This guest article was written by Vadim Epstein from emet-trading-solutions.com

Let’s continue reviewing the topic of hedging opportunities that we started in the first part of the article.

Gap Hedging

This strategy shows one more purely technical hedging technique that does not require any “feel for the market” or a “magic” indicator, so it can be used by new traders.

If you look closely at the contract specifications of different brokers, you can note that the closing by “Take Profit” is made according to its level even if such a price has not been in the flow of market quotations. On the contrary, opening of a pending order is made quite often on the nearest real price. Therefore, considering that the price is actually not moving smoothly and makes big or small jumps, it’s possible to extract its income on the so-called “roughness” of the market.

In the simplest case, instead of the “Take Profit” in the existing strategy, you can place a pending order to lock in profits. When it turns to the market, it must be closed back-to-back to the main counter order. If your broker has five digits in the quotation, the profit will almost always be slightly larger than when using “Take Profit” if you are going to use the counter-closing orders “OrderCloseBy ()” function.

But nothing prevents us from going ahead and forming a coherent strategy based on price gaps, which are gaps in the flow of quotations.

Hedging at time intervals of the investment range

Maximum gaps occur between the closing and opening of the market. It’s not always clear which way prices will jump by Monday, but in some cases it is quite obvious. If during the week the currency was clearly losing ground, then over the weekend it has a very low chance of going up. Government offices are closed on the weekend, and news that affects the economy is extremely rare, so the trend, if it is already formed, is likely to continue unchanged.

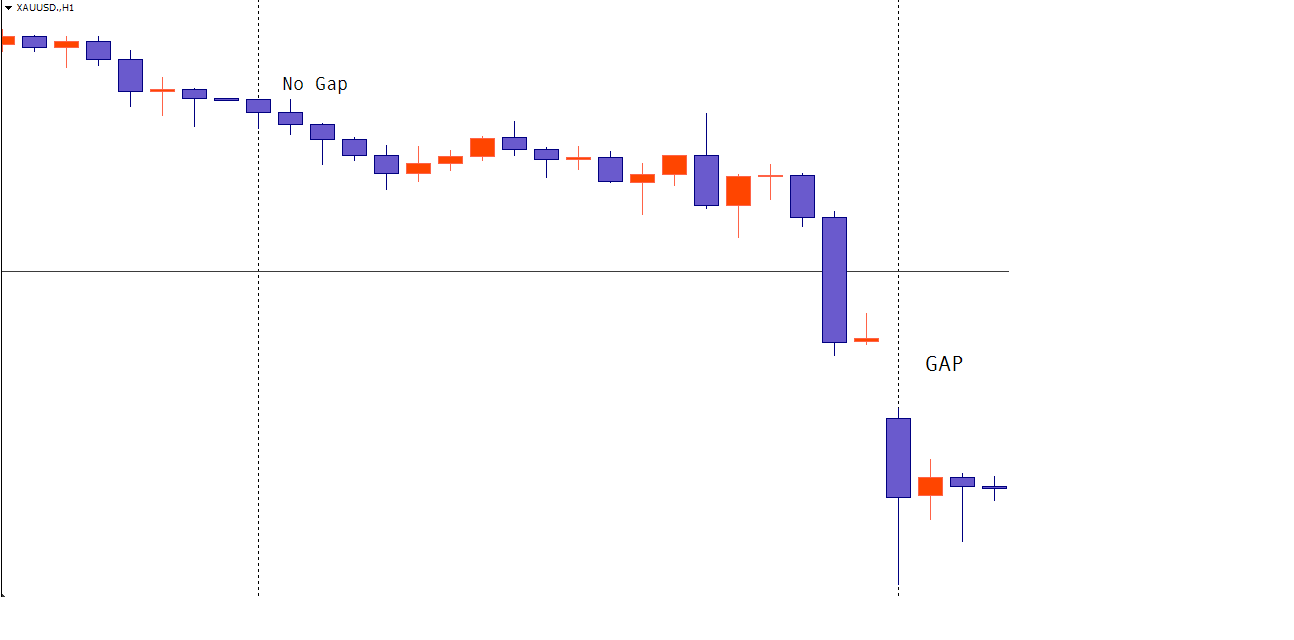

This figure shows an example of a gap in prices between weeks.

If you choose a broker with a high level of Leverage and open at the last second a “Sell” transaction by the maximum possible size, you cannot just double your capital in a single weekend. You could actually increase it by 5–18 times, and the risk of completely losing money does not exceed 20%–25%. Currently, many are already enjoying this method and are in a hurry to close the deal immediately after the opening of the trading session. The result is often a rapid pullback in prices followed by a high spread, and profit fixation becomes a problem.

In this case, once again, hedging can help out. If you use the “Take Profit” to fix profit, then the order will be closed on it at a profit, but it is possible that you could get three times as much income since the price jump was three times higher. If the pending order will be set in the “Take Profit” place, it will be opened to the nearest fair price and reliably detects all possible amounts that can be extracted from the price jump between trading sessions.

Let’s consider an example of such a hedge on one of the most popular GBP/USD currency pairs. The week of 31/08/2014 brought a few more price declines than usual: from 1.65912 to 1.63246 at the close of the trading week. Based on this, we can conclude that this movement will likely not stop over the weekend. Let’s suppose that we had a balance of $200 and it was decided to risk the entire sum, using the 1000 leverage. In practice, you rarely meet brokers with higher leverage. It is extremely rare for such small sums to offer 2000 leverage. We are not going to use the most favorable conditions but consider average opportunities. When the leverage is 1000, it’s possible to open a total volume order of nearly $200,000. In fact, the amount will be somewhat less because of Margin Requirements , but in order to demonstrate the strategy it’s not so crucial. It is of prime importance to open an order at the last second when a further price change in an unfavorable direction is no longer possible.

At the market opening on 07/09/2014, the price was: 1.61673.

1.63246 - 1.61673 = 0.01573.

This much was the gap between trading sessions.

$200,000 * 0.01573 = $3,146

This is the size of the equity in the account.

Next, you need to make an immediate counter-closing order by taking a profit. Naturally, it is necessary to take into account the spread and additional margin limitations, which don’t allow orders to be opened with full use of leverage. Therefore, it would be better to round off the amount from $3,146 to $3,000, but in this case the capital increased by 15 times in just two days with minimal risk—more than paying for soft rig, which is necessary to use in this strategy.

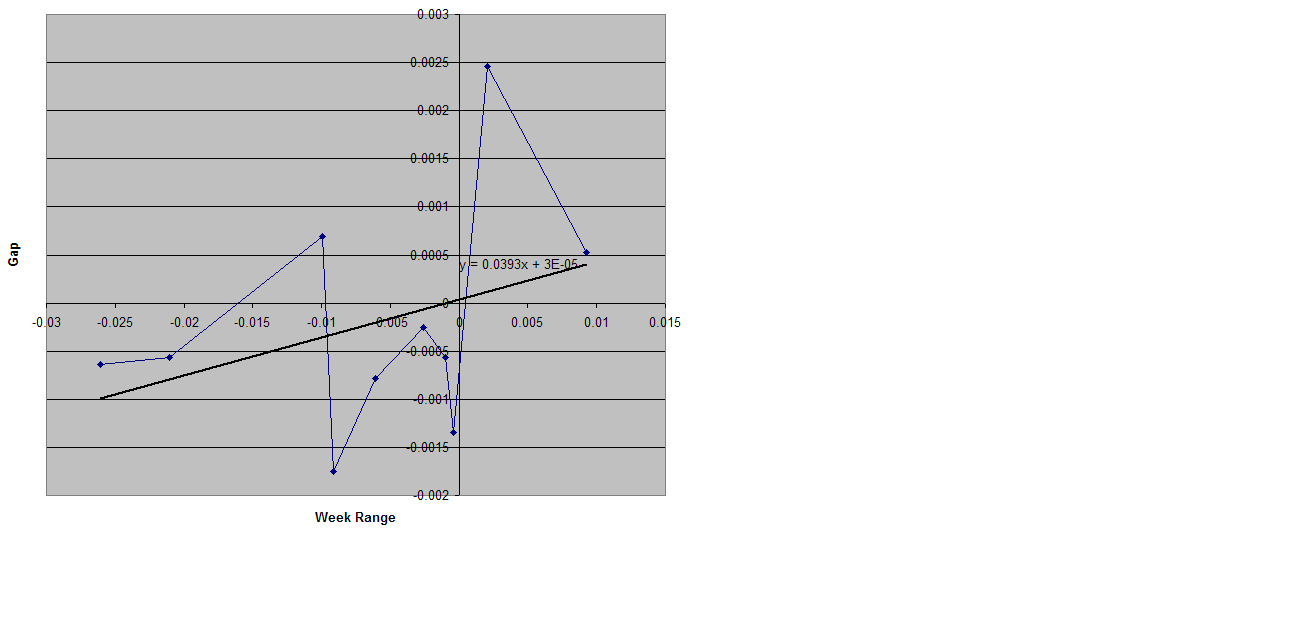

It’s natural to wonder how often do such opportunities happen for you to be able to use this strategy. Let’s consider the intersession gaps on the popular GBP/USD currency pair over the past 10 weeks.

The horizontal axis shows the size of the weekly bars. The vertical axis shows the value gap that followed this bar. As the figure shows, the possibilities for using this strategy were offered weekly, and only once were trading results unprofitable. For more information, a linear approximation by point was made: black line and the formula to calculate the approximate size of the expected gaps in prices on the amount of the weekly bar.

Conclusion

1. Although at first glance the hedging instrument appears meaningless, taking into account the number of technical nuances of trading, it can be used for strategies enhancement or creating separate trading systems.

2. Hedging efficiency depends directly on the code quality of supporting and basic programs that are used in trading, so it is especially important to order them from a reliable and verified service provider.