It is expected that inflation will continue to play a central role among the most prominent themes in the global stock markets of the United States in 2023, as it did in 2022.

After reaching record levels, the rapid increase in inflation has had a large influence on all economic actors, resulting in a significant reduction in buying power. As a direct consequence of this, national central banks, most notably in the United States, have started to quicken the pace of their monetary tightening cycles.

However, there are indications that inflation in one of the most important economies in the world is beginning to decline. Does this imply that inflation in the United States has reached its peak? What does this mean for the future course of monetary policy in the United States? Let’s take a look in this article.

Where is US inflation at right now?

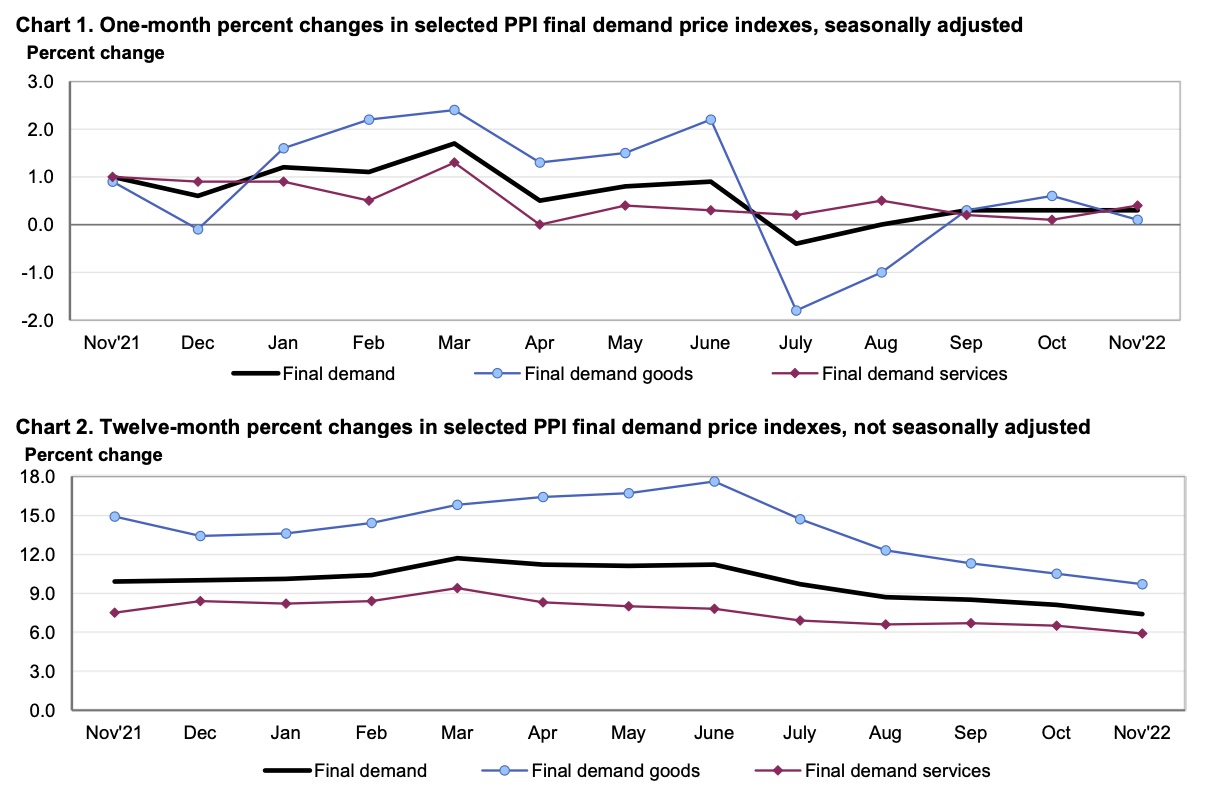

Producer Price Index

The Producer Price Index (PPI) for final demand, which is a measurement of what firms get for their items being created, increased by 0.3% for the month of November and by 7.4% from the same month a year earlier.

Although this was a decrease from the annual increase seen of 8.1% in October (and the slowest 12-month pace of expansion seen since May 2021), wholesale prices rose more than expected in November, compared to analysts' forecasts. The sharp increase in food costs was the primary contributor to this unexpected monthly increase.

PPI figures - Source: US Bureau of Labor Statistics

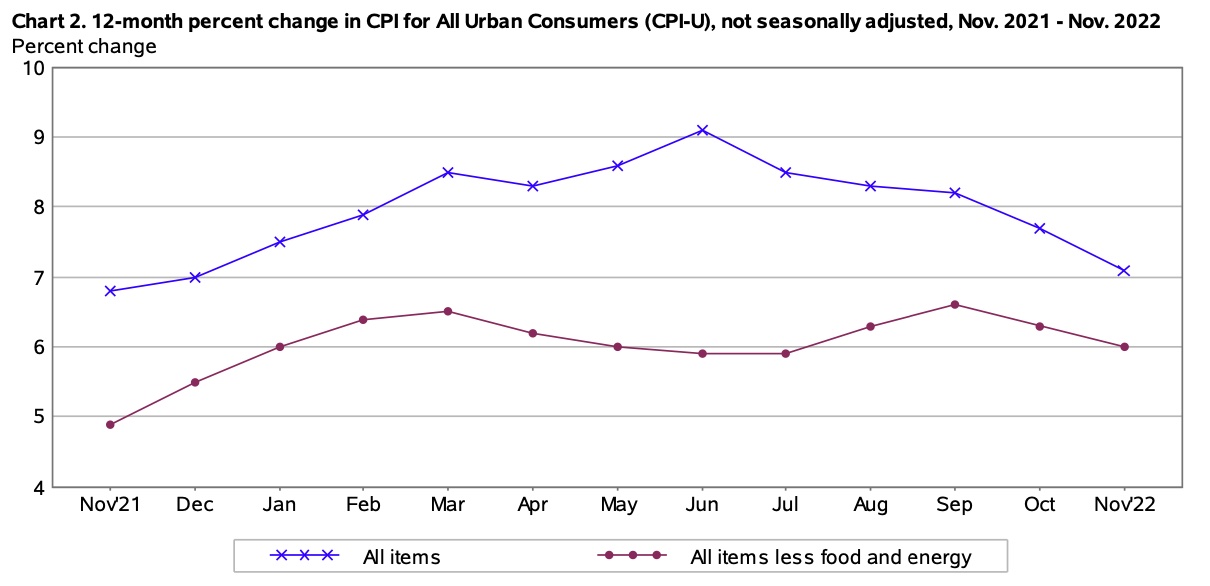

Consumer Price Index

Since reaching a high of more than 9% in June 2022, annual inflation has been trending downward, as seen by the most current numbers from the Consumer Price Index (CPI). In point of fact, it achieved a level in November (+7.1% after 7.7% in October), which is virtually identical to the level that would be reached in December 2021. In addition, November was the lowest 12-month growth since the period ended in December 2021.

CPI figures - Source: US Bureau of Labor Statistics

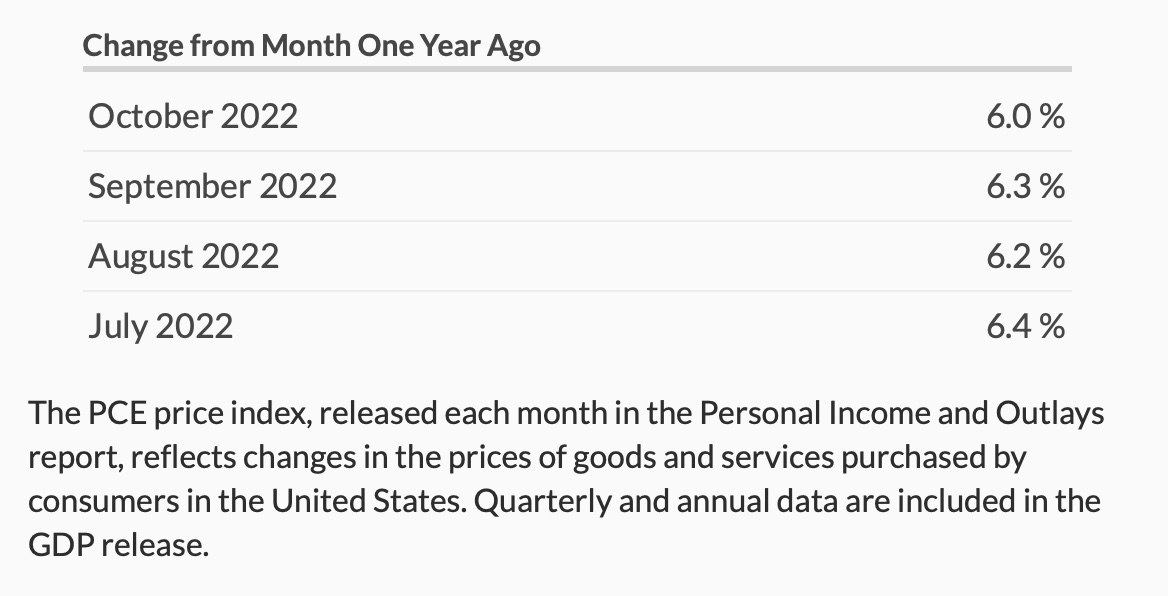

Personal Consumption Expenditures Price Index

The personal consumption expenditures (PCE) price index, which is the favoured method of measuring inflation by the Federal Reserve, is also exhibiting indications of slowing down.

Economists were taken aback by the fact that inflation remained at its previous level of 0.3% during the month of October. They had expected a moderate increase, anticipating +0.4%. The PCE index had a year-over-year decrease to 6% in October, down from 6.3% in the previous month's reading.

PCE figures - Source: US Bureau of Economic Analysis

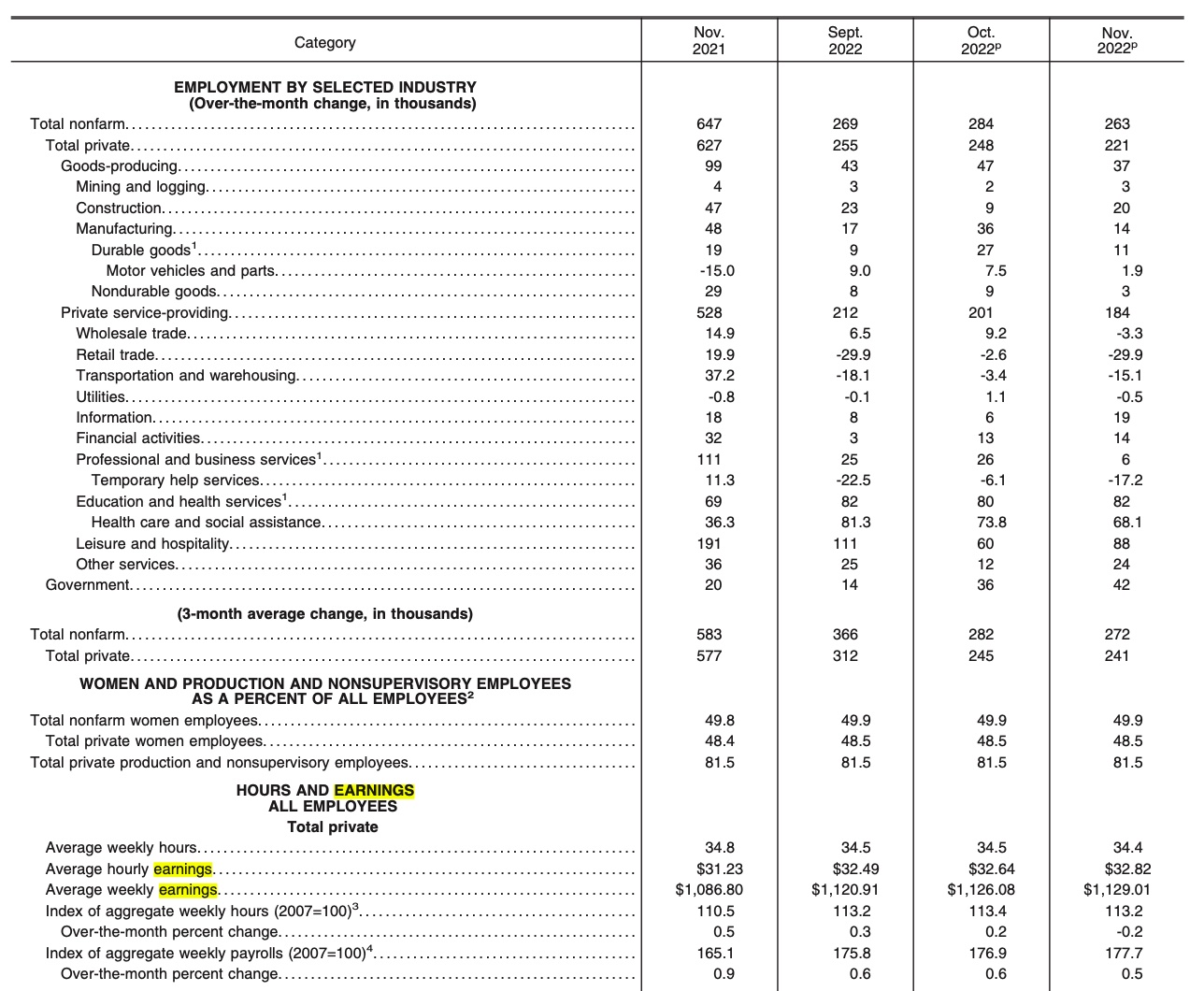

Earnings

Last but not least, it is interesting to examine pay increases in the United States, particularly for the purpose of estimating the potential for a wage-price spiral.

When there is an increase in the cost of living, it is not unusual for individuals to also want an increase in their income in order to make up for the reduction in the amount of money they have available to spend. However, these increased salaries have the potential to continue fueling inflation, since businesses may opt to boost their final pricing in order to preserve their profit margins.

According to the NFP report for the month of November, the average hourly salary for all non-farm employees increased by 18 cents to $32.82. This is a 0.6% gain over the previous month. Following an annual gain of 4.7% in the previous month of October, the average hourly salary climbed by 5.1% in the subsequent month of November.

Average hourly earnings figures - Source: US Bureau of Labor Statistics

Should investors expect US inflation to continue to fall?

If the costs of energy and food stay largely unchanged, there is a good chance that inflation in the United States will become more manageable. In addition, inflation seems to be continuing its downward trend, despite the fact that salaries are increasing, which suggests that the dangers of a wage-price spiral are being contained for the time being.

The analysis made by the International Monetary Fund in its World Economic Outlook shows that "a sustained acceleration of wages and prices is unlikely", because the shocks that are driving inflation aren't coming from the labour market, because real wages seem to be declining, which is helping to ease price pressures, and because the Fed and other central banks have adopted quite aggressive monetary policies.

Source: IMF Blog

Does the fact that it seems as if inflation in the United States has reached its maximum suggest that it will continue to decline in 2023? That cannot be said with absolute certainty since there are many uncertainties about growth prospects, the end of the war in Ukraine, as well as China’s re-opening after 3 years of strict zero-Covid policy, among other factors.

One thing is sure, inflation will be one of the main themes driving the stock, bond, and Forex markets next year, so be sure you’re using a reliable and fast broker like ActivTrades to invest in stocks that can thrive in an inflationary and rising interest rate environment (no leverage trading account), and exploit market volatility through bullish and bearish price fluctuations with short term financial products like CFD or Contract For Difference (leveraged and margin trading account).

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.