To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

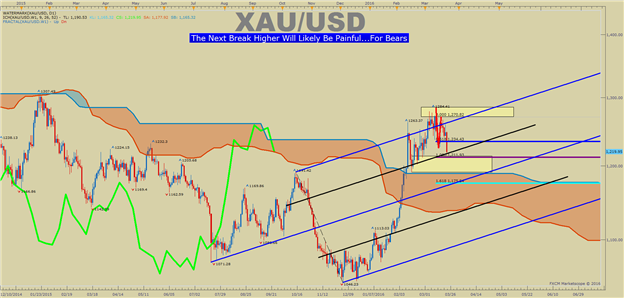

- Gold Technical Strategy: Watching for a Break Above 1,270 To Enter Long

- The 200-DMA In USDollar Could Be a Key Driver for XAUUSD in Q2

- Weekly Ichimoku Cloud Favors a Behavior Change is Afoot

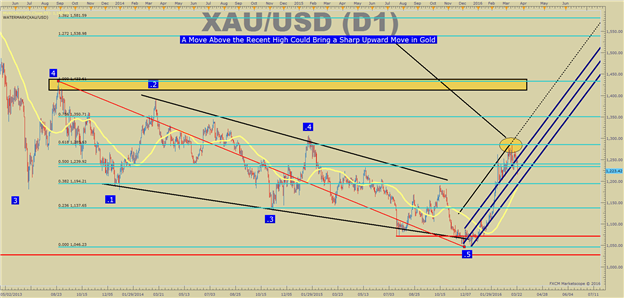

Gold bears often look smart until they do not. The move higher from the December, when the Federal Reserve decided to hike interest rates for the first time since 2006, has been breathtaking. Gold has moved higher by 23%, and another 10 to 20% rally could happen should the US dollar fail to recover and move back above the 200-day moving average again. The recent move higher in gold preceded other commodity markets like crude oil and silver moving higher.

To See How FXCM’s Live Clients Are Positioned In FX & Equities Click Here Now.

The chart below shows that a corrective move lower was due, but also may not last for long. Not only is Gold now in a technical Bull market but fear from an unstable global macro environment and at the same time, signs of inflation in major economies are starting to perk up. Both fear and inflation are natural drivers of gold bulls.

This environment means not only is the chart showing signs of life that favor further upside, but the fundamental forecast also makes it hard to discount this precious metal. Negative interest rates, at the confession of former Minneapolis Fed President Narayana Kocherlakota, is an admitted policy failure of central banking. All of this make it hard not to foresee a move above $1300/oz. shortly, if not $1433/oz, the summer 2013 high, later this year.

A Break Above the Lower-High at 1,270 Opens Up A Strong Move Higher

Key Support Levels from Here

The chart above utilizes a weekly Ichimoku cloud as resistance. What is interesting is whether the each mocha cloud can act as support within this retracement. The aggressive move through the cloud on the way higher argues that a behavioral shift in capital markets is underway, and a bounce off the cloud as support into new multiyear highs would favor that argument. Currently, the top of the weekly Ichimoku Cloud sits at the same level as the October high of $1191.42 per ounce.

Another key technical event is that $1190 per ounce is the 38.2/61.8 divide of the June 2013 to December 2015 range. Our breaking out of a bullish falling wedge pattern, all of these events favor further upside. The upside I specifically will be looking at is $1,433/oz, the August 2013 high. A validating Intermarket analysis move would be a breakdown longer-term in the US dollar though that is not necessarily required in certain risk off scenarios where Treasury yields plummet due to increased demand like the one they have since December.

T.Y.

By: Tyler Yell, CMT, Forex Trading Instructor