As you know, working with IB’s is going to become a lot more challenging in light of MIFID 2. If you are reliant on IB’s for EU and UK clients then you are going to have to make some adjustments given the new rules. In our previous article, we discussed marketing adjustments due to the recent passage of new regulations.

The question to ask yourself is do all of my Affiliates have to be classified as IB’s. If not, then how can you work with your affiliates in an out of the box way. We do have some ideas that you want to run by your legal and compliance team that may help you make strong marketing relationships that will drive traffic and leads your way and may not be affected by the new rules.

[gptAdvertisement]

Classify your affiliates

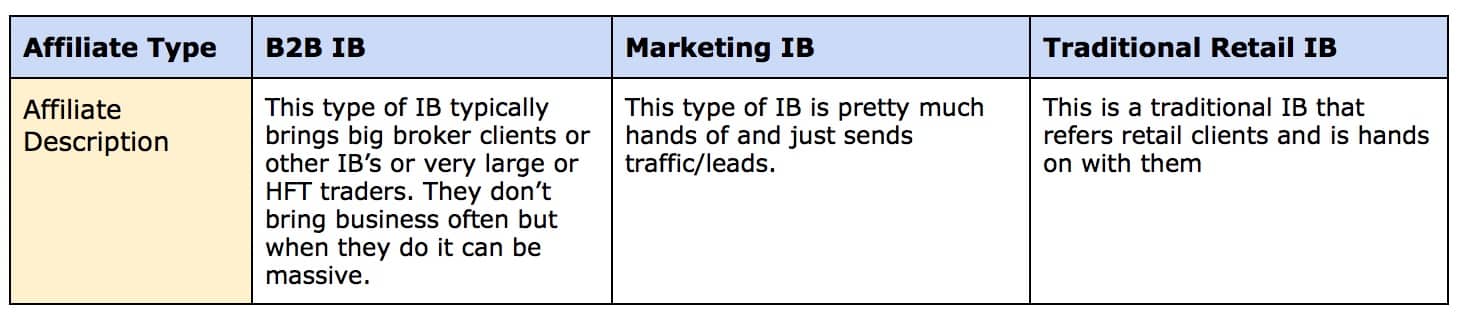

An IB is simply a type of affiliate. First let’s classify all your affiliates based the table below and in subsequent text we will discuss strategies of working with each of them.

The big questions to ask your legal/compliance team is are each of these affiliates an IB in a true sense of the word?

- Is a B2B IB more of a consultant?

- Can you work with the marketing IB simply with a marketing agreement?

- Can you purchase leads under the new MiFID 2 rules?

B2B affiliates/consultants

First let’s look at B2B IB’s – these types of IB’s typically bring B2B types of clients or other IB’s. They are technically not interacting with retail clients directly. The clients they bring are fairly sophisticated.

It can be construed that these types of affiliates are not IB’s but rather B2B marketing consultants. Can these types of “consultants” be paid a flat fee with a bonus structure for their services? So, you may be able to continue working with these types of consultants.

As you know they don’t bring in business often but when they do they can make a serious impact on your revenue.

Check with your council if these types of affiliates can be classified differently than an IB and see if you can come up with a more creative way to pay them. Obviously be careful here and don’t violate the rules. However, can these types of relationships be considered as more of PR than IB?

Marketing affiliates/consultants

The big question here is can you still buy leads of EU and UK clients with MIFID 2 rules? If so you will need to create and optimize a strong conversion funnel and make relationships with financial marketers and lead brokers to accumulate leads and convert them automatically using your funnel.

With the current crypto craze many people want to trade and invest. This is a great time to capture a ton of leads at lower costs. And a strong reason to have a crypto offering. If you currently don’t have a crypto offering visit our Liquidity wizard LQEdge.com to find the best crypto LP for you. We will work with you to build out and optimize your crypto offering.

We can also help you find financial marketers and lead brokers that can help you build and optimize a strong conversion funnel and sell you leads.

Traditional IB’s and using a master IB

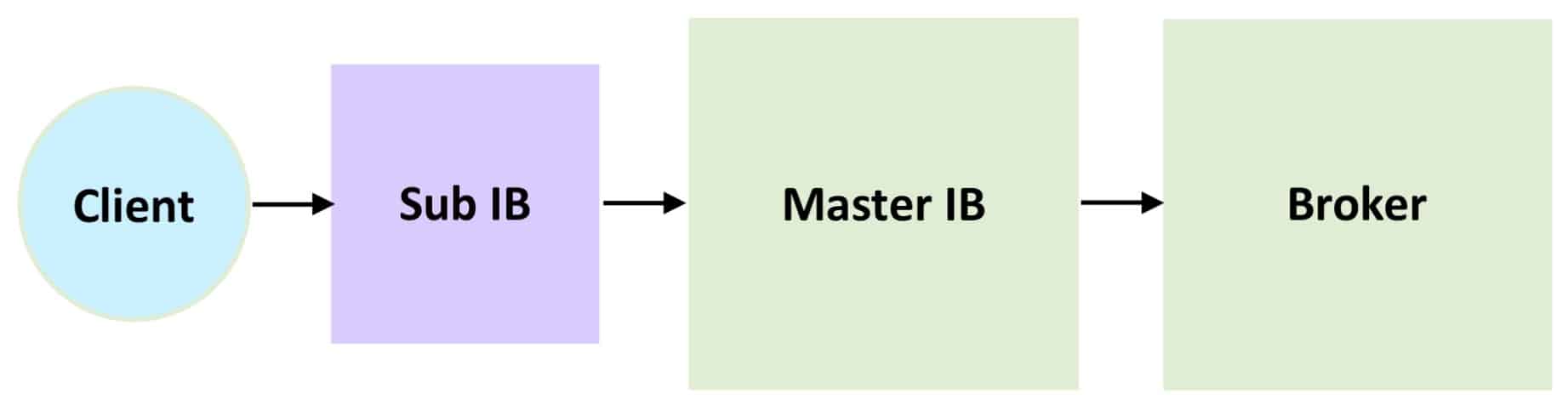

Finally, you will get certain traditional B2C IB’s who simply do now want to get MIFID or FCA registered. One of the best solutions for those IB’s is a master IB. A master IB is simply a large IB that will be registered that is willing to work with sub IB’s and sub affiliates. The key here is to ask your legal counsel if you can work in this manner with master IB’s.

If you can work with a master IB you will be able to drive affiliates that don’t want to get registered to them and they will in turn drive the clients to you.

At Nekstream we have access to master IB’s and can get you connected. So, if you are looking for a FCA registered master IB to work with the new rules simply email info@nekstream.com to discuss.

Conclusion

One of the most important steps is to classify your affiliates properly. Make sure that the affiliates that you are classifying as IB’s are truly IB’s. We are not legal experts so consult your legal and compliance team before making any decisions. However, you can use the table below for suggestions on what you can check on with your legal counsel for each affiliate type.

Finally if you don’t have a CRM and conversion funnel set up, now is the time to do so. Because of the crypto boom, leads are cheap and can be captured and nurtured to trade all products. Even if you break even on cryptos you can accumulate a ton of new leads. At Nekstream we can help you get connected with marketing experts that can create and optimize your conversion funnels and provide you with cost effective leads. We can also help you get a crypto offering.

Disclaimer: Please keep in mind that we are a consulting firm and these are some creative ideas that we have of the adjustments to your marketing strategy that you can make in light of the new rules. We are NOT lawyers or compliance professionals. So if you like any of our ideas PLEASE check with your legal counsel or compliance officers before acting on any of them.

Alex Nekritin is the Managing Director of Nekstream Global, a liquidity and technology consulting company helping brokers, HFT traders and money managers to find proper liquidity and tools for their ventures. Alex has over 10 years of experience in the financial space.