Over the past year, Forex and CFD brokers have consistently strengthened their offerings to help gain an edge in an evolving and cutthroat retail industry. This includes harnessing Twitter, which has grown to encompass a core service on offer at leading brokerages.

This trend should hardly surprise anyone in the industry or financial world. With social media influencers on the rise as well as standout personalities gaining newfound traction, it is simply impossible to ignore the impact of Twitter in the financial sphere.

More so than ever before, individual tweets can result in big market moves. Elon Musk, has millions of investors dialed into his Twitter account. He can move either his own stock or crypto markets with a single tweet.

Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock.

Do you support this? — Elon Musk (@elonmusk) November 6, 2021

But it’s far more than just the celebrity names where Twitter is leading the financial news. For example take the OOTT – the “Organisation of Oil Trading Tweeters” - tweeting real time tanker movements and analysis of OPEC policy as it is announced.

Twitter has now established itself as an integral medium for investing, capable of revealing unique content and new types of perspective and analysis. With so much content exclusive to Twitter, traders should ignore this platform at their own peril.

Harnessing Natural Language Processing

The challenge presently is not access to this information as it’s freely available for all investors. Rather, the issue is finding ways to sort through the noise to extract a coherent snapshot and investment advice.

Deciphering an unlimited pool of data has never been an easy feat. However, using Natural Language Processing (NLP), computers can be successfully programed to analyze large swaths of data.

This in turn leads to ‘processing’ or understanding of information across any field or medium.

Using NLP, it is now possible to tap into the Twittersphere with tailor-made solutions, exclusively for retail investing. This advancement has not gone unnoticed by brokerages, with retail clients consistently demanding improved access to educational tools and resources.

Retail Brokers Playing Catchup in Newly Automated World

Retail brokers must adapt or die. With a larger and more diverse pool of investors than ever, personally curated financial news feeds have become a catch-all offering that traders now recognize as mandatory.

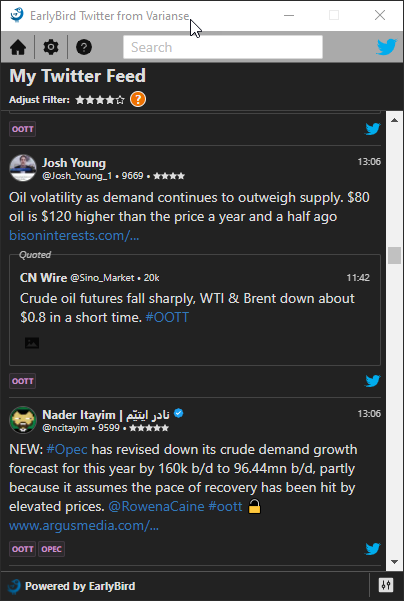

There are several providers of these types of services utilizing NLP, though a few have quickly separated themselves from the pack. One of the most widely used service providers in the professional finance arena is Market EarlyBird, which has now adapted its existing suite of financial news apps specifically for the retail market.

Already used by thousands of finance professionals in global banks and funds, EarlyBird offers embedded financial Twitter feeds that are individually curated to match each user’s portfolio.

The result is a relevant, actionable Tweet feed for retail brokers and financial information sites, complete with tradable news and sticky, engaging insight - a refreshing contrast from generic Twitter-feeds.

The feed is compatible with the two most popular trading platforms in the market, i.e., MetaTrader 4 and MetaTrader 5. Installed as an EA but displayed as a real-time feed of financial Twitter content, the user is also pro-actively alerted to changes in Twitter activity that could indicate a trading opportunity for one of their favored assets.

Retail brokers can seamlessly integrate this into their offering, allowing users to manage feeds, import directly from chart symbols, and more. Using SmartTracks (EarlyBird’s intelligent filters) traders can harness tweets for specific asset classes, providing a truly different outlook.

Coverage is growing daily but already includes FX, equities, commodities, and Cryptocurrencies .

Keep Up with the Big Players

Brokers are always looking for new ways to attract users, especially using tools that competitors do not have. The EarlyBird Financial Twitter feed functions as a premium product that is available only on selected online trading platforms and paid financial information sites.

Using a bespoke Twitter feed that harnesses NLP empowers retail traders, giving ordinary investors information that was previously reserved for the institutional space.

This is why EarlyBird’s early adopters are set to stand out from the competition as providers of today’s most relevant and powerful trading tools.

EarlyBird frequently breaks tradeable financial news minutes or hours ahead of traditional news sources. These are precisely the news items traders are looking for, which can directly lead to increased trade volumes on retail platforms.

Finally, EarlyBird’s intelligent Twitter feed keeps customers returning with financial insight they won’t find anywhere else. The comprehensive feed is customized for each portfolio ensuring only relevant content is shown, while linking the users to highly tradable news on related products your platform supports.

Find out today what EarlyBird can do for your brokerage or request a demo.