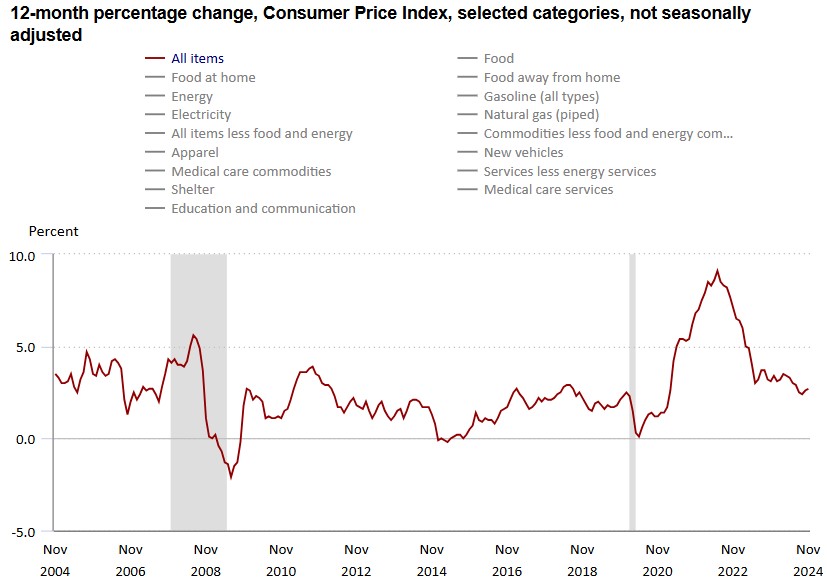

In September, the Federal Reserve cut its benchmark interest rate by half a percentage point (the first reduction in more than four years), signaling confidence that inflation was under control. However, the November data suggest they might have acted too soon.

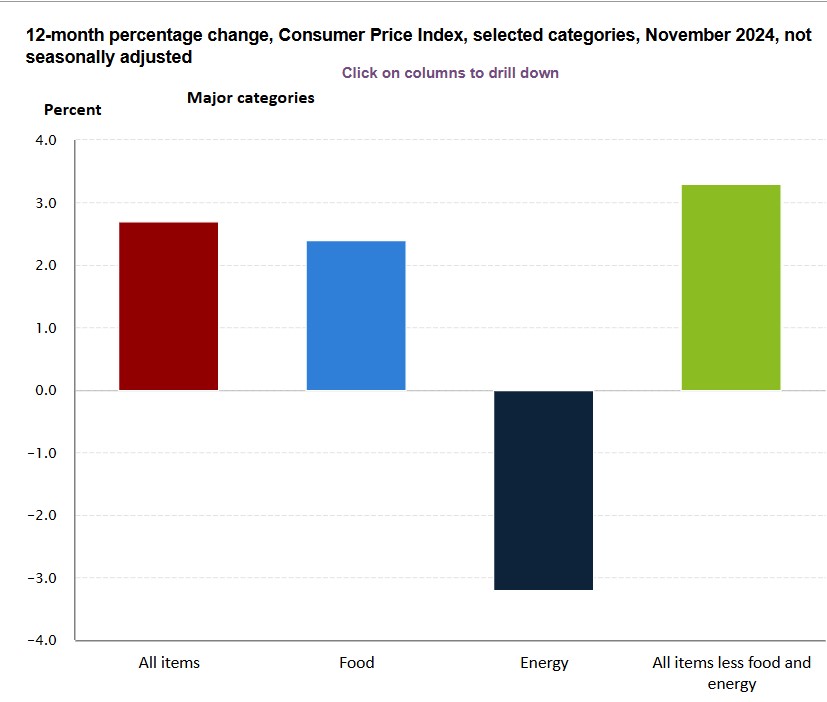

Inflation gained fresh momentum last month, adding new challenges to an already uncertain economic outlook. Consumer prices rose by 2.7% over the past 12 months, marking the steepest increase since July, according to the latest data from the US Bureau of Labor Statistics.

What is Next for the Fed?

While rising costs for food and energy played a significant role, the Federal Reserve remains on track to lower interest rates in the coming days. For much of the year, shelter-related costs dominated inflation reports. However, in November, the narrative shifted. Shelter prices rose by 0.3% and accounted for 40% of the monthly inflation gain, down from previous months, where they made up as much as 90%.

Instead, food prices climbed 0.4%, while energy costs posted their first increase in six months at 0.2%. These categories carry significant weight in consumer budgets, especially for lower-income households. In November, core inflation, which does not factor in food and energy prices, rose by 0.3% for the fourth consecutive month, holding steady at an annual rate of 3.3%.

This highlights a new challenge of bringing inflation closer to the Federal Reserve's 2% target. Progress has stalled despite cooling trends in areas like rent and motor vehicle insurance, which posted their slowest increases in years, CNN reported.

Economic Uncertainty

Despite the rise in inflation, the Federal Reserve is expected to cut interest rates for the third consecutive time next week. Policymakers aim to support a labor market that has shown signs of slowing while keeping a close eye on inflation metrics.

Rents, one of the stickiest inflation components, are cooling, and other categories like motor vehicle insurance show signs of moderation. However, volatility in food and energy prices continues to inject uncertainty into economic forecasts.

In September, the Federal Open Market Committee said: “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent and judges that the risks to achieving its employment and inflation goals are roughly in balance.”

Federal Reserve is now faced with the test of balance, its dual mandate of promoting employment and maintaining price stability. With inflation showing signs of stubbornness, the economic journey ahead could prove more challenging than anticipated.