Talking Points

- The FTSE 100 is slightly lower today following the news of terrorist attacks in Brussels and mixed German data. Some strategists are saying that the likelihood of a Brexit could increase following the attacks.

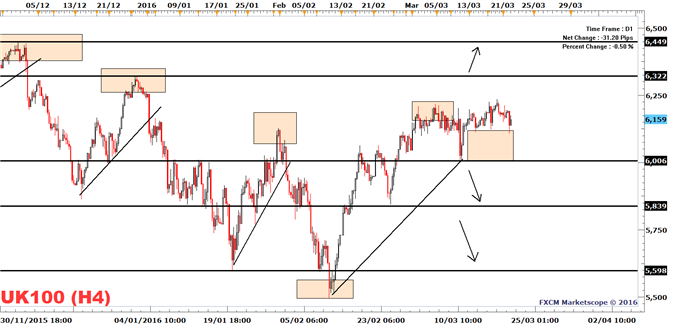

- The trend remains bullish for now and last week’s low of 6006 is the trend defining level.

The FTSE 100 (FXCM: UK100) is lower by 0.50% at the time for writing, a decline which is partially fueled by the news of terrorist attacks in Brussels. Strategists said to Bloomberg news that the likelihood of a Brexit could increase following these attacks.

Several German economic data reports have been published this morning and they have all been mixed. We watch German data as it affects the DAX and thereby the FTSE 100, with Germany also being one of the biggest trading partners of the U.K.

The German March IFO index beat expectations.

German Markit flash PMI was a tad lower than expected, while the services PMI came in at a solid 55.5 and thereby beat the 55.3 expected (Bloomberg news poll). Both the German ZEW Current situation index and Expectations index printed lower than expected. See our economic calendar for estimates and outcomes.

In the afternoon, U.S. Markit Mfg. PMI is on tap.

Technical trend

The technical trend for the FTSE 100 remains bullish despite today’s softer prices. For the trend to turn bearish price would need to break the March 10 low of 6006 and with this in mind, some people may see today’s softer FTSE 100 as an opportunity to enter in line with the overall bullish trend. Price may reach the next resistance level, which is now the December 29 high of 6321 as long as the trend remains bullish.

On the trend turning bearish, the FTSE could fall to the February 24 low of 5843, as it is the next support level following the March 10 low of 6006.

Download the DailyFX Analysts' 1Q forecasts for the Dollar, Euro, Pound, Equities and Gold

FTSE 100 | FXCM: UK100

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar

By: Alejandro Zambrano, Market Analyst