A White Label option is the most cost-efficient path to setting up a new forex broker however every broker needs to find the right technology partner to achieve long-term success.

If, you’ve taken the decision to start a new brokerage you will be looking at the wide variety of white label solutions available that offer licenses for MT4, MT5 or cTrader platforms.

However, if your research stops there you are a lap behind existing brokers and carrying a heavy handicap.

The market is filled with customer management systems and many are offered at extremely competitive rates. There are also many providers that offer CRM solutions designed for forex brokers that do a fine job of meeting basic customer expectations.

But unless they can deliver insights that drive business performance, they cannot equip your brokerage to compete in today’s market.

Today’s successful brokers are weighing up the merits of the latest broker technology to ensure they continue to compete at the sharp end of the industry. Existing and new brokerages need to be aware of the growing impact that artificial intelligence (AI) is having on broker technology.

Modern businesses have monetised data-driven behavioural insights to gain a competitive advantage. Operating a brokerage without tools that leverage data which deliver actionable insights is setting on a path to failure.

It’s a hyper-connected world in which people expect the same level of customer service they receive from most of the online services they use on a regular basis.

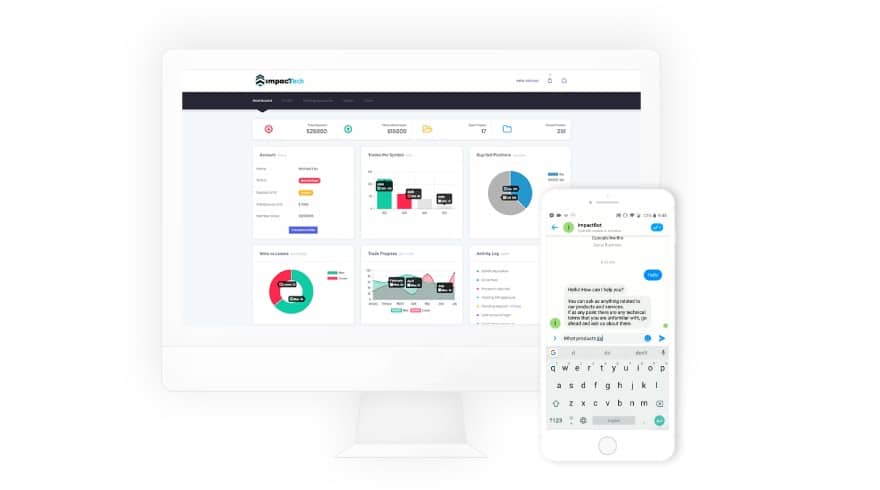

Sales, customer support and marketing functions all generate data. When this is processed through AI-driven tools via a central platform it enables a business to deliver a personalised and more profitable customer journey.

Artificial Intelligence Provides a Competitive Advantage

When customers have a query, they want to be dealt with quickly and by someone who has the knowledge to solve their problem. This can happen if they speak to an agent who has access to the context and history of previous interactions.

However, the potential exists to extract more value from this interaction and exceed client expectations. There are tools that can process interactions, using sentiment analysis, to gauge the mood of the client. Machine Learning (ML) then extracts insights about what makes up a successful client interaction.

AI-driven broker technology, like Impact CRM, gives a business data-driven behavioural insight.

The use of sentiment analysis and ML reflect the growing influence of AI in business and the need to make full use of data. Impact Tech’s Impact CRM is a platform that ticks all the required boxes and offers brokers a cost-effective way to access the benefits of AI-driven insights.

Within five years 95% of all customer interactions will be through channels supported by AI with intelligent chatbots forming a key component in supporting customer experience.

The use of conversational AI in a chatbot produces more efficient lead acquisition, drives higher lead conversion, increases retention and improves customer support. These new chatbots are equipped to build relationships with clients and some businesses have doubled conversion rates in comparison to their traditional website.

The information collected by intelligent chatbots provides sales agents with insights about which products and services to upsell. They can also be equipped with an automated lead scoring tool to ensure sales teams focus on the best leads.

Marketing campaigns can also be better targeted and personalised while re-targeting campaigns deliver more precise marketing and even higher conversions.

Find a Scalable Solution

When weighing up the choice of technology partners, a major consideration is whether their products and services allow room for growth and the price of scalability. It often becomes clear at this point if your business and your potential tech providers are a suitable match in business culture.

Once you’ve identified a technology supplier you can leverage their industry expertise in favour of your business. This not only fast-tracks the path to reaching clients, your business gets a field-tested platform with proven reliability.

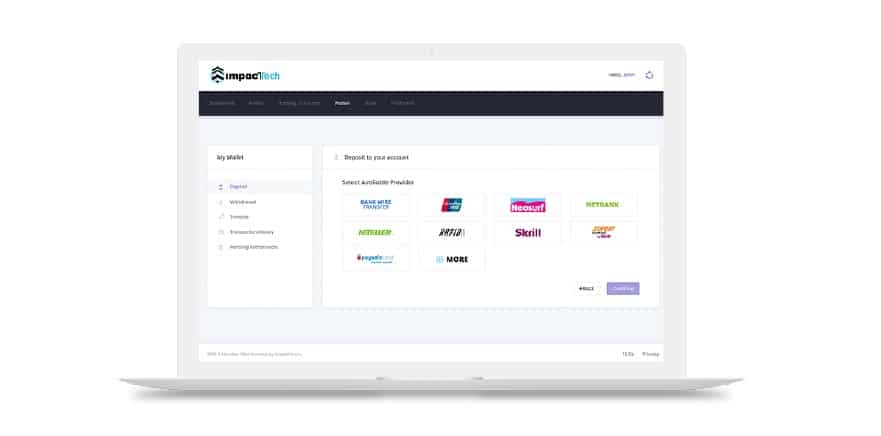

Most brokerages expect to attract traders from all over the globe. In addition to offering a multi-lingual solution your business needs to offer PSPs (payment service providers) that cater for your entire client base.

Impact PSP Gateway is the intelligent way for a business to receive Payments

The ideal solution offers both the variety in payment options that clients expect and ensures your business pays the lowest transaction fees. One of the latest solutions on the market is Impact PSP Gateway.

It offers over 250 integrated payment gateways that adhere to a rule-based transaction flow. It’s available through a single integration which is both secure, highly available and offers real-time reporting.

The reporting system gives your business an overview of payment flows and highlights payment issues. It also generates custom reports on currency, payments and gateway.

This payment platform also offers businesses the option of unlimited users and the control to set permissions to customise reporting access to selected users and manage access to sensitive information.

Trading Platform Essentials

Platform flexibility is essential to meet the demands of today’s clients. It is imperative to offer desktop, mobile and web trading with user-friendly interfaces that synchronise automatically. Your clients will expect to be able to trade whenever they want to and on whichever device is convenient at the time.

MT4 and MT5 are the world’s most popular trading platforms followed by Saxo Trader and cTrader. These platforms took the largest share of the market by being easy to use, easy to install and always available.

As the retail online trading market developed so have these platforms. Access to new tradeable instruments have been added as well as educational features and the ability to set up trading bots to trade automatically.

A white label solution is the most cost-efficient way to acquiring a trading platform like MT4 and MT5

Liquidity is another essential brokerage component. Choose a liquidity provider that can cater for all the financial instruments your brokerage plans to offer. If your brokerage wants to appeal to experienced traders, you will also need to consider trade execution speeds and spreads.

Experienced traders are looking for low-latency execution and tight spreads which are available with STP (straight through processing) and ECN (electronic communications network).

Simply advertising that your brokerage offers low latency execution without being able to deliver will not cut it. Experienced traders will use demo accounts to test out your platform before committing their funds to trading with your new brokerage.

Plan Ahead for Compliance Management

Many new brokerages explore unregulated markets in their first foray to get a foothold in the business. It’s a tried and tested method that has served many successful brokers in the past and still does today.

At some point a broker will tap a regulated market and when that time comes it’s important to have a robust compliance management strategy in place. Most, if not all, successful established brokers that operate in regulated markets flag up compliance management as an area for improvement.

The increasingly global nature and independence of financial markets has led to international co-operation and the creation of common standards. As a result, there is a growing body of legislation that extends beyond national borders which make the regulatory landscape more complex.

Companies need to be aware of the legislation they are subject to and understand its potential impact.

Compliance monitoring tool highlights compliance issues

The risk of reputational damage and fines has created a need for compliance management tools for regulated brokers. This recently launched compliance monitoring tool is dedicated to forex brokers.

It uses NLP (natural language processing) and ML to highlight potential compliance issues during sales calls. Many top brokers have already adopted the module to improve the efficiency of compliance infringement detection.

Digital Transformation is Happening

Many industries, including online trading, are going through a digital transformation. Part of this transformation involves embedding analytics and AI into operations and services. This transformation enables a business to manage the customer journey far more efficiently.

Starting at lead generation and conversion followed by customer satisfaction and retention. Unlike other innovations which have linear effects that scale with investment the pay-off for investing in AI technology only increases in time

The insights AI-driven tools improve in relation to the volume of data available to process.