Directional Trading Using Options

As mentioned in 'Part 1 - Options Evolution', you buy a Call when you expect the market to go up and you buy a Put when you expect the market to fall. In the following article, we explain how options are used in directional trading.

Ancient Options

Directional trading has existed for thousands of years. Aristotle in 600 B.C., documented a story explaining how the philosopher Thales benefitted from the rising cost of hiring olive presses. Thales predicted there would be a good crop of olives coming in the summer. With that, he paid a premium to hire all the olive presses in Miletus and Chios at a reserved price. When summer arrived, his forecast proved correct and demand for olive presses grew enabling him to let-out the presses to olive farmers at a higher price than the price he reserved. This made him huge fortunes!

The contracts Thales cleverly traded were Call options; he paid a premium to secure an asset (the olive presses) at a certain price over a certain period of time.

Modern Day - Trading an Uptrend

Moving forward 2600 years, not much has changed in the method of options trading, however today’s options are used in a great number of different markets. Take WTI oil as an example, it is the most actively traded energy product in the world and options are a popular instrument used to trade its direction.

If you forecast that WTI oil price will rise, similar to Thales and the olive presses, you could reserve a buy price for a certain number of barrels over a certain amount of time. This type of contract is a 'Call option'. If the market price is above your reserved price by expiry you would 'exercise' the option which means you buy at the reserved price. At the same time, you can sell the same number of barrels at market price. You are selling at a higher price than you are buying hence you make a return. If market price is at or below your reserved price, you would not 'exercise' the option and lose at most the money paid to buy the option.

WTI Oil Option Trade Walk-Through

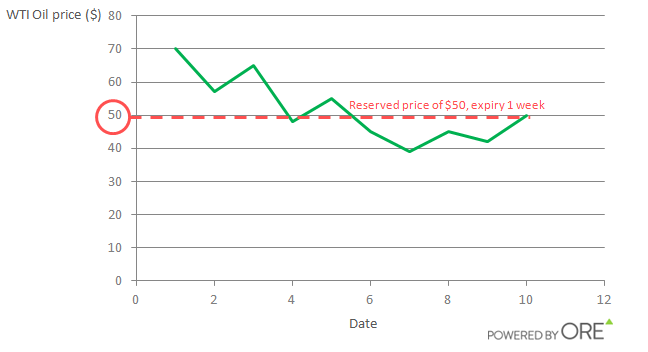

WTI oil is trading at $50 per barrel. You buy a Call option to reserve 100 barrels at this level over the next week by paying a $100 premium. See chart below.

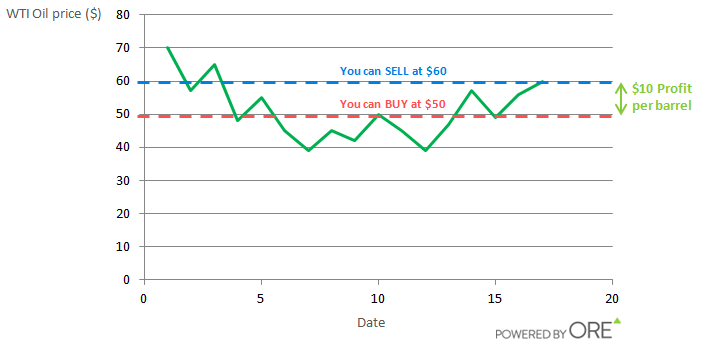

If oil price subsequently rises to $60, you would 'exercise' your option. This means you buy 100 barrels at your reserved price of $50. At the same time, you can sell in the market at $60. You are selling at $60 and buying at $50, thus making $10 for each barrel. Your gross profit is $10 multiplied by 100 barrels, that's $1000. See chart below.

Then, subtract the amount you paid for the option, $100, to determine your net profit, $900.

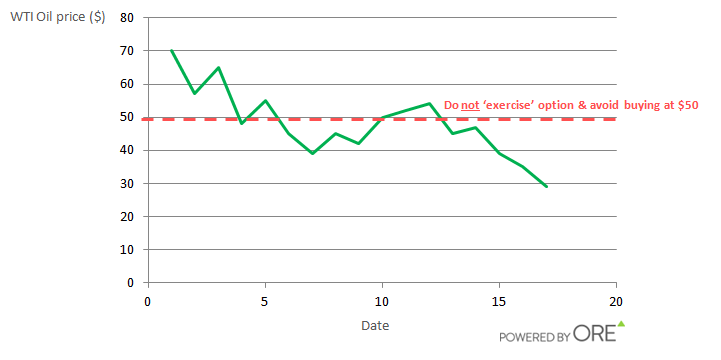

On the other-hand, if oil prices fall, you will incur a loss, but this loss is limited to the amount you paid for the option, that's $100. Even if the price fell to $0, your risk is never greater than $100. See chart below.

This is what makes buying options unique; the maximum risk of any trade is the amount you pay for the option (the premium). It means investors can take directional positions without having to make use of a stop-loss order.

Buying Put Options - Trading a Downtrend

Put options are used to reserve a sell price in the market over a certain period of time. Under the same reasoning as the example above, you can buy a Put option to trade a falling price. If the price falls, the Put allows you to sell at a higher price than the market. The difference between your Put option's reserved price and the market rate is your profit (before subtracting the premium paid).

Cash-settled Options

On e-trading platforms, it is common to trade cash-settled options. The actual physical delivery of the asset (currency or commodity) is not required. Instead, if the option has value, cash is credited to your free balance. If an option has no value, no cash is credited to your free balance.

Another benefit of trading on an electronic platform is your real-time profit or loss from the trade is calculated for you. Profit and loss can be monitored and trades can be closed before expiry via the open positions’ screen.

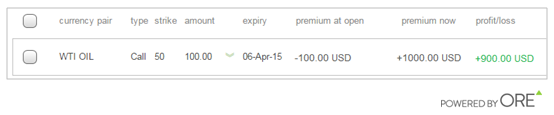

Below is an example of a WTI OIL cash-settled Call option trade. The reserved buy price, known as the strike, is $50 and the contract is for an amount of 100 barrels. The cost to buy the option, premium at open, was 100 USD. The value of the option now, premium now, is +1000 USD. Hence, the profit/loss is +900 USD. The trader can receive the profit in 'cash', he does not have to physically buy 100 barrels of oil to collect the option's profit. Cash-settled transactions makes options trading a lot easier!

In Part 3 of The Options Game, Zoe Fiddes, explains how to calculate option payouts.

And if you want to start from the very beginning, then click here: The Options Game: Part 1 - Evolution