An XRP exchange-traded fund (ETF) may soon be introduced as US crypto regulations improve. Ripple President Monica Long shared this outlook during an interview with Bloomberg yesterday (Tuesday).

“I think we will see one very soon,” Long stated. She further explained that the emergence of more crypto spot ETFs in the US is expected this year, with XRP potentially following bitcoin and ether.

Ripple President Predicts Faster Regulatory Approvals

Long emphasized that regulatory approvals might speed up due to the current administration's approach. “We think, especially with the administration change, the approvals of those filings will accelerate,” she noted.

In addition to the ETF discussion, Long highlighted Ripple's RLUSD stablecoin , which will soon be listed on more exchanges. She expressed confidence in its future role in Ripple's payments and financial services.

RLUSD, launched in December on Ethereum and the XRP Ledger, currently holds a $72 million market capitalization. It has integrated Chainlink's services to enhance its utility within decentralized finance (DeFi) protocols, as reported by Finance Magnates.

Bitwise Files XRP ETF Proposal

Bitwise, an asset management firm, filed an S-1 form with the US Securities and Exchange Commission (SEC ) in October to create an ETF linked to XRP. Other firms, including Canary Capital, WisdomTree, and 21Shares, have also submitted filings. However, no decision has been made on any of these applications.

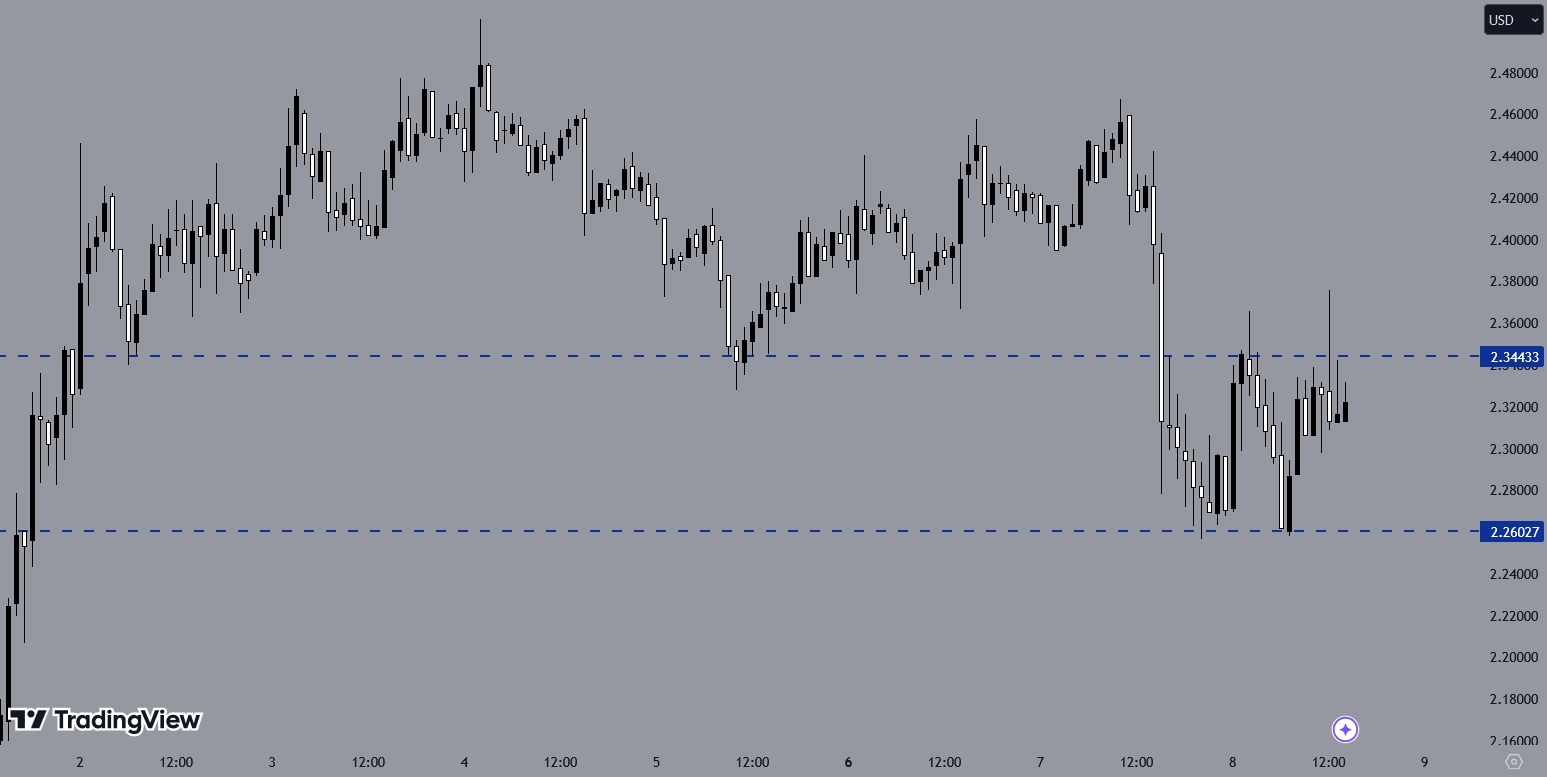

XRPUSD Consolidates on the H1 Chart

XRPUSD, after encountering resistance at a bearish trendline on the daily chart, has experienced a bearish correction.

On the H1 chart, it has been trading in a choppy range between the 2.34433 and 2.26027 levels for some time. A bullish breakout could push the price higher, while a bearish breakout at support may lead it toward the 2.00000 level.