This series examines the best practices for retention and acquisition in the retail FX space. It is sponsored by All Sherpa, a data intelligence & behavioral science company serving dozens of retail brokerages worldwide. In this article we'll focus brokerage practices.

A mutual friend from the trading industry introduced me to a large European broker. Their email was short and had no details. “Anna, meet _____, they are looking to dramatically strengthen their direct acquisition efforts. Take it from here.”

The London Summit 2017 is coming, get involved!

In our follow-up call, it became clear that the combination of their affiliate-dependency and new Regulation was wreaking havoc on their business. Their business was built almost exclusively through opaque affiliate traffic. And despite long-standing relationships with Affiliates , the traffic quality was erratic and its flow was regularly being renegotiated based on a more competitive offering.

The broker’s leadership made the strategic decision to grow their direct traffic. And with crunching regulation, they looked to Sherpa technology and experience to help them, quickly.

We started by enriching broker’s client base with users’ personal information

So what did we do?

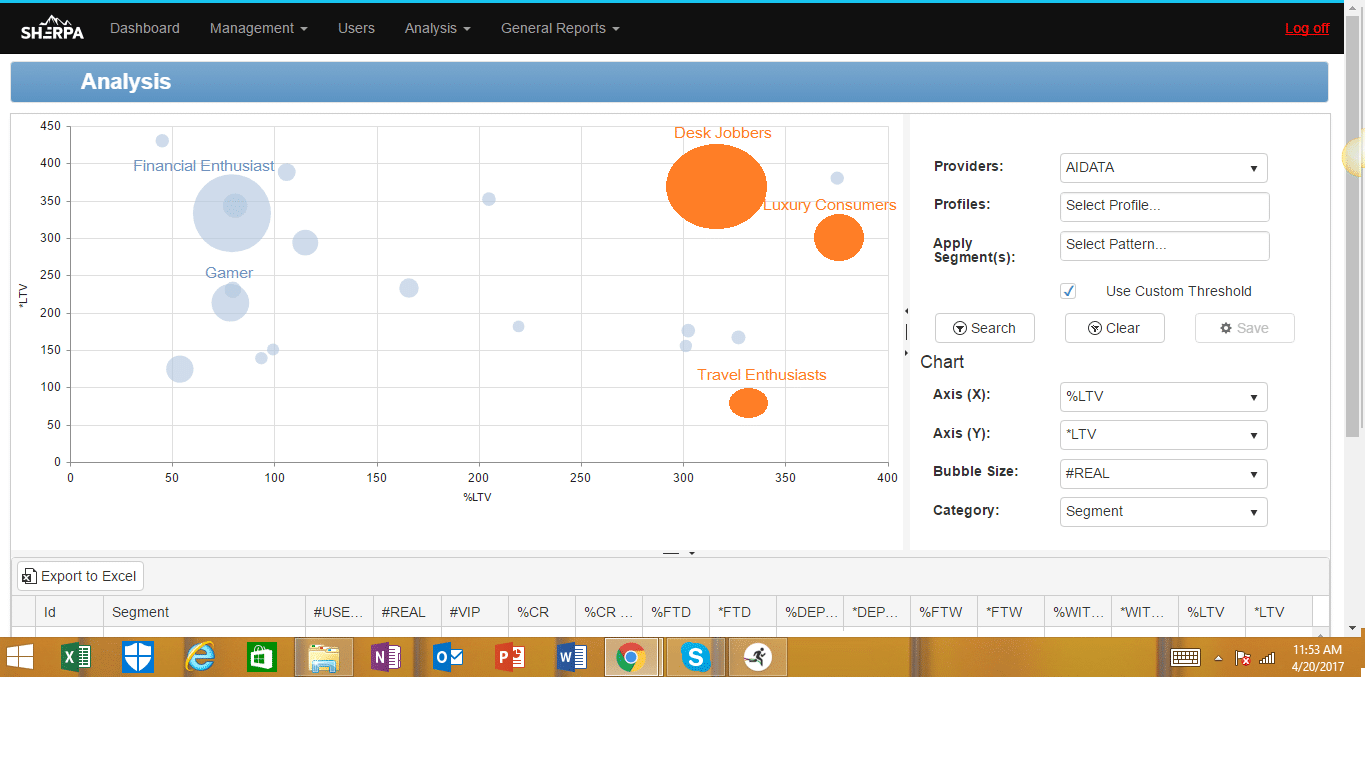

Another way to put it would be how can brokers open up direct channels with little financial risk? We started by enriching broker’s client base with users’ personal information. The next step was to create five client profiles, based on the personal information and behavior within the web-platform.

Running some tests on the segmented profiles, ‘desk-job’ has performed best: it is the easiest to convert, and yields higher LTV (Life Time Value) than other profiles. In terms of sources, this targeted traffic is available in local media.

Bloomberg

In order to attract these ‘desk jobbers’, the broker resurrected an old, ‘poorly performing’ campaign. To match it, we’ve decided to work with relatively cheap, 3rd-tier traffic suppliers on a limited scale, to make our point and demonstrate how the power of enhanced profiling translates into traffic.

The test brought 3rd-tier traffic that mirrored the profiles of those desk-jobbers and directed them to a gamified landing page and onboarding pages. As an example, messages were sent to this group an hour before ‘quitting time’ to catch workers in their ‘boredom’ and get back to an exciting activity (trading).

'Seek The DeskJobbers' . Segmentation of user profiles.

How did the broker do?

The short answer is so far so good. Their direct CPA is 40% cheaper than the best performing affiliate. But it didn’t start like that. The initial traffic resulted in CPA on par with the best performing affiliate.

But, after 3 weeks of trafficking, the team delved further into the profiles of the clients and was able to find interests and imagery that better matched their audience. For two profiles, we offered a three days demo prior to going to deposit, while for two others - direct deposit pages with no demo.

They then improved ads and landing pages accordingly. Per the time of publication, using targeted traffic (which is not competed for by others yet), the broker is acquiring customers for 40% less than its leading affiliate and is scaling its direct channel.

What did Programmatic Algorithm Do to the Tier 3 Traffic?

A proven strategy for profitable growth is to identify your most profitable clients, and then attract more of those client type. Easier said than done.

Enters The ‘Lookalike’ Revolution

The most popular advertising networks, Google, Facebook and the like, have built their advertising engines with ‘lookalike’ audiences and ‘audience extensions’ - both techniques that try to mirror an audience and find a similar audience using a host of other data (like social graph and interests or internet browsing and searching behavior) to find similar audiences.

They then serve those audiences your ads that respond remarkably positively. Sounds like every advertiser’s dream, right?

Strict advertising guidelines limit the nature of the advertiser and the ads shown

Retail Finance Has its Regulation & Limits

A visionary marketing machine. Plus500

Unfortunately, in retail trading, brokers have not been able to use such proven mechanisms. Strict advertising guidelines limit the nature of the advertiser and the ads shown. At first, visionaries like Plus500 grabbed the opportunity. But, for others, it was proven to be a hard road to follow.

As a result, brokers have had to rely on opaque acquisition channels (like affiliates) and have been unable to capitalize on this fundamental data-base led approach to profitable client acquisition. Acquisition teams, therefore, can’t really select their target audience characteristics and end up acquiring a mixed bag of clients based on a ‘middle rate’.

Cherry-Picking Your Clients

In a transparent market, brokers would be able to pay for only certain types of clients and reject all traffic that doesn’t meet their expectation. Clients traffic would be ‘right priced’. Moreover, with better data systems, brokers can know more about their client’s other interests and behaviors.

Enters Programmatic Profiling

Programmatic advertising has gained a huge popularity in e-commerce in the last decade, lead by tech monsters Oracle, Adobe and Neilsen. These solutions aggregate web behavior and can enable advertisers to target specific audiences.

Now, programmatic methods can be applied to the full customer lifecycle - from acquisition to reactivation and impact all aspects of a brokerage business (marketing, sales and operations).

Smart programmatic work can tell brokers about visitor profiles - even before they engage with your platform. This solution can help poor performing channels improve, replace channels that are not regulatory-compliant, or expand your business reach.

The Power of Programmatic Throughout Client’s Lifetime

When you connect your acquisition and retention channels to a programmatic, algorithmic approach, broker teams can know key pieces of client information to empower smarter campaigns and offering. That smart profiling impacts who to attract, the publishers to target, the channels, the funnels and even their product experience.

Our programmatic automated technology, for example, empowers brokers with critical information like client/prospect age, their income, habits, education, profession, financial interests and more than 40,000 other data points per client.

Core Areas Programmatic Profiling Helps Brokers

An intelligent use of programmatic can provide data points for pretty much every question you need to ask during your client journey. Few key examples:

- Acquisition:

Do you want to prevent leads turning out to be 15 years old users? Do you have offerings that match specific high or low income clients? Do your landing pages speak emotionally or analytically? Do you try to bring clients when they are going for lunch break options, or during quiet evening hours?

- Conversion:

What do you know about your prospects that can help you tailor conversion paths? What are their level of commitment? should you be offering a demo/trial or no trial? What temperament? Are they VIP potential?

- Retention

Do you segment users by who they truly are, or just by how they currently behave on your platform? know which clients are most valuable? Can you find patterns amongst your VIPs? Do you know if you should offer promotions, services, education or other.

To conclude, rather than guessing endlessly and stressing your operations with endless A/B tests, a programmatic approach can be used to profile your brokerages’ different segments and prescribe the highest-potential actions.

Smart profiling impacts who to attract, the publishers to target, the channels, the funnels...

Anna Becker, CEO, AllSherpa

Bottom line impact

In an ever-tightening business landscape, effective brokers should know whom they are able to serve, and whom they are not.

It will enable them to consolidate efforts and budgets, in attracting the most profitable customers, and streamline the product, marketing and sales messages line-up. The broker we worked with has fully understood it. Now it’s your turn.

This article is written by Anna Becker, CEO of All Sherpa. Learn more about how data intelligence and behavioral science can drive redeposits.