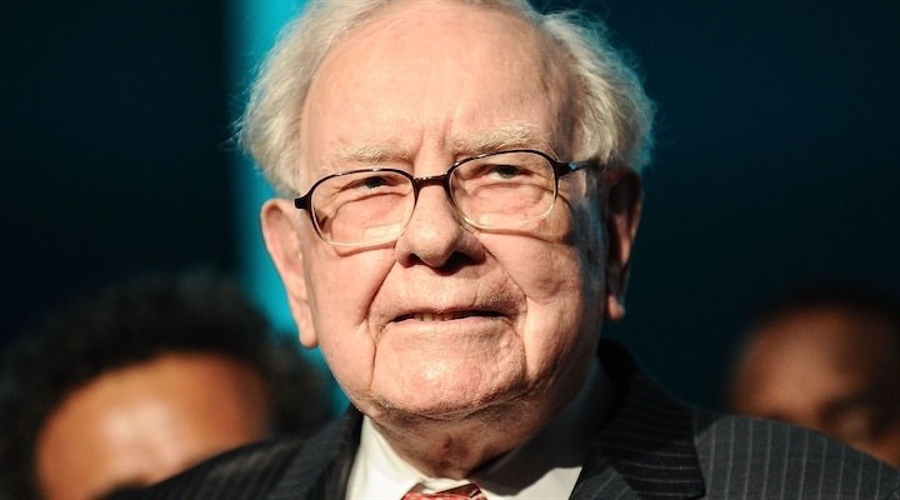

Warren Buffett's Berkshire Hathaway is holding more short-term Treasurys than the Federal Reserve. Is this a sign of looming market trouble?

When Warren Buffett makes a move, the financial world takes notice. The news that he’s amassed more short-term U.S. Treasury bills than the Federal Reserve—has left many wondering what message the Oracle of Omaha is sending. On the surface, this might seem like just another chapter in Buffett’s storied career of shrewd investments. However, dig a little deeper, and this massive accumulation of Treasurys might be saying more about the current state of the market than anything else.

In a world where investors are perpetually on the lookout for the next big opportunity, Buffett’s decision to park over $120 billion in short-term government debt isn’t just noteworthy—it’s downright cautionary.

⚠️BREAKING: With $234.6 Billion, Warren Buffet now holds more US Treasury Bills than the Federal Reserve.

— Andrew Lokenauth | TheFinanceNewsletter.com (@FluentInFinance) August 7, 2024

Buffett and Berkshire Hathaway $BRK.B own 4% of all T-Bills issued to the public.

If invested in 3-month Treasury bills at about 5%, $200 Billion in cash would generate… pic.twitter.com/wbdrb7UEUT

Buffett’s Move and Market Sentiment

Historically, U.S. Treasurys have been the go-to asset for investors seeking safety during turbulent times. They’re reliable, backed by the full faith and credit of the U.S. government, and, most importantly, they’re not subject to the wild swings of the stock market. By increasing Berkshire Hathaway’s Treasury holdings to unprecedented levels, Buffett is signaling a classic flight to safety—a move that typically occurs when market conditions are uncertain or when the risks associated with other investments are deemed too high.

But why now? What does Buffett see that the rest of the market might be overlooking? One interpretation could be that Buffett anticipates increased market volatility ahead. With inflation pressures, geopolitical tensions, and the ongoing effects of central bank policies, the economic landscape is anything but stable. By opting for the security of Treasurys, Buffett might be positioning Berkshire to weather a storm that others have yet to see coming.

Warren Buffett's Berkshire Hathaway now owns more Treasury Bills than the Federal Reserve pic.twitter.com/ehmiD17Tak

— Barchart (@Barchart) August 8, 2024

A Lack of Attractive Opportunities?

Another angle to consider is Buffett’s well-known investment philosophy: “Be fearful when others are greedy, and greedy when others are fearful.” The fact that Buffett is hoarding cash in the form of Treasurys could imply that he doesn’t see many attractive opportunities in the current market. With stock valuations high and many asset classes looking increasingly frothy, Buffett may be choosing to sit on the sidelines, waiting for better deals to emerge.

This isn’t the first time Buffett has taken such a cautious stance. During the dot-com bubble and the 2008 financial crisis, Buffett famously refrained from jumping into the fray when others were buying into the hype. His patience paid off, allowing him to make significant investments when prices were more reasonable. Is this history repeating itself?

Buffett’s Strategy: Preparing for the Next Big Opportunity

Buffett’s Treasury holdings also reflect his preference for maintaining a strong liquidity position, especially during times of uncertainty. Having a substantial amount of cash or cash equivalents allows Berkshire Hathaway to act quickly when the right opportunity presents itself. This is a hallmark of Buffett’s approach—he isn’t one to rush into investments without careful consideration. Instead, he waits, sometimes for years, until the market offers up a golden opportunity at the right price.

By holding more Treasurys than the Fed, Buffett ensures that Berkshire Hathaway is in a position of strength, ready to deploy capital when the next big opportunity arises. This strategic patience is a stark contrast to the more speculative behaviors seen in today’s market, where many investors chase short-term gains with high-risk bets.

Reading the Tea Leaves

So, what does this mean for the average investor? Should they follow Buffett’s lead and shift their portfolios towards safer assets? While it’s tempting to mimic the moves of one of the greatest investors of all time, it’s essential to remember that Buffett’s strategy is tailored to the unique circumstances of Berkshire Hathaway—a company with vast resources and a long-term investment horizon.

However, Buffett’s actions do offer a valuable lesson: caution and patience are powerful tools in investing. In a market that’s increasingly driven by speculation and short-term thinking, Buffett’s focus on safety and liquidity might serve as a reminder that sometimes the best move is no move at all.

Whether or not Warren Buffett’s Treasury hoard signals an impending market correction remains to be seen. What’s clear, though, is that he’s preparing for whatever the future may hold, armed with a war chest of safe, liquid assets. In typical Buffett fashion, he’s poised and ready to pounce on the next big opportunity—whenever it may come.

For more coverage of finance and finance-adjacent news, visit our Trending section.