To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

- Crude Oil Technical Strategy: Oil At Long-Term Resistance, Difficult Price To Buy

- The US Dollar Weakness Could Provide Next Leg Higher in WTI Crude

- March is statistically the most bullish month of the year for WTI crude oil by mean and median returns

Oil continues to hang around $35/bbl to the confusion of industry insiders and investors expecting the price of Oil to fall further. Yesterday, the Department of Energy announced the build in inventories increased by 1040K barrels surprisingly, production continues to drop, which is likely behind the multi-week rise in Oil as production dropped for the 6th week to 9.08m to 2014 lows. In fact, Bank research says the U.S. rig count could fall to the lowest levels since record keeping began in 1948 suggesting we would have to go back to the beginning of the Oil Boom in 1859 in the hills of Pennsylvania to see similar activity.

To See How FXCM’s Live Clients Are Positioned In FX & Equities Click Here Now.

Furthermore, the data in the United States since early February may show that demand is starting to pick up, which is why the U.S. Stockpiles rising are being digested so well. As mentioned in that last article, this move higher is coming at a time that sentiment from producers is hitting an extreme low. Exxon Mobil CEO Rex Tillerson seems to think the glut or oversupply will persist, and he sees Exxon’s output flat for four years through 2020.

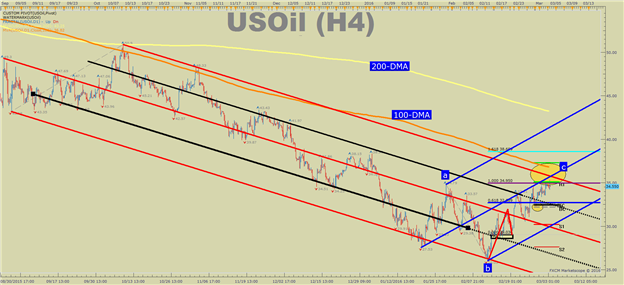

WTI Crude Oil Moves Aggressively Into Price Resistance

Key Support Levels from Here

WTI Crude Oil has seen few negative price shocks since the current low on February 11. Now, the focus will turn to a barrage of resistance ranging from $35/bbl up to the 100-DMA at $36.82. The key zones of support worth watching are the $30.20 low that was a pivotal low on February 24 followed by the February 19 low of $29.03/bbl. If we hold above these intra-trend lows, and the price of the US Dollar weakens again as it did in early February, we could be soon retesting the YTD high of $38.36 up to a bullish head and shoulder’s target of ~$43/bbl.

Bullish Head & Shoulder’s Breakout on H4 US Oil

Contrarian System Warns of Further Price Support

In addition to the technical focus around the 34% rally resistance, we should keep an eye on Bears unsuccessfully trying to push down the price of Oil. A move into resistance, and possibly beyond aligns with our Speculative Sentiment Index or SSI. Our internal readings of Oil are showing an SSI reading of -1.365. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders have moved from net long to now net short provides a contrarian signal that US Oil may continue eventually higher through resistance. If the reading were to turn positive yet again, and the price broke back below $32/30, we could begin looking for a retest of the YTD low of $26.03. Until then, higher looks to be the path of least resistance.

T.Y.

By: Tyler Yell, CMT, Forex Trading Instructor