Change is the only constant. And with the new year upon us, it’s a good time to think about some of the trends and areas of focus that brokers and technology providers should consider as they plan their marketing for the rest of the year. So without further ado, how will marketing be different in 2015?

1. Companies become publishers

PR is Dead, Long Live PR. As PR in the traditional sense has stopped working as well, brokers are realizing that in order to get in front of the right audience they need to become Thought Leaders. Getting in front of your target audience with the right message at the right time is great for Acquisition purposes but much more than that, it allows any financial services company to get the brand awareness and associations needed to secure business in today’s trust-driven market.

2. Marketers will focus more on LTV

What is the Life Time Value of a client and how do we optimize it? That is a deceivingly simple question which requires a more detailed qualification. Because what a simple average doesn’t tell you is what the value of an individual client is or what it will be over time. We also need to know which marketing sources drive the highest LTV clients or what the impact of the various stages of the client lifecycle is on the value. So in 2015, financial services companies will start putting in place the systems and people to measure and optimize this; Marketing attribution, demand generation, web Analytics , CRM systems, back office – all will be looked at and integrated in order to serve the goal of full insight and optimization.

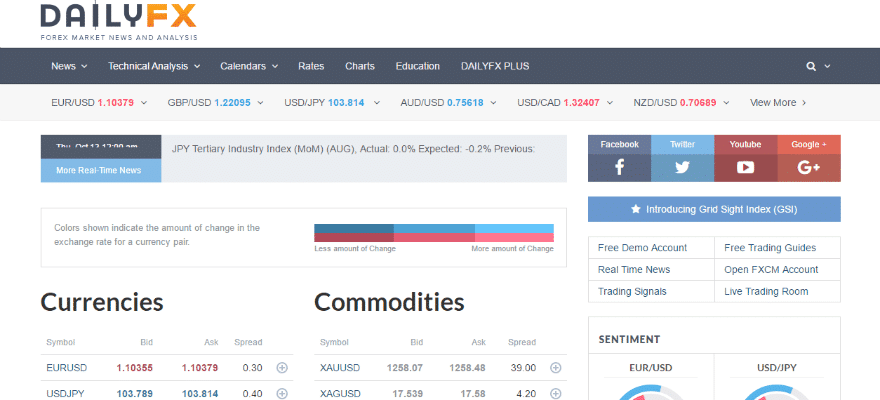

3. Cross channel becomes real

With a fragmentation of media consumption across mobile, tablet, desktop, TV, print media and other channels comes the need to target your audience, wherever they are. But how do you measure the impact across channels? How do you make sure you are, in effect, not spending twice on the same client? What is the best way to divide your marketing expenditure? Through the use of improved measurement systems and attribution algorithms companies will be able to answer these questions at a lower cost than ever before in 2015.

4. Focusing on mobile experiences

While it’s no longer considered news that the mobile channel is getting more and more important, financial services companies have a long way to go in order to provide an optimal mobile experience for their clients and prospects. This year, all the tools are available at a low enough cost to be able to provide a quality advertising, website, signup and product usage experience on mobile devices.

5. Sales and marketing integration

With a focus on LTV comes accountability for the marketing team not just to drive clients but to drive revenue. This can only be achieved through a closer cooperation with the sales team and their CRM infrastructure. Besides, marketing communication is written salesmanship, so there is a lot to learn from sales people that speak to clients each and every day to try and convince them of the merits of your company.

6. Employing new advertising methods

As digital marketing is becoming more and more mature, marketers in the financial services sector will widely start to employ programmatic advertising as a way to drive additional growth. Think RTB display advertising but also, in some markets, programmatic buying of TV and outdoor. Besides RTB, we see email marketing making a big comeback, along with native mobile advertising as brokers focus on better mobile experiences. Lastly, with companies becoming publishers (see above!), we see increasing use of content promotion as an indirect way of gaining a new audience.

7. Segmentation and differentiation

With an increasingly competitive field, lower spreads and customers becoming ever more demanding, comes the need to segment the market and differentiate brands to fit niche target audiences. This will be the year in which niche brokers start to grow and larger brokers build diversified brands as a response.