To further expand its Blockchain -based wine investment platform, WiV Technology will roll out the $10 million WiVX open-ended DeFi fund in January 2022.

Adding Value To Real-World Wine Assets Via Tokenization

In a bid to provide users enhanced Liquidity and access to low-cost funding opportunities, WiV Technology, the world’s first blockchain-based brand to merge the promising wine industry with high-yielding NFTs, will soon roll out WiVX, a $10 million DeFi fund governed by the WiVA ($WIVA) token.

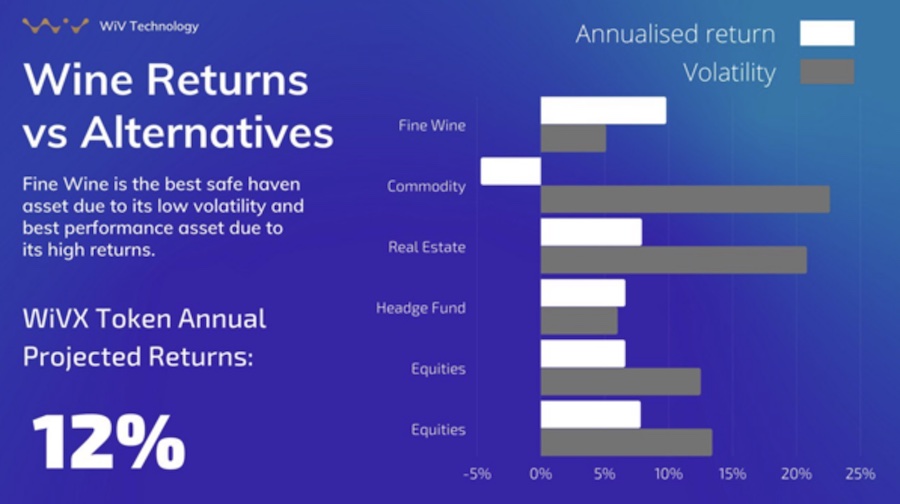

The WiVX fund combines the efficiencies and decentralization of crypto with the stability and performance of the fine wine sector, which has handily outperformed nearly every traditional asset class over the past two decades.

With the launch of WiVX, WiV Technology will establish itself as the first decentralized finance (DeFi) fund backed by real-world assets.

By assigning real-world value through tokenization, WiVX will allow users to secure collateralized loans for physical wine industry-related assets. Tokenized assets can be listed for sale through open marketplaces to increase global exposure.

Håkon Harberg, a WiV Technology co-founder, notes, “Identifying exceptional wines before they are recognised by the rest of the market motivated our progressive data-focused approach to wine investing. Our data analysis methods and proprietary insights will help this fund maximise returns and stand independently from other industry indices. Developing it as a DeFi fund based on physical assets means that we can make participation efficient, transparent and relatively low-cost. It is an important next step to our goal of creating value to our ecosystem token WIVA, making this type of investment open to a far wider audience.”

Disrupting The Wine Industry With Blockchain Technology

As the first platform on Polygon to provide non-fungible tokens (NFTs) backed by physical assets, WiV Technology leverages the blockchain to deliver faster, cheaper, and more transparent transactions.

The platform facilitates lending via tokenization, enabling wine-based businesses to borrow as much as 50% of their wine asset’s total value.

Following the launch of the WIVA token in August and the exceptional growth of its platform, WiV is spearheading the efforts to support real-world use cases through blockchain technology.

With the platform, vineyards can tokenize and trade their wines across various marketplaces globally, bringing liquidity to an asset class that has consistently outperformed other real-world assets.

The WIVA token powers the WiV ecosystem to facilitate blockchain-based verification and trading of NFTs associated with wine brands by seamlessly bridging the stable and profitable wine industry into the growing DeFi segment.

With the WIVA token in place as the WiVX fund’s utility and governance token, WiV Technology is spearheading a new borderless, digital, and transparent economy for the wine and fine spirits industry.

Besides serving as the platform’s utility and governance token, WIVA also enables users to participate in the WiVX exchange trading fund as a governing DAO community.

As a result of this decentralized approach, all token holders will be eligible for voting on any proposed investment strategy, asset allocation, and rebalancing events while receiving rewards based on their investment and the fund’s overall success.

WiV Technology enables users to allocate each wine asset to a corresponding digital token that securely collects valuable information for each bottle’s provenance and stores the accompanying transaction history.

Other than wine bottles, the platform offers vineyards, merchants, and owners an opportunity to showcase (and tokenize) their assets whenever they wish to trade online.