Talking Points

- The CAC 40 Opens Up 0.24%

- Price Consolidation Continues for sixth Daily Candle

- SSI Reads Bearish at +1.59

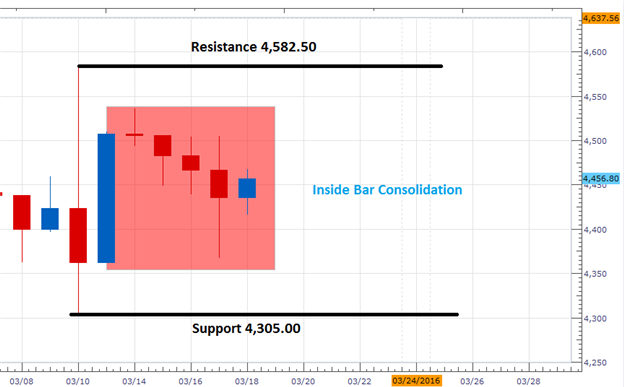

CAC 40 Daily Chart

(Created using Marketscope 2.0 Charts)

Interested in Learning the Traits of a Successful Trader? Click HERE

The CAC 40 is trading up .24% on the day, as the Index is poised to close the week relatively unchanged. With the Index mixed, Societe Generale is leading the way trading up 2.69%. As mentioned in previous updates, the CAC 40 remains consolidating inside of last Thursdays high (4,582.50) and low (4,305.00). Today now marks the sixth consecutive trading day without a breakout from these values. Traders looking to take advantage of this consolidation period may elect to look for range based trading opportunities until a daily breakout occurs in the markets chosen direction.

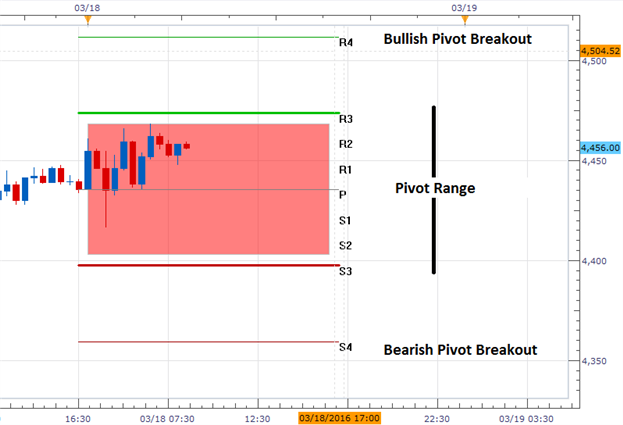

Todays, range can be seen outlined above through a series of pivot points. Range resistance is marked by the R3 Camarilla pivot point, which is found at a price of 4,473.59. Conversely, support is found below at the S3 Pivot point at a price of 4,397.41. Range traders may elect to trade between these values until either a breakout occurs, or this week’s trading closes inside of these boundaries. It should be noted that today’s pivot breakout values are denoted by the R4 and S4 pivot depicted below. Bullish breakouts begin above R4 at a price of 4,511.68, while bearish breakouts begin beneath S4 at a price of 4,359.33. In either breakout scenario, traders may look for prices to challenge the daily support and resistance values mentioned previously.

CAC 40 30 Minute Chart with Camarilla Pivots

(Created using Marketscope 2.0 Charts)

SSI (speculative sentiment index) for the CAC 40 (Ticker: FRA40) is currently reading at +1.59. It should be noted here that this value has increased from the last reported total of +1.14. As an increasing number of positions are long, SSI when taken as a contrarian indicator suggests that the CAC 40 may be setting up for a future decline. Alternatively, in the event of a bullish advance, traders should look for SSI to level off to a more neutral value, and flip to a net negative reading.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guideto find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.

By: Walker England, Forex Trading Instructor