Walking the floor of the iFX Expo in Limassol, Cyprus, the big story was how payments and payment service providers are adapting to changing demands and emerging markets, specifically the forex and crypto spaces.

The following observations are made following interviews with representatives of payment companies and crypto companies that were present at the Cyprus iFX Expo (site).

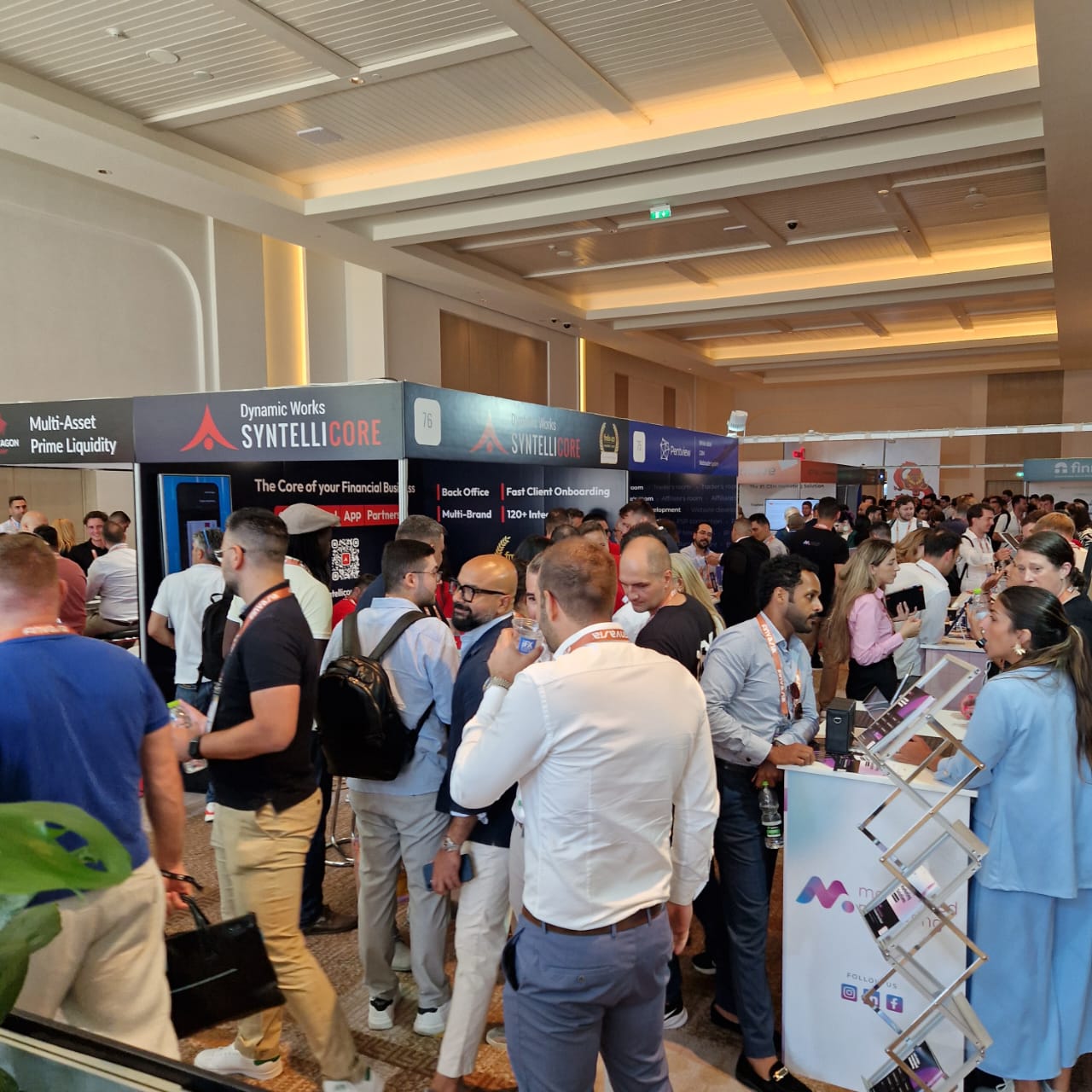

🌟We've left a successful iFX EXPO International 2024 Day 1 behind us.

— iFX EXPO (@iFXEXPO) June 20, 2024

Take a look at the thrilling atmosphere!#iFXEXPOInternational2024 #iFXEXPOInternational #iFXEXPO #Cyprus #Limassol #UltimateFintech #B2Bevent #Networking #Business #Forex #Finance #Fintech #B2BMarketing pic.twitter.com/VjXMpLFzm1

Expanding Horizons: Payment Companies and the Forex Market

The payment sector has witnessed significant evolution, particularly with increasing integration into the forex market. Historically, many payment service providers (PSPs) have viewed the forex industry as high-risk due to its association with unregulated entities and potential for fraud. However, this perception is shifting. Providers are recognizing the financial opportunities and are becoming more open to collaborating with regulated forex companies to ensure safety and compliance for their clients.

This shift is driven by the growing number of forex traders and the need for robust payment solutions that facilitate smooth transactions. Many payment companies have long-standing relationships with large, regulated forex brokers, ensuring secure transactions and maintaining market integrity. This trend is mirrored by other payment firms looking to capitalize on the burgeoning demand for forex services, particularly in emerging markets such as Latin America and Africa. This was evidenced by the number of companies both based in these emerging markets, and European providers that are building networks within these regions.

Get ready to witness a new era in industry recognition. We listened to the industry and we are proud to announce the launch of a highly anticipated product that's been in the making for quite a while.

— Finance Magnates (@financemagnates) June 18, 2024

Join us at Booth #111 to find out more!#FinanceMagnates #iFXEXPO pic.twitter.com/cnUdTBz6uv

Navigating the Crypto Landscape

The cryptocurrency market presents both opportunities and challenges for payments companies. On the one hand, crypto offers fast, cheap, and borderless transactions, which are highly appealing in an increasingly globalized economy. The ease of crypto transactions—where funds can be deposited and withdrawn quickly without the scrutiny typical of traditional banking systems—is driving adoption among traders and consumers.

On the other hand, regulatory uncertainty remains a significant hurdle. Many countries are still developing comprehensive regulatory frameworks for crypto transactions, causing apprehension among payment providers about potential future constraints. Despite these challenges, some companies are actively embracing crypto, seeing it as a necessary step to stay competitive and meet client demands. Firms are investing in compliance measures and expanding their licensing portfolios to adapt to these evolving regulations.

However, while many firms are exploring crypto options, others are choosing to focus on traditional payments, along with forex. In one extreme example, one representative hinted that their firm – predominantly targeting the African, LATAM and South American markets – was avoiding crypto payments due a partner’s financial collapse.

While all this might sound off putting, almost all of the payment providers working, or seeking to work, in the crypto space where bullish about the sector’s future. Regulation was seen as both inevitable and as a positive thing across the board. The questions posed all related to how, and when, rather than if.

Emerging Markets: A New Frontier

Emerging markets are becoming a focal point for payment providers looking to expand their reach. Africa and Latin America, in particular, are drawing significant attention due to their growing economies. Payment solutions tailored to local preferences and regulatory requirements are crucial in these regions. For example, in Brazil, the Pix payment method has revolutionized the market, capturing a significant share from traditional methods like Boleto Bancário.

In Africa, increasing internet penetration and higher incomes are driving demand for more sophisticated financial services. Payment companies are facilitating this growth by providing solutions that connect local economies to the global financial system, thus supporting both local and international transactions.

In addition, crypto is growing within Africa as internet penetration rises rapidly and personal income is on the rise. However, as hinted at before, many companies are cautious about future regulations.

The Role of Technology and AI

Several of the interviewees highlighted the increasing impact of technological advancements and how the integration of artificial intelligence (AI) is transforming the payments landscape.

Payment providers are leveraging AI to enhance security, streamline operations, and offer innovative solutions that meet the dynamic needs of the forex and crypto markets. AI-driven insights are helping companies understand transaction patterns, detect fraud, and provide personalized services to clients.

Moreover, the development of omnichannel payment solutions is enabling providers to offer a comprehensive range of services under one platform. This integration simplifies processes for users and allows companies to adapt to varying consumer behaviors across different regions. As the demand for diverse payment methods grows, companies are increasingly focusing on offering multiple solutions to remain competitive.

The continued growth of the forex and cryptocurrency markets with the payments sector is driving significant innovation and expansion. Payment companies are adapting to the regulatory landscape and leveraging technological advancements to offer secure, efficient, and versatile solutions. As emerging markets become more integral to global financial systems, the evolution of payment services will continue to shape the future of international trade and finance.

The iFX Expo runs until the end of today.

For more finance and finance-adjacent stories, visit our Trending section.