Credit scores play an important part in the complex world of personal finance. They affect not just your capacity to obtain loans and credit, but also interest rates, insurance premiums, and even the impressions of future employers. Recent advances in the area of credit scoring have sparked debate, with people asking how these changes would effect their financial situation.

Understanding Credit Scoring's Evolution

Since its beginnings, credit ratings have gone a long way. FICO ratings have traditionally been the gold standard in determining creditworthiness, but in recent years, there has been a drive toward greater inclusivity and accuracy. Alternative credit scoring models have evolved as a result of technological improvements and increased access to more complete data, with the goal of providing a more holistic assessment of people' financial behavior.

Accepting Diverse Data Points

One notable change in credit scoring is the inclusion of data points other than traditional credit history. This is especially advantageous for people who do not have substantial credit histories or who are otherwise disenfranchised by the traditional system. Utility bill payments, renting history, and even educational background are examples of alternative data. Credit scores become more representative of an individual's financial habits and obligations as the amount of data analyzed expands.

The Role of Fintech in Credit Scoring

The development of fintech has been a big driver of credit scoring innovation. Platforms powered by technology use artificial intelligence and machine learning to analyze massive volumes of data rapidly and effectively. This allows them to spot patterns that traditional credit scoring algorithms may have missed. As a result, fintech solutions frequently provide a more personalized approach to credit risk assessment.

Emphasis on Financial Inclusion

Recent credit score news has focused attention on the goal of financial inclusion. The existing credit rating system has disenfranchised many people, particularly those from underprivileged neighborhoods. The move toward alternative data and inclusive models strives to level the playing field, allowing a broader range of people to get access to credit and financial possibilities.

Borrowers Should Be Aware

Borrowers should be aware of the most recent credit score news. Because of the increase of data sources, responsible financial conduct other than credit card payments and loans now factors into credit scores. This allows individuals to demonstrate their creditworthiness in a variety of ways. Borrowers should, however, stay attentive about their general financial health, since missed payments and growing debts can still have a negative impact on their credit scores.

Loan Approval and Interest Rates

Credit scores continue to play an important part in setting loan interest rates. While alternative data may provide a more accurate picture of creditworthiness, lenders continue to rely on traditional credit ratings. Borrowers with favorable alternative data may be able to negotiate better terms with lenders who take these aspects into account. Nonetheless, understanding your credit score and actively striving to improve it might still result in lower interest rates.

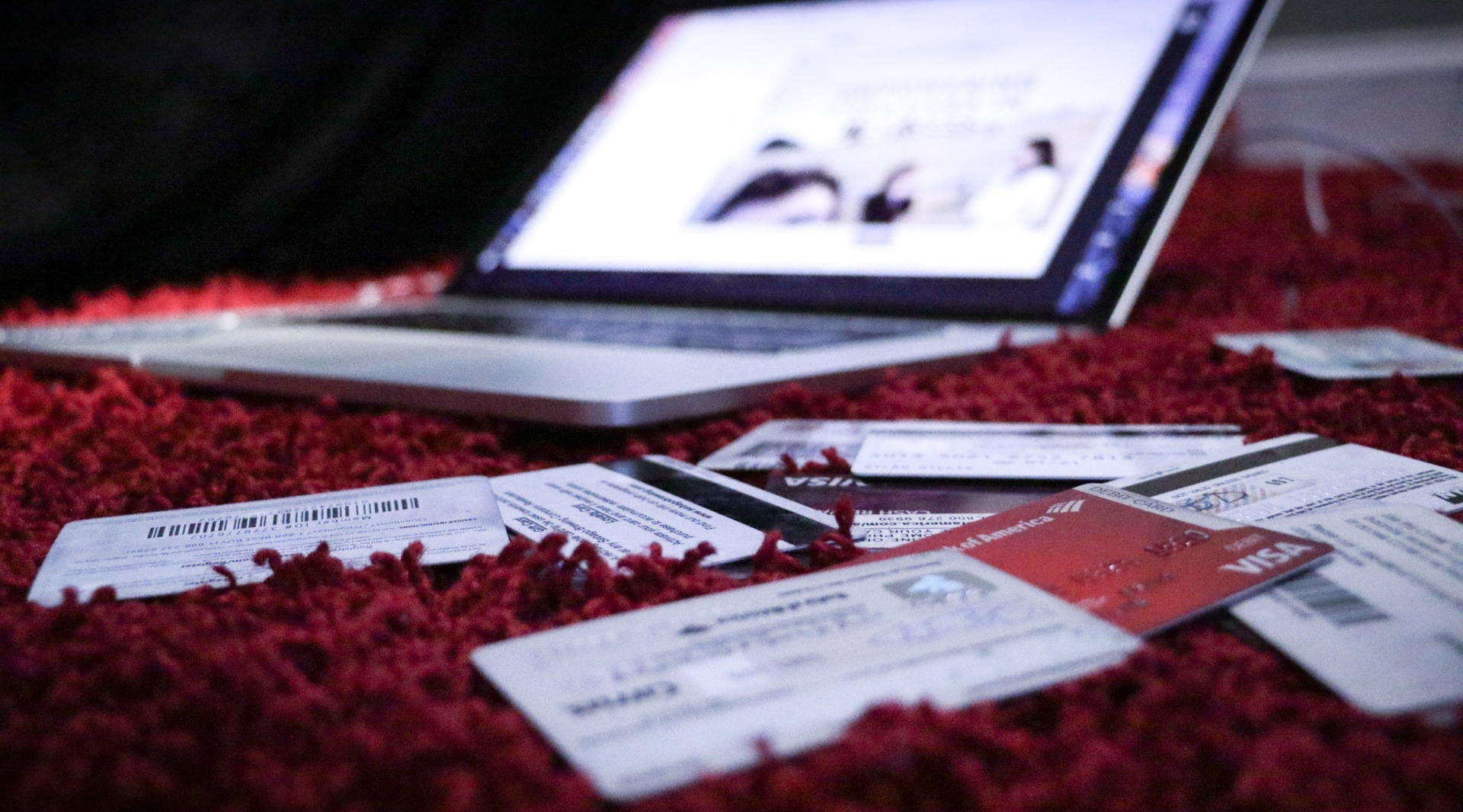

The Importance of Credit Monitoring

Staying knowledgeable about your credit profile is critical in a context of altering credit scoring techniques. Monitoring your credit report on a regular basis allows you to uncover mistakes, potential fraud, and issues that may have a negative impact on your credit score. The ability to detect and correct problems quickly can save you from unanticipated difficulties when applying for financing.

Financial Empowerment and Education

Financial literacy is becoming increasingly important as credit scoring models change. Individuals can make more informed financial decisions if they understand how credit ratings are produced and the elements that influence them.

Engaging with tools that provide insights into credit management, debt reduction, and responsible financial conduct can be extremely beneficial in successfully navigating these changes.

Public Credit Scoring: Advantages Over Private Solutions

In the realm of credit assessment, the idea of public credit scoring presents notable advantages compared to solely private-run solutions. Primarily, transparency and fairness would be enhanced. Private credit agencies often utilize opaque algorithms, whereas a public system would likely employ transparent criteria, promoting clarity and fairness in credit evaluation.

Acknowledging that technology is still evolving, a recent World Bank guideline suggested seven policy recommendations to govern credit scoring and facilitate regulatory oversight, all of which could be met by both public and private solutions. These include establishing legal and ethical frameworks, ensuring transparent and fair decisions, strengthening data accountability, implementing model governance, encouraging collaboration, balancing innovation with risk mitigation, and enhancing the capacity of regulatory bodies and credit service providers.

Furthermore, public credit scoring would mitigate information asymmetry. Private agencies hold information advantages, but a public system would ensure equal access to data, fostering better-informed financial decisions and heightened financial literacy.

Bias could also be better addressed through public credit scoring. Privately run systems may inadvertently perpetuate biases, whereas a public approach could be designed to minimize such issues, leading to more equitable credit evaluations.

Public accountability and oversight would further strengthen the merits of a public system. Unlike private agencies, a public system would be accountable to the public and subject to regulatory scrutiny, engendering trust and confidence in credit assessment.

The Way Forward: Managing Credit Score Changes

The most recent credit score announcement represents a welcome move toward a more inclusive and thorough credit evaluation process. However, the shift may not be without difficulties. Individuals must maintain a proactive approach to managing their finances, embracing appropriate credit habits, and remaining educated about changes in the credit scoring landscape.

While the incorporation of alternative data shows potential, keep in mind that no single metric can properly capture your financial health. Your credit score is only one aspect of your overall financial situation. Regularly examining your credit report, resolving any anomalies, and striving for a well-rounded financial profile can equip you to successfully manage these shifts.

Finally, the ever-changing world of credit scoring highlights the significance of adaptability and ongoing learning in personal finance. Individuals who remain knowledgeable, proactive, and focused on their long-term financial goals will be best positioned to exploit these changes to their advantage as the environment develops. In an ever-changing credit market, embracing alternative data, technology-driven solutions, and financial education will pave the way for a more resilient financial future.