Nearly all Forex brokers advertise their spreads on their websites as a key way to differentiate themselves from their competition.

Spreads starting from 0.0 pips… USD/EUR spreads from as low as 0.1 pips… Sounds impressive right?

Most of these statements aren’t wrong but have you ever sat down to work out how much it will actually cost you to trade with a broker?

Justin Grossbard at Compare Forex Brokers recently did and this article details most of his company’s findings.

Starting with the Right Account Type For You

Might sound pretty straightforward but before getting into specifics about the fee structures the various brokers boast, it’s important to stress that fees don’t just simply vary from broker to broker.

They also differ between the different accounts or platforms that a particular broker offers.

For example, Pepperstone charge lower fees for some instruments on their Razor MT5 platform than they do on the Razor MT4.

IC Markets’ Raw Spread account boasts EUR/USD spreads of 0.1 pips but you shouldn’t expect to pay the same rate using their standard account.

Delving Deeper into Trading Fees & Charges

One mistake traders and particularly novices can often make is that they take the fees advertised on broker websites as gospel.

Unless you may be trading with a broker that offers fixed spreads, it is very difficult to forecast the exact price you’ll pay to execute a currency trade without doing some research first.

This is where guides such as this one provided by myfxbook come in handy. Very rarely will a trader just concentrate their focus on one currency pair.

Opportunities present themselves on a vast number of major and minor pairs.

Therefore, look at the spreads and commissions charged on each pair you might trade before executing your first trade.

Demand and Liquidity also play a big part in dictating the spread quoted on a currency pair which is another reason why you won’t always be charged the advertised bid/ask quote.

In order to overcome this, take a look at historical spread charts like this one from oanda. Most brokers offer this feature on their respective websites which lets you analyse how a broker’s spreads respond to key market events in turn helping you get a little closer to forecasting your costs.

Research We Conducted at Compare Forex Brokers

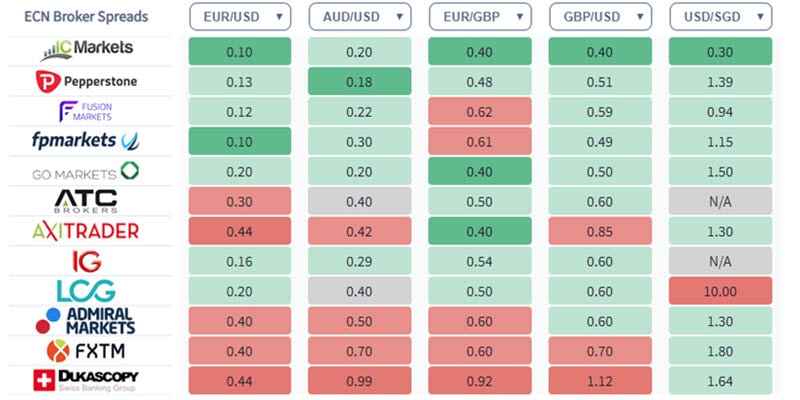

In February 2020, our team at Compare Forex Brokers conducted exhaustive research around the various spreads and commissions charged by the industry’s top brokers.

We looked at over 30 brokers, segmenting them into three key sections: Spread + Commission brokers, Spread Only (Zero Commission) brokers and Fixed Spread brokers.

What we found was that average trading costs were lower when trading FX with a broker that charges a Spread + Commission.

In fact, even the highest Spread + Commission charged by a broker we looked at was still lower than the cheapest Spread Only (Zero Commission) broker.

Unsurprisingly, trading with a Fixed Spread broker was the most expensive way to trade with the cheapest Fixed Spread broker.

Interestingly, the average fee charged by Fixed Spread brokers was 2.55 pips vs 1.55 for Spread Only (Zero Commission) brokers.

The one thing our findings highlighted above all else was that it pays to do some careful research into the fees brokers charge.

Your level of trading confidence and expertise will ultimately dictate the type of account you open with a broker.

An occasional or opportunistic trader will normally opt for a very different account than a professional who trades each and every day.

Before settling on the broker with the advertised ‘lowest fees or spreads,’ consider your trading needs, examine a broker’s fees closely using some of the tools mentioned above.

It’s difficult to work out your exact trading execution costs but with some research and working out an avg. on the currency pairs you buy and sell, you can get quite close.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates.