As an investor, conducting fundamental analysis on the company you intend to invest in is critical to maximizing your chances of securing a profit.

This is accomplished by assessing various qualitative and quantitative criteria such as revenue, profit margins, return on equity, and future growth potential.

The primary goal of this method of analysis is to find companies that are fundamentally sound so that profitable long-term investments may be made in them.

That way, you’ll know where the company stands in the market, how healthy its finances are, and if it’s priced appropriately.

After all, a stock’s current price may not be indicative of its true value.

As an investor, it’s up to you to figure out if the stock is overpriced or undervalued in the market.

However, one of the most frequently overlooked areas of analysis is evaluating a company’s digital performance, which is becoming increasingly relevant in light of recent events.

Why is digital performance important?

An estimated 60 percent of the world’s population has access to the internet. That’s around 4.7 billion people.

With this in mind, you can see why it’s so crucial that companies have an active online presence, especially if they are a B2C company that relies on customer engagement to generate new sales.

Furthermore, due to the Covid-19 crisis, we have witnessed a significant shift in consumer buying behavior, prompting many businesses to implement digital transformation strategies to generate new income streams and safeguard existing ones.

As a result, companies have been rushing to migrate data to the Cloud , use new tools and technology for communication and collaboration, and automate business operations.

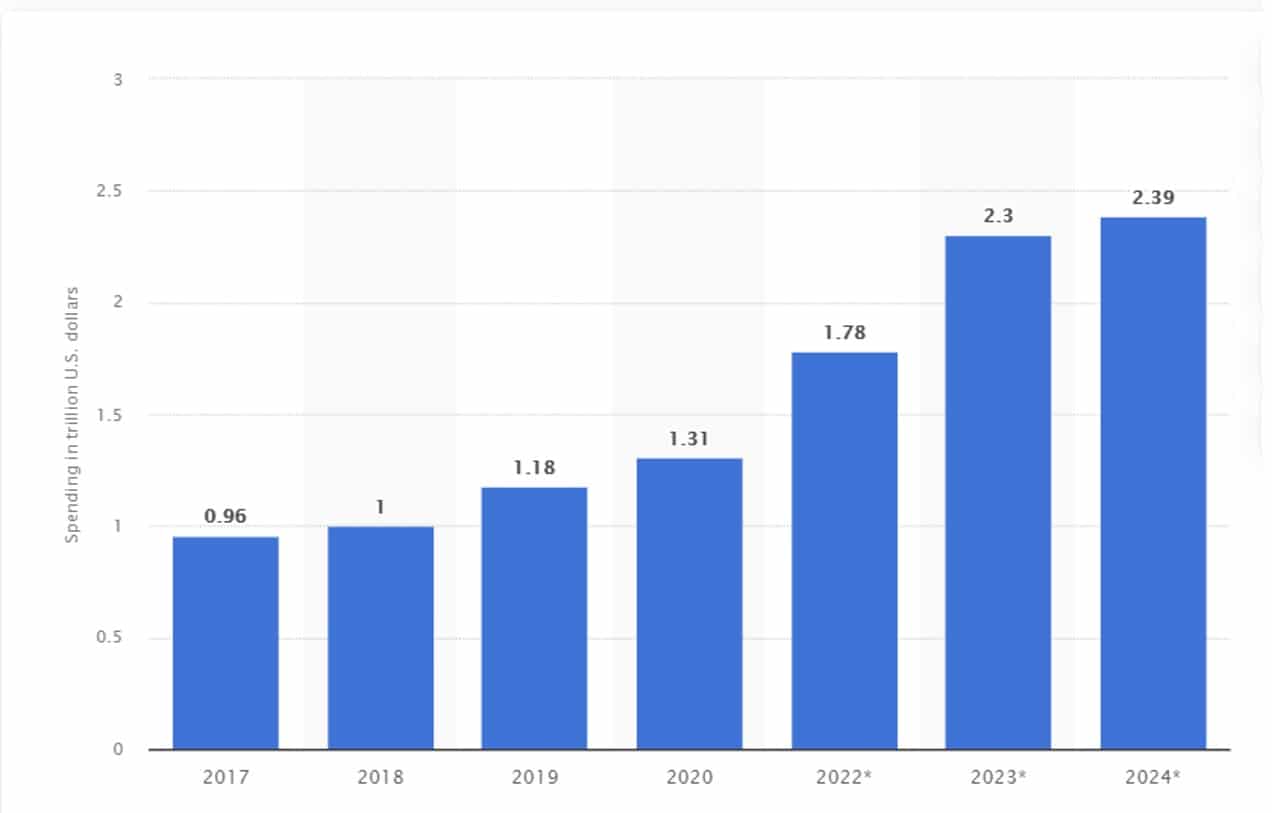

It’s no real surprise to see that direct investment in digital transformation initiatives is expected to reach $2.39 trillion by 2024.

Finally, the successful implementation of digital Marketing strategies is crucial to overall brand management and how the wider public perceives a company.

This is something worth considering as an investor, as most of the time, the way a company is perceived is reflected in its stock price.

How to analyze a company’s digital performance

Unfortunately, it can be challenging to get an accurate insight into the performance of a company’s digital strategies.

This is because most of the important data, such as return on advertising spend, conversion rates, and online customer retention rate, aren’t disclosed in public reports. With that said, there are still a few ways you can gauge their digital performance. Let’s take a look at a few here.

Social media engagement

Social media is at the heart of most successful digital marketing campaigns. When it comes to the longevity of a company’s brand and how people interact with it over time, social media engagement is one of the most essential indicators to track.

Fortunately, you can use a simple trick to get an objective measure of how much engagement a brand has online. To assess the engagement rate for a post, total how many likes, shares, and comments it receives.

Divide this by the number of followers on the page and multiply the result by 100. This will give you the engagement rate for that particular post (as a percentage).

With this information, you may compare their engagement rate with their competitors’ to get a good idea of how they’re performing and how much they’re interacting with their consumers.

Website, app, and industry traffic

There are many tools out there that you can use to gain valuable insights into a company’s website and app traffic and what the overall averages are for the industry.

This information will tell you what share of the online space they “own” within their sector.

This method of monitoring a company’s websites will provide you with a complete picture of what they’re doing and how well they’re doing it.

You’ll learn about the keywords they’re focusing on, their search engine rankings, their most popular content, the links they’re acquiring from external sources, and their social media activity.

Once you have this information, you will be in a much better position to determine if their digital performance is effective or falling behind their competitors.

Observe trends

You can track the digital performance of firms in a variety of ways using an investors’ intelligence tool. This powerful service helps you to anticipate long-term company performance trends that are indicative of future profitability.

This gives you a significant advantage over the competition because this is information that few people seek since it is outside the scope of traditional fundamental analysis.

However, the capacity to anticipate long-term trends in corporate performance, analyze consumer behavior trends, and monitor any company’s digital footprint is a fantastic way to strengthen your investment hypothesis and validate your investment choice.

Final word

When it comes to making your investment decision, it’s essential to conduct fundamental analysis so you can determine whether you’re getting a reasonable price on your investment and so you can assess the long-term potential of your position.

However, most people tend to underestimate the importance of assessing a company’s digital performance before investing, which is unfortunate because you can learn a lot about an organization in a short amount of time.

Social media engagement, website traffic, and long-term trends are all helpful indicators that an investor may use to determine how effective a company’s digital initiatives are and whether or not they are taking advantage of the broad array of opportunities available online.

While this may not be enough to base your final investment decision on, it certainly doesn’t hurt to have more information at your disposal when looking for a new company to invest in.