To See How FXCM’s Live Clients Are Positioned In FX & Equities Click Here Now

Talking Points:

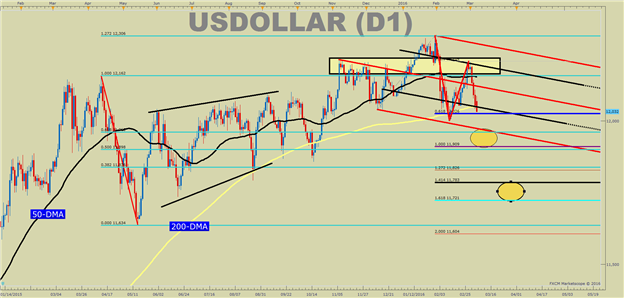

- US Dollar Technical Strategy: US DOLLAR Failing at 200-DMA

- Fed Rate Hike Probability Creeps Back Into

- Risk-On Could Be the Short-Term Ruin for US-Dollar. But, Will It Last?

Do not look now, but the US Dollar is close to printing 2016 lows. We have a scenario on our hands that is uniquely different to 2015 at the same time of year. Last year, the US Dollar was a run-away train into the Ides of March, and then the Fed came out to tell markets that the Fed would not harm the world with a Strong Dollar on their own accord. From there, on March 18 the US Dollar started a steady multi-month decline until August 24 or Black Monday of 2015.

One theme we have seen since the US Dollar produced a lower high is a risk-on rally. Specifically, we have seen stocks and US Oil push closer and closer to 2016 highs. The scenario we see at hand is that traders who bought US Dollar via Treasuries as a safe-haven are quickly dumping US Dollar to buy equities and Oil in case the bottom is in place. Therefore, if risk continues higher and higher, the Dollar may move lower & lower. The counter-balance to this would be risk-sentiment falling apart, and the Fed pushing the reference rate higher as economic data has picked back up since February.

US Dollar Takes a Back Seat To Risk-Rally Seen in Equities & Oil

The chart above shows the US Dollar coming off a lower high that aligns with the late 2015 high. Many will look at this as a bearish head and shoulders that has more downside ahead. That is completely fair and a close below the 200-DMA below 12,050 would likely further that cause for a bearish US Dollar unless the European Central Bank and Federal Reserve decides to muddy the water and change the current risk-paradigm.

Interested In our Analyst’s Longer-Term Dollar Outlook? Please sign up for our free dollar guide here.

Key Levels: Watch the 200-DMA

The US Dollar is getting no respect as US Data picks up, which is exactly why it’s helpful to keep an eye on key levels. The first key level to focus on that was consistent support in 2H2015 is the 200-dma. If the 200-DMA acts as resistance, we could have a clean move down to 11900/850.

The big scenario to watch for is a slingshot move higher after a temporary stay below the 200-DMA. We saw this scenario in October of 2015 that preceded the US Dollar’s strongest move of the year since the Q1 Rally. The obvious resistance is 12,214, the late February high. Until that level is broken, it will be difficult to get on the US Dollar train unless risk, as seen via WTI Crude Oil collapses in which then, US Dollar could resume its ascent.

T.Y.

By: Tyler Yell, CMT, Forex Trading Instructor