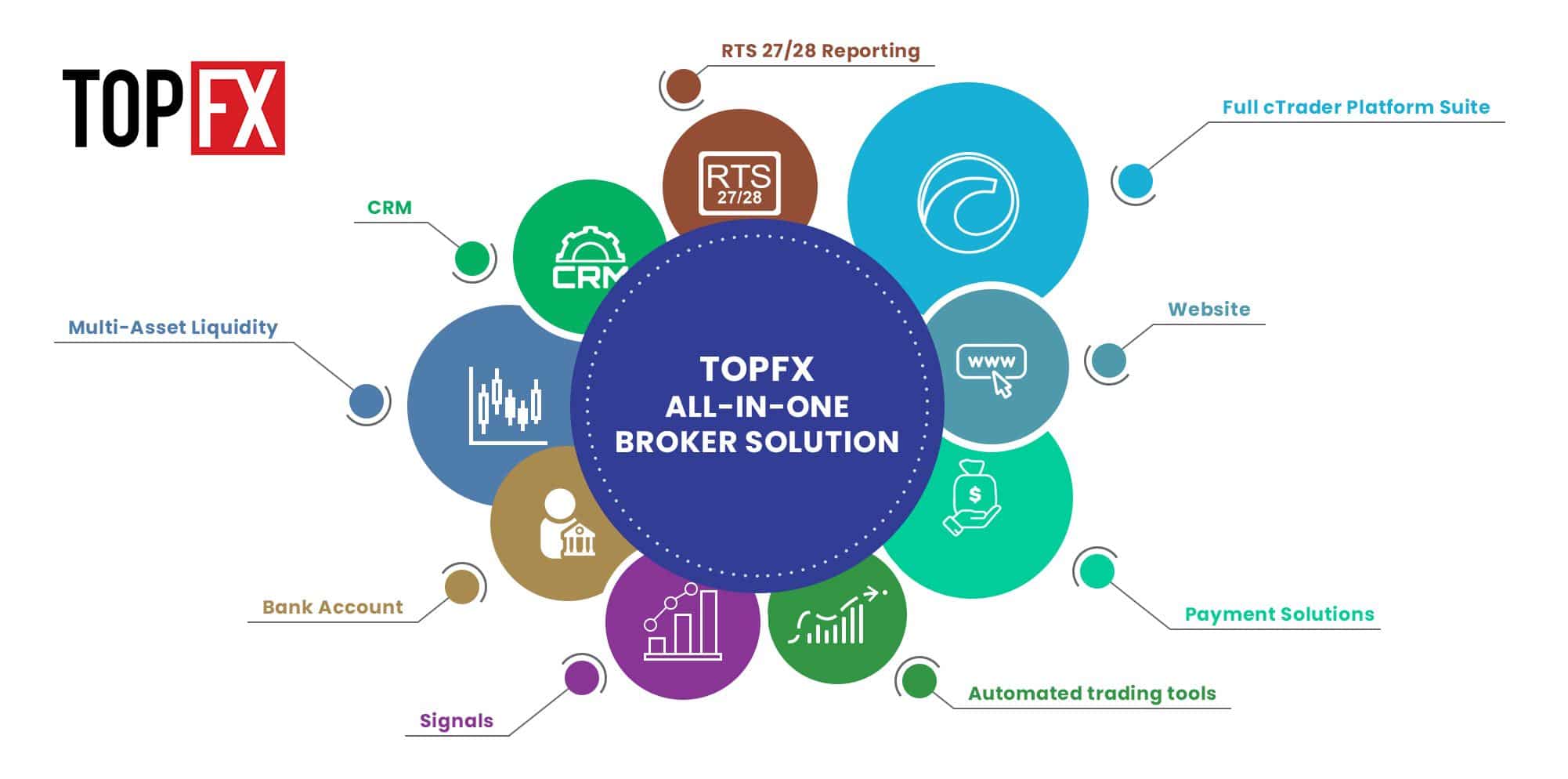

It’s difficult to navigate this as a new startup broker. This is why we utilized our ten years of market experience to create the All-in-One Broker Solution, a complete package of services to start and operate a CFD brokerage.

We offer a ready infrastructure for brokers to run their business and have secured strong partnerships that allow them a smooth entry in the eFX industry.

Another hurdle for a startup broker apart from the knowledge of putting together the right components is sourcing economical solutions without compromising quality.

You can agree that it would be difficult for a small, low-volume broker to get the same cost-effectiveness that the All-In-One Solution would be able to provide, simply because of economies of scale.

Now, the challenge doesn’t end here. Once you have a winning and cost-effective solution, you are already well ahead with a solid base to build on. It’s crucial at this point to get clients to sign up and start trading.

You have a solution with almost everything set up and technical responsibilities being taken care of, so you do not need an army of staff to deal with issues and can instead focus on marketing.

What solutions does TopFX provide to brokers that address the above issues?

Our decade-long experience in institutional liquidity allows us to offer entrepreneurs the best market solutions to launch their brokerage.

To begin with, the main component of any brokerage is the trading platform. We have partnered with Spotware’s award-winning, multi-asset cTrader platform, which includes a Desktop, Webtrader and Mobile app version. cTrader enables traders to perform manual, copy and algorithmic trading on one interface.

Another benefit of using cTrader are the integrations that help brokers increase trading activity and revenues. Tools like Autochartist and services by ClickAlgo means that traders are given options and have no lack of trading ideas to follow.

Our partnerships also include BridgerPay for payments and Tradefora for automated RTS27/28 reporting that is required under MiFID II.

The All-In-One Broker Solution is something we continuously work on. We keep researching the market to find the latest options and review them.

If we believe they will give our brokers a competitive edge, we look at making them available. You need to stay ahead of the trend in today’s market.

What are the advantages of choosing white labels over owning a brokerage?

This is an excellent question which brokers often have misconceptions about. Firstly, it is crucial to understand the difference between opting for a white label and becoming the full owner of your brokerage.

A white label solution provides the convenience of using someone else's infrastructure, but you have to think about at what cost this comes to the broker.

Often there are revenue share agreements and liquidity markups that make it almost impossible to survive and scale.

Starting on the right foot with your own brokerage is a lot more attainable than many startup brokers are led to believe. The cost of the All-in-One Solution makes it possible for any entrepreneur to own their own brokerage.

With their own brokerage, they are fully in control and are able to keep their hard-earned revenues with an infrastructure that is scalable.

How can brokers encourage active trading and retain clients longer?

Another excellent question and key to a broker’s ongoing success. A key to keeping traders active with you longer is by:

a) Providing fair and yet competitive conditions

b) Avoiding large markups while allowing for flexibility

Brokers should aim to retain traders by offering everything they are looking for, so they do not need to have accounts with different brokers to make up for what's not been provided to them, giving traders options is the best way to go.

For example, offer them trading on all devices, the ability to algo trade and copy trade as well as follow signals.

This brings me back to exactly why we partnered with cTrader and integrations like Autocharist. Traders can trade on any device and choose their preferred trading method.

Looking ahead, are there any industry headwinds in 2020 that brokers should plan ahead for?

Yes, as always, we need to be aware of our surroundings. Brokers need to be aware of the constant changes in regulation and reporting.

We are helping brokers address some of these headwinds in advance; we have established a partnership with Tradefora, which automates RTS 27/28 reports.

Other issues that are remaining are the changes to ASIC regulation, the constant Brexit uncertainty, and what the implications will be for brokers and payment providers.

Something worth remembering is that changes such as these are challenges but also opportunities to be prepared and capture growth.

At TopFX, we like to keep our brokers as up to date as possible to seize any such opportunities. Their success is our success.